The display of such largesse should be a troubling signal for shareholders who worry about corporate governance.

Hemindra HazariBANKINGGOVERNMENT25/JUL/2017

Rewarding senior management during a particularly bad year should be a troubling signal for shareholders. Credit: Reuters

Mumbai: In a year when the net profit of Axis Bank – India’s third-largest private bank –...

Hemindra Hazari

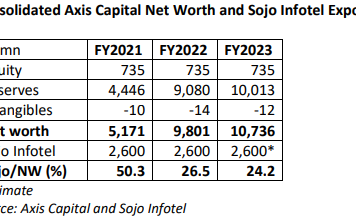

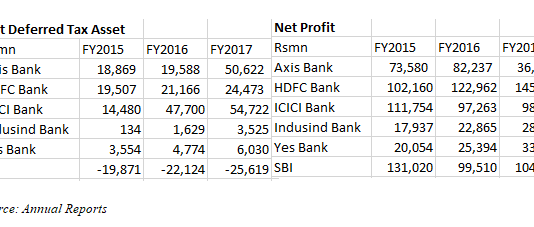

Rising net deferred

tax assets (DTA) in a scenario of stagnant and depressed net profits is not a

healthy sign in some of the banks, as current years’ net profits get enhanced

while sometime in the future the net DTA will get reversed impacting future net

earnings. This trend is visible in...

State Bank of India (SBI), India’s largest bank, became even larger with the merger of its five commercial banking subsidiaries on April 1, 2017.

Leading up to the All Fool’s Day merger, in mid-February 2017, finance minister Arun Jaitley was confident the step would make the bank a global player; a month...

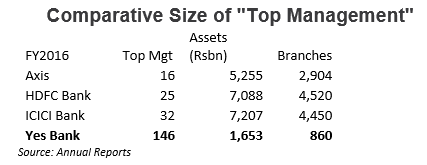

Credibility issues have plagued Yes Bank’s asset quality disclosures in the earlier (year ending March 31, 2016) annual report, added to these concerns is a top heavy organisational structure with significant expansions and contractions in the “top management” category in the last 2 years without any explanation in the...

Hemindra Hazari 23/MAY/2017

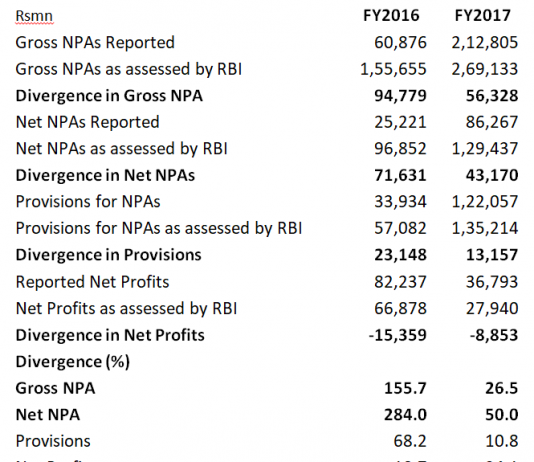

Recently, Axis Bank and Yes Bank jolted the Indian banking community while releasing their annual results. Both banks disclosed a staggeringly large divergence between the banks’ audited accounts and the Reserve Bank of India’s (RBI) findings regarding bad loans on the books of these banks...

The systemic erosion of public institutions indicates that Vinod Rai, a roaring tiger, has been reduced to a caged parrot, and the BBB’s expiry date is fast approaching. Perhaps the BCCI will turn out to be a more absorbing engagement than the nation’s public sector banks.

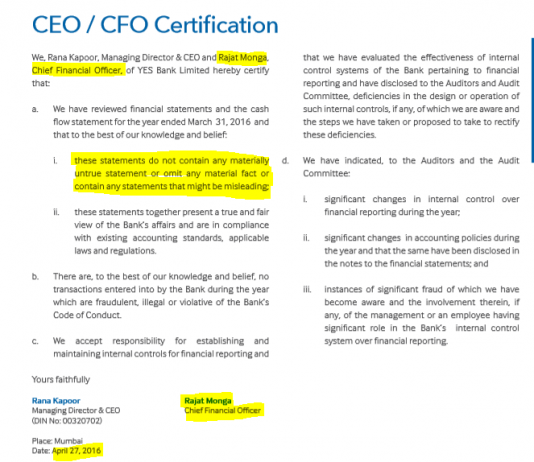

On May 12, 2017, Yes Bank, released its annual report for the year ended March 31, 2017 where the Reserve Bank of India’s (RBI) mandatory disclosure showed that for the year ended March 31, 2016, the bank’s gross non-performing assets (NPAs) was higher by 5.6x to Rs49.3bn instead of...

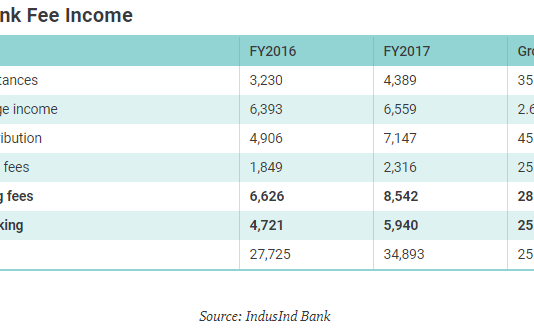

IndusInd Bank’s quarter ended March 31, 2017 (4QFY2017) was impacted by a “one-off” exposure to a company whose cement operations is in the process of being acquired by a top-rated company. While sell-side analysts regard it as a blip in the secular positive outlook on the bank, they are...

Hemindra Hazari BANKING BUSINESS ECONOMY 12/APR/2017

Uday Kotak’s much hyped press conference on March 29 promised a bang. But all we got was a whimper. Kotak’s announcement was a new digital-based saving account, christened “811”, no doubt in honour of the Modi government’s demonetisation move, which was announced on November...

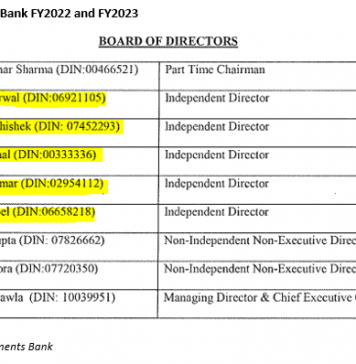

Even in a rowdy game of soccer, two yellow cards result in dismissal from the field of play. Indian banking, though, adheres to lower standards. For two consecutive years, Axis Bank has been exposed by the regulator for mis-reporting in its financial statements; yet the bank’s board of directors...