Hemindra Hazari

Everyone knows public sector banks are less profitable, more prone to political influence and have higher ratios of non-performing assets (NPAs) than their private sector counterparts. In contrast, new private sector banks, set up post 1991, are media and stock market darlings. Most analysts tend not to mention...

It is curious that the first step of a reform-minded Chicago-school scholar was to announce a subsidy. Of course, unlike the subsidies that Rajan criticised as chairman of the Committee on Financial Sector Reforms in September 2008, this subsidy would go not to low income sections of the population, but to the banks.

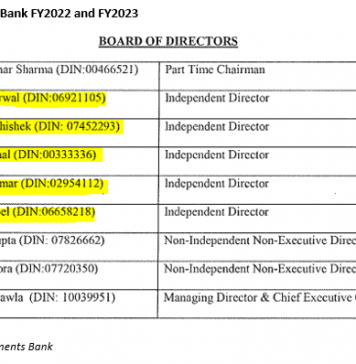

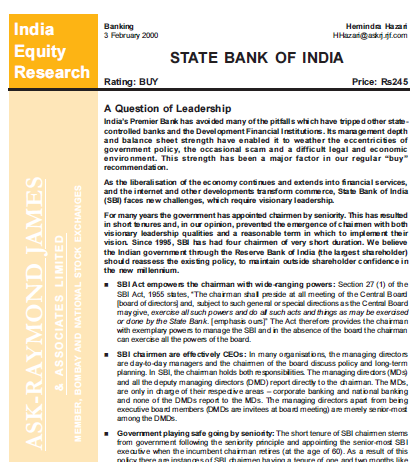

Compliance with the formal corporate governance code will be incorporated in FY2001 annual reports. investors should not be dismayed by the lack of a corporate governance structure or conversely, lower their guard at elaborate corporate governance norms. Our report reveals that substance (eg, the importance of truly independent directors)...

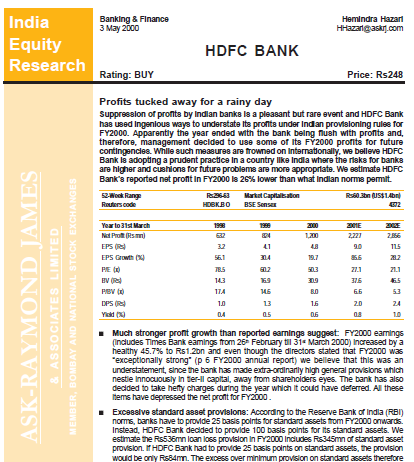

HDFC Bank has used ingenious ways to understate its profits under Indian provisioning rules for FY2000. Apparently the year ended with the bank being flush with profits and, therefore, management decided to use some of its FY2000 profits for future contingencies.

HDFC-Bank-BUY-3-May-2000Download

Post this report and the subsequent media coverage, the Indian government changed the selection policy of appointment of SBI chairman solely on the basis of seniority.

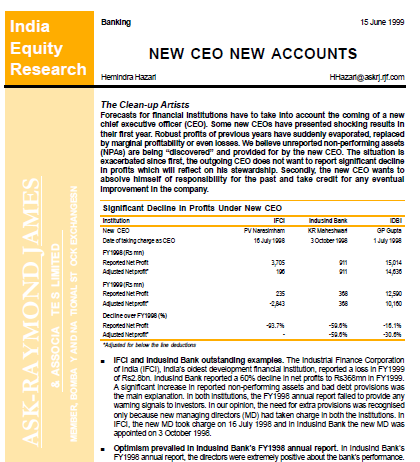

Forecasts for financial institutions have to take into account the coming of a new chief executive officer (CEO). Some new CEOs have presented shocking results in their first year. Robust profits of previous years have suddenly evaporated, replaced by marginal profitability or even losses.

New-CEO-New-Accounts-15-June-99Download

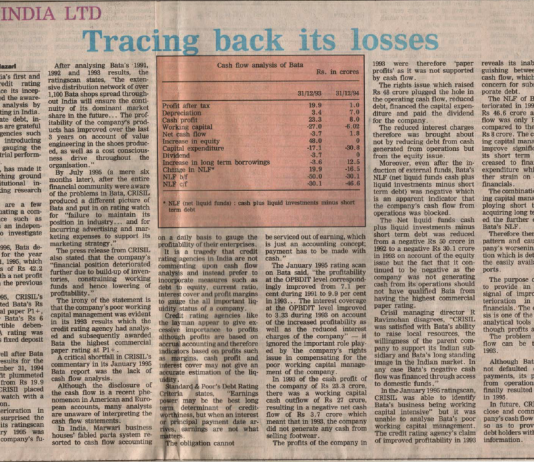

In our

experience companies adopt liberal accounting policies to cover up flagging fundamentals

otherwise there is rarely a valid business reason.

Academic studies have proved the commercial viability of research by taking it from the lofty towers of academia to the lowlands of the trading floor.

A liquidity crisis of such a magnitude is not an overnight phenomena yet the credit rating agency certified the compnay as investment grade thereby misinforming bond holders and bankers