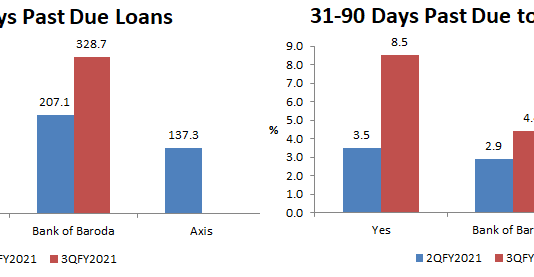

EXECUTIVE SUMMARY. Despite reporting a 36% yoy fall in 3QFY2021 net profits and being below consensus estimates, Axis Bank’s share price on January 28, 2021 closed 6% up, while the Nifty-50 declined by 1%. The strong and positive response to the bank’s results was surprising, as Axis Bank declined...

EXECUTIVE SUMMARY. Senior executives are rushing for the exit door at Aditya Birla Finance Ltd. (ABFL), the non-bank finance company (NBFC) subsidiary of Aditya Birla Capital (ABC), the holding company for all the financial services business of the Aditya Birla group. Since May 2021, at least five senior officials...

The ICICI Bank Board recently staged a ringing defence of its Chief Executive Officer (CEO), Chanda Kochhar with a categorical press statement reposing trust in her. Now that statement has blown up in the board’s face. A new exposé has revealed the smoking gun: Kochhar and her family were...

EXECUTIVE SUMMARY

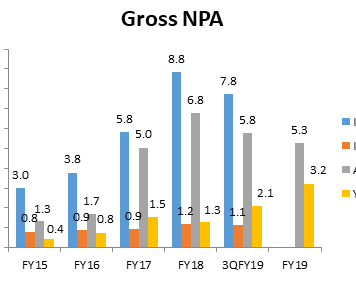

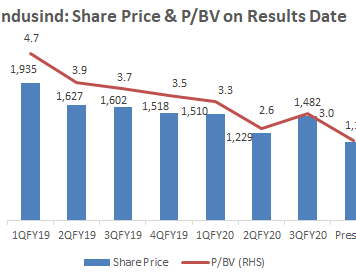

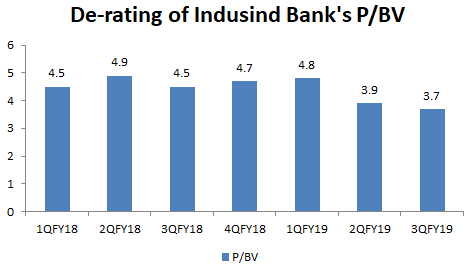

Indusind Bank’s reckless decision to provide a Rs 20 bn (8% of the bank’s capital) unsecured bridge loan to IL&FS, an insolvent infrastructure company has led to a significant de-rating of its valuation multiple. In the 3QFY2019 results call, Ramesh Sobti, the bank’s CEO believes that the bank...

The bank’s official explanation of a technical glitch needs to be examined, by the RBI, which should commission a probe.

Hemindra Hazari

On November 5, 2021, the auspicious day of the Hindu New Year, the Economic Times burst a firecracker of a news story on IndusInd Bank. The story cited whistle blowers (a group...

It is difficult to read the SEBI's scathing order and not wonder what on earth the NSE board was doing.

In Rudyard Kipling’s Jungle Book, Akela, the lone grey wolf leader, exhorts the pack to “look well” upon the cubs who are to be inducted into the pack as their own....

IndusInd Bank’s quarter ended March 31, 2017 (4QFY2017) was impacted by a “one-off” exposure to a company whose cement operations is in the process of being acquired by a top-rated company. While sell-side analysts regard it as a blip in the secular positive outlook on the bank, they are...

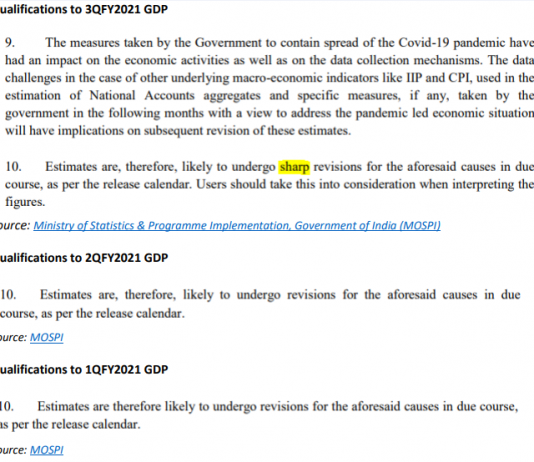

EXECUTIVE SUMMARY. A noteworthy feature in the 3QFYGDP estimate is its dubious credibility, as indirectly admitted by the official statistical agency itself. In the 1QFYGDP and 2QFYGDP, while the National Statistical Office (NSO) had acknowledged that, on account of the lockdown, the estimates are “likely to undergo revisions” the...

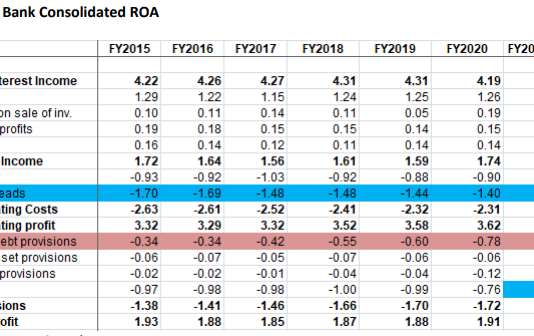

EXECUTIVE SUMMARY. A 6-year profitability analysis of HDFC Bank, India’s most valuable bank, reveals that it has been able to maintain it ROA despite a surge in credit cost for three reasons. Firstly, it has leveraged its overheads to generate more business for the bank, secondly, the lower tax...

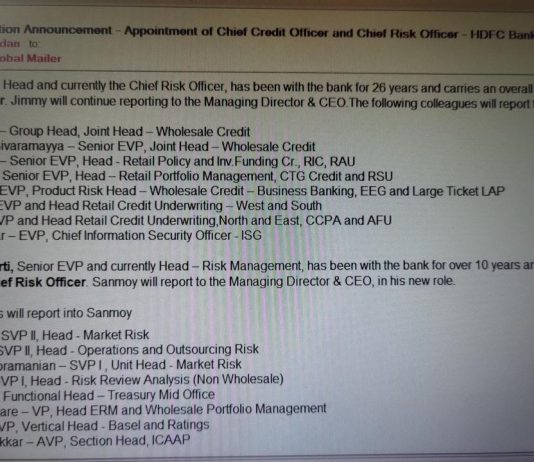

EXECUTIVE SUMMARY. Nearly a year after Axis Bank truncated the responsibilities of its Chief Risk Officer (CRO) by transferring corporate credit risk to the role of the newly created Chief Credit Officer (CCO) who reported only to the CEO, HDFC Bank has decided to go a step further. It...