EXECUTIVE SUMMARY

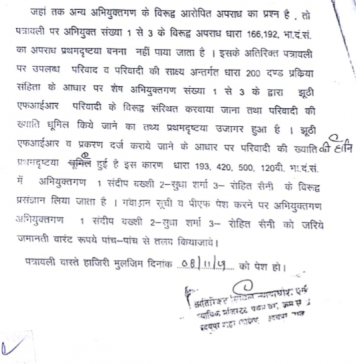

The Central Bureau of Investigation (CBI), India’s premier federal police investigation agency, finally filed a First Information Report (FIR) and charged Chanda Kochhar, former CEO, ICICI Bank, her husband, Deepak Kochhar and V. N. Dhoot, managing director, Videocon Group, with cheating ICICI Bank in the Rs 32.5 bn Videocon loan...

EXECUTIVE SUMMARY.

“hush money”: money paid to someone to prevent them from disclosing embarrassing or discreditable information – Concise Oxford English Dictionary

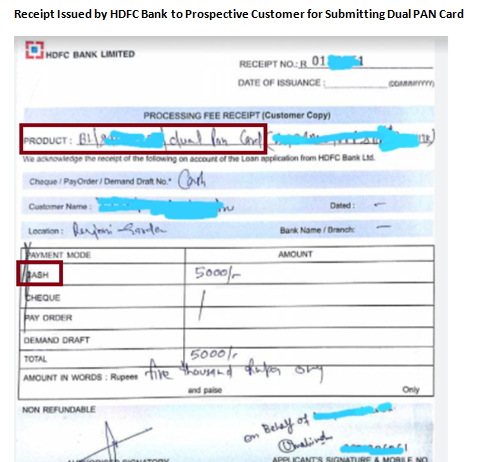

HDFC Bank, India’s most valuable bank, has been found to be levying ‘processing fees’ on prospective retail customers who submitted spurious documents for availing a loan from the...

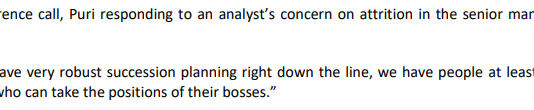

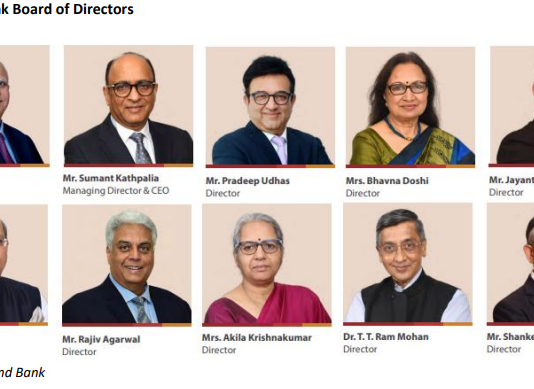

EXECUTIVE SUMMARY. The Chief Executive Officer (CEO) succession fiasco at HDFC Bank, coupled with the tweets of an anonymous source on the abrupt and controversial exits of senior level bank staff (which the bank had no intention of disclosing), has clearly unnerved the senior management of the bank. Aditya...

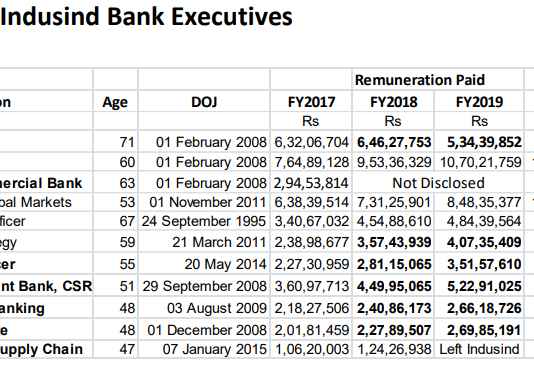

EXECUTIVE SUMMARY. Most private sector banks withhold the remuneration details of senior executives in the annual reports. However, shareholders can specifically request this disclosure from companies. The remuneration disclosure provides valuable information on the quantum of monetary compensation, revealing how senior managers have been appraised and compensated.

In Indusind Bank,...

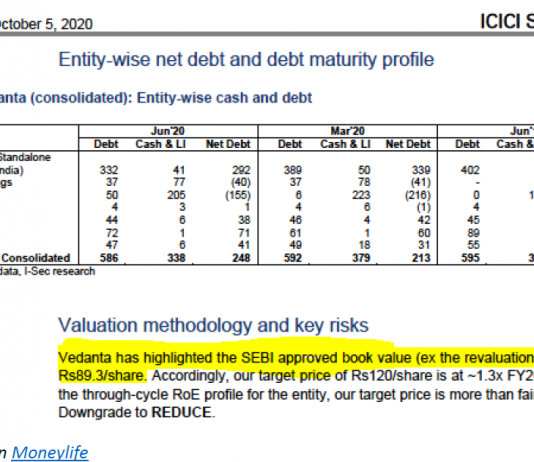

EXECUTIVE SUMMARY. On the opening date of Vedanta’s delisting offer (October 5, 2020), ICICI Securities (I-Sec) issued a results research note on Vedanta with the following bizarre statement: “Vedanta has highlighted the SEBI approved book value (ex the revaluation reserves) of Rs 89.3/share.” I-Sec, a listed subsidiary of...

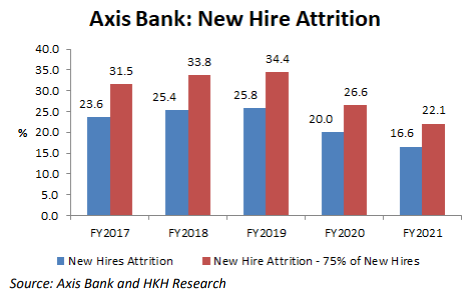

EXECUTIVE SUMMARY. A closer look at Axis Bank’s staff data reveals the alarming mortality rate of new hires in the bank, and provides a glimpse of new hire attrition in the private banking industry in India. This appears to be a symptom of toxic work culture at the bank,...

Indusind Bank: When Half the Staff Left, Why Didn’t Independent Directors Think It Worth Mentioning?

Private sector banks’ high and sharply rising attrition is in the spotlight, thanks to the mandatory disclosures in banks’ annual and business sustainability reports since FY2023. However, inter-bank comparison may not be an accurate indicator of the attrition in a particular bank, as some large banks use unlisted subsidiaries...

Hemindra Hazari

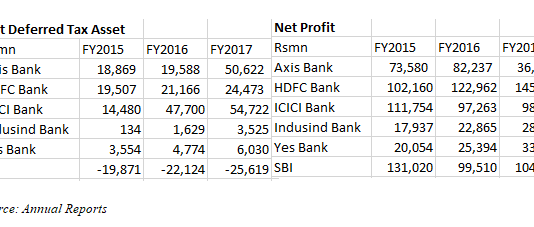

Rising net deferred

tax assets (DTA) in a scenario of stagnant and depressed net profits is not a

healthy sign in some of the banks, as current years’ net profits get enhanced

while sometime in the future the net DTA will get reversed impacting future net

earnings. This trend is visible in...

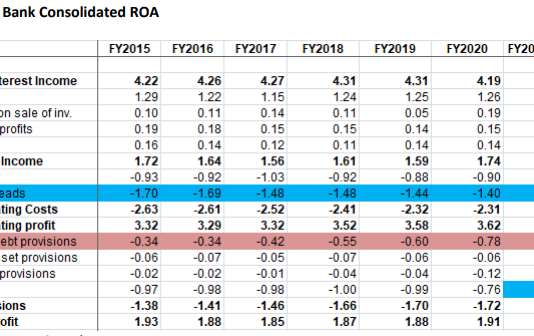

EXECUTIVE SUMMARY. A 6-year profitability analysis of HDFC Bank, India’s most valuable bank, reveals that it has been able to maintain it ROA despite a surge in credit cost for three reasons. Firstly, it has leveraged its overheads to generate more business for the bank, secondly, the lower tax...

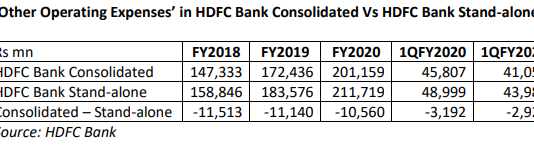

EXECUTIVE SUMMARY. In comparing a company’s stand-alone expenses with its consolidated accounts, it is highly unusual for the consolidated numbers to be lower than the stand-alone numbers. But what has gone unnoticed for some years in HDFC Bank is that its stand-alone ‘other operating expenses’ has been consistently higher...