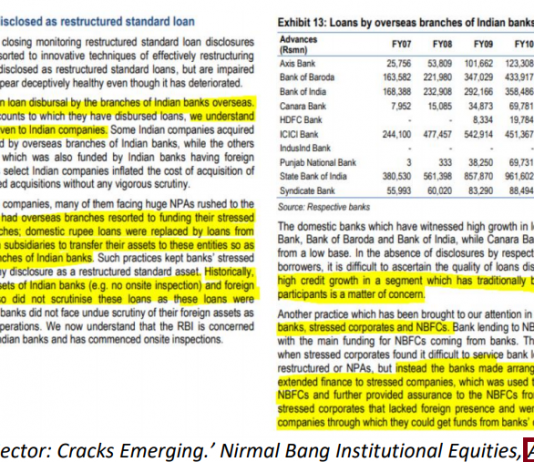

EXECUTIVE SUMMARY. The ET Prime 3-part series based on the Securities and Exchange Board of India’s (SEBI) show cause notices to Standard Chartered Bank, Indusind Bank and Aditya Birla Finance highlighted the manner in which these institutions allegedly ‘evergreened’ their exposure and shifted their loans from the unlisted Thapar...

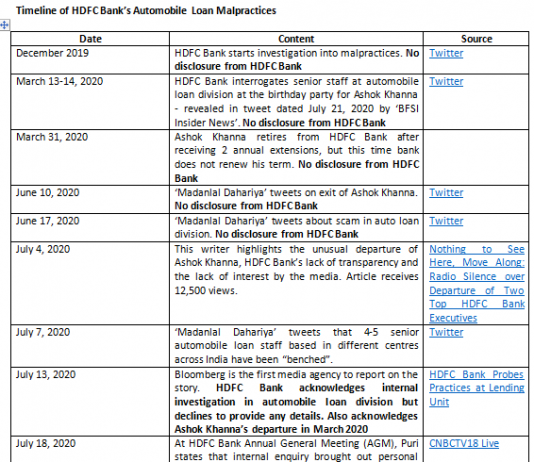

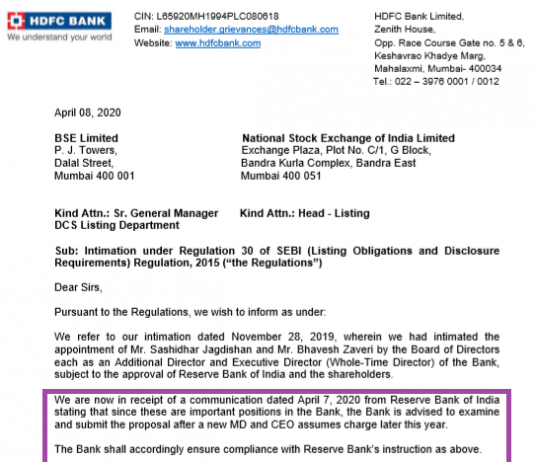

EXECUTIVE SUMMARY. US law firms, Rosen Legal, Pomerantz and Schall have filed class action suits (here, here and here) against HDFC Bank. The grounds are that HDFC Bank allegedly misled investors, provided inadequate disclosures and internal controls over financial reporting, and engaged in improper lending practices in its automobile...

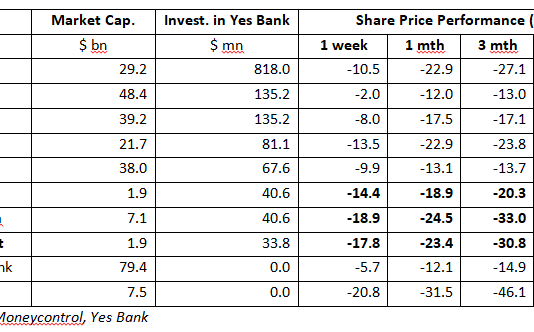

EXECUTIVE SUMMARY. In the SBI-led bail-out of Yes Bank assisted by private sector entities, HDFC Bank, the largest private sector bank, is notably absent, as is Indusind Bank. Stranger still, much smaller banks like Bandhan Bank, Federal Bank and IDFC First have decided to come to the rescue of...

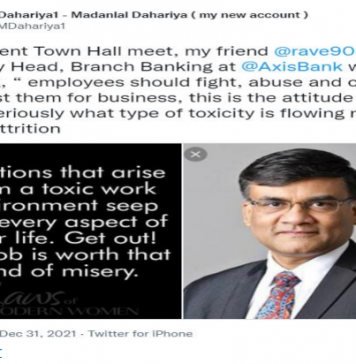

EXECUTIVE SUMMARY. When an anonymous whistleblower tweets on malpractices at India’s most valuable bank, and provides authentic information to justify his claims, one would expect prominent banking journalists and independent directors of the bank to read his tweets. After verifying the details, they ought to bring these issues to...

Leadership is

unravelling at Yes Bank and the stock is tanking. In the dark hours of November

14, the bank announced the immediate resignations of Ashok Chawla, its

non-executive, independent chairman, and Vasant Gujarathi, an independent

director and head of its important audit committee. The directors of Yes Bank appear to have

joined the...

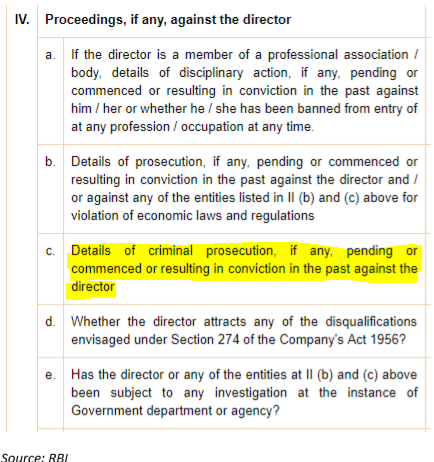

EXECUTIVE SUMMARY. At a time when the economic environment is very volatile, and HDFC Bank’s share price has seen an unexpected slump, comes news of another bizarre corporate governance episode. Once more this paints a sorry picture of the board of India’s number 1 bank by market capitalisation, and...

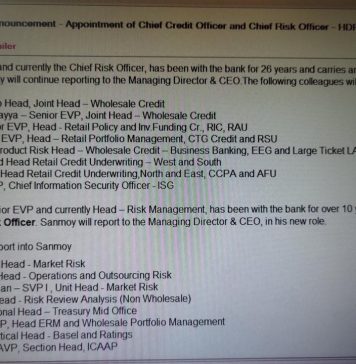

EXECUTIVE SUMMARY. The Chief Executive Officer (CEO) succession fiasco at HDFC Bank, coupled with the tweets of an anonymous source on the abrupt and controversial exits of senior level bank staff (which the bank had no intention of disclosing), has clearly unnerved the senior management of the bank. Aditya...

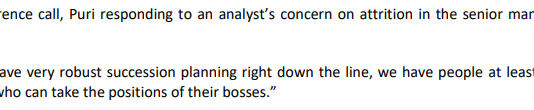

EXECUTIVE SUMMARY. With the Reserve Bank of India (RBI) imposing a penalty of Rs 100 mn (US$ 1.4 mn) on HDFC Bank, the curtain has finally come down on the considerable irregularities (in around 2014-2019) in the bank’s automobile loan division. After verifying a whistleblower’s tweets (June 17, 2020),...

EXECUTIVE SUMMARY. Aditya Puri, the iconic first CEO of HDFC Bank, will finally step down on October 26, 2020 after 26 years at the helm. In this period he rightly deserves the credit for making HDFC Bank India’s most valuable bank, with a market capitalisation of US$ 92.1 bn,...

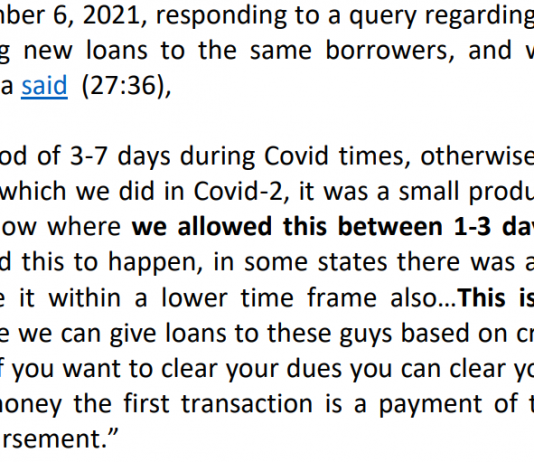

EXECUTIVE SUMMARY. In the ongoing Indusind Bank microfinance saga, we earlier learned of a "technical glitch" whereby the bank generously disbursed loans to customers without their consent. Now comes the bank’s claim of a "procedural lapse" whereby the bank received repayments of large numbers of loans, and disbursed new...