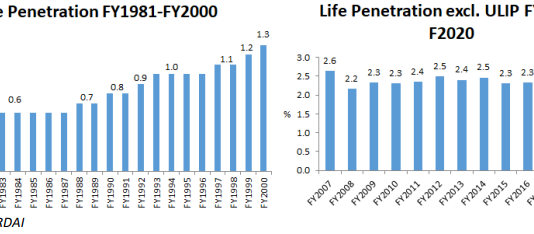

EXECUTIVE SUMMARY. The argument made at the time of opening up the life insurance sector and allowing the private sector was that doing so would increase life insurance penetration (life premium/GDP) and thereby increase long term savings, which would flow into infrastructure investments (which are inherently long-term). But despite...

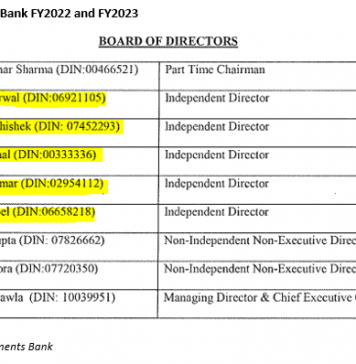

Indusind Bank: When Half the Staff Left, Why Didn’t Independent Directors Think It Worth Mentioning?

Private sector banks’ high and sharply rising attrition is in the spotlight, thanks to the mandatory disclosures in banks’ annual and business sustainability reports since FY2023. However, inter-bank comparison may not be an accurate indicator of the attrition in a particular bank, as some large banks use unlisted subsidiaries...

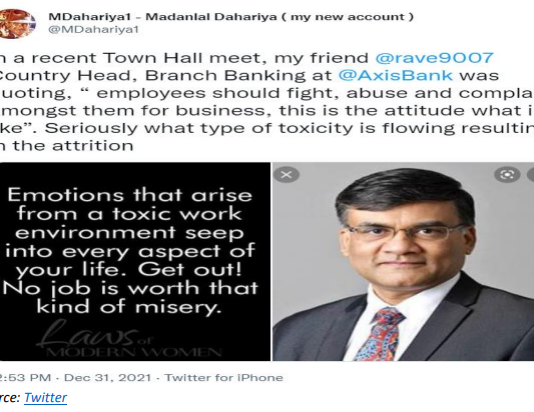

EXECUTIVE SUMMARY. The toxicity in Axis Bank’s work culture which this analyst has been highlighting (here and here) was recently confirmed by Ravi Narayanan, Group Executive - in-charge of retail liabilities, branch banking and products. As disclosed by ‘Madanlal Dahariya’, a pseudonym used by a bank whistle-blower on Twitter,...

HDFC Asset Management Co. (HDFC AMC), promoted by HDFC is in the news for all the wrong reasons, a rare situation for a blue-blooded group which is the darling of institutional investors. The only saving grace is that it is not the only AMC which has been impacted...

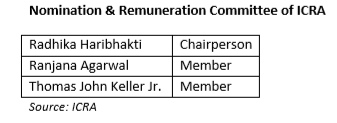

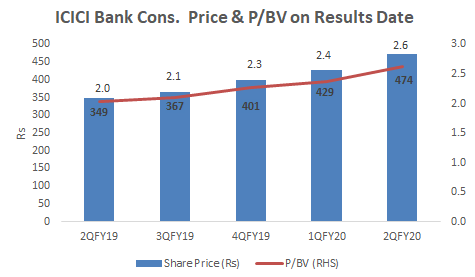

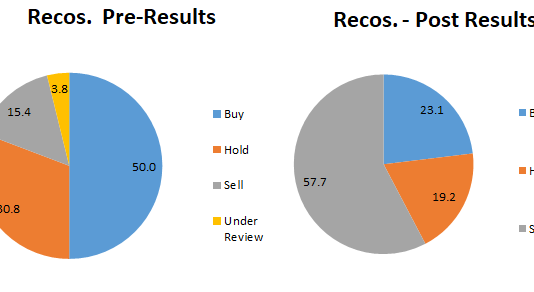

EXECUTIVE SUMMARY. Since 2QFY2019, the stock market has been kind to ICICI Bank. It has rewarded the bank with a consistent rise in the share price and an equally consistent re-rating in its P/BV. With such a strong performance in the share price, the sell-side has bent backwards to...

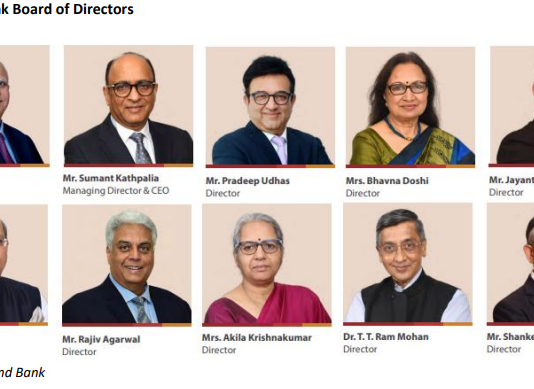

Banks are considered special, but Kotak Mahindra Bank (KMB) and its high profile founder-CEO, Uday Kotak are extraordinarily special (here and here). Ever since KMB was granted a banking license in 2003, Uday Kotak has been its CEO. As per the Reserve Bank of India’s directive, he will have...

The pitifully situation in sell-side research is on account of their inability to publicly question or even condemn the management of the companies they cover and expose accounting fraud, mismanagement and mis-governance.

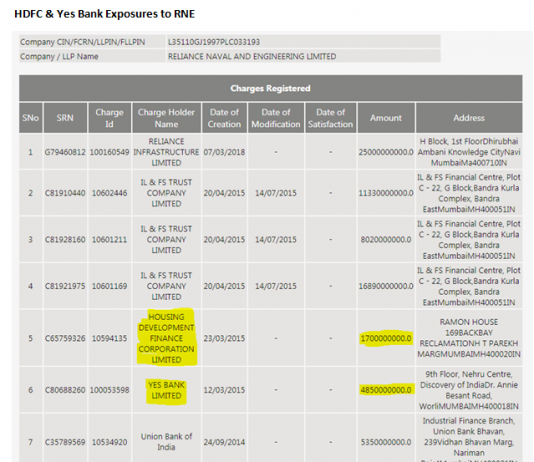

Reliance

Naval Engineering (RNE) will in all likelihood be classified as non-performing

by all the concerned banks in the consortium for the quarter ended March 31,

2018. Long facing difficulty meeting its financial obligations, the company

finally fell short in the December quarter. In the March quarter, banks in the

consortium were unable to...

EXECUTIVE SUMMARY. Two long serving senior executives of HDFC Bank who headed important business verticals have abruptly quit the bank, reportedly under unusual circumstances. Abhay Aima (Group Head – Private Banking), quit sometime in FY2020, while Ashok Khanna (Group Head – Secured Vehicle Loans) left in early FY2021. Aima,...

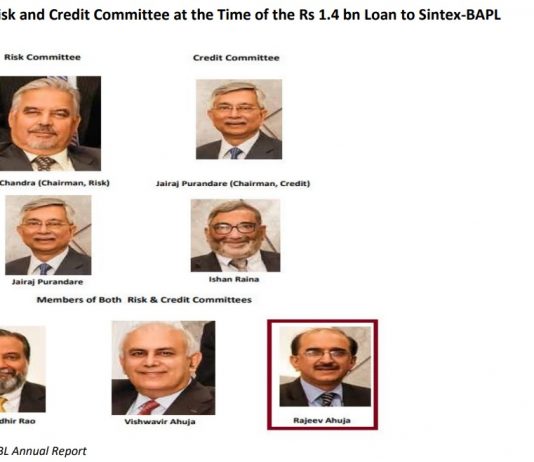

EXECUTIVE SUMMARY. The Mint newspaper broke a news story on February 15, 2022 exposing how, in June 2019, RBL Bank had disbursed a high-risk loan to Sintex-BAPL. Thereafter Sintex-BAPL lent the bulk of those funds to group company Sintex Industries which enabled it to repay a Rs 2.8 bn...