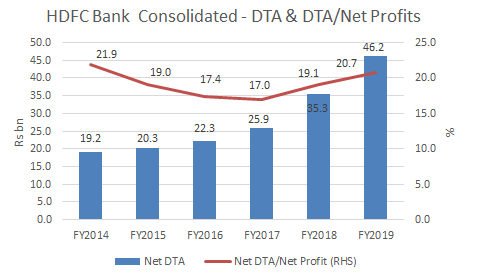

EXECUTIVE SUMMARY. Post the announcement of HDFC Bank’s results, the sell-side rejoiced and the overwhelming majority reaffirmed their bullish stance on the stock, which has handsomely rewarded shareholders in its quarter century of existence. The perennially bullish sell-side has been disregarding the cautions of Daniel Tabbush, one of the rare dissenters who has been alerting investors to the quality of consumer loans at this venerable bank. The market apparently has also ignored the bank’s practice of partly negating the rising bad debt provisions through the net deferred tax asset (DTA), which inflates current year’s profits but ultimately will impact future profits when it reverses. For a bank which trades at such rich valuations, it would have been more prudent to take the hit of its rising credit costs on the chin, i.e. on current profits, instead of partly deferring it to a later date through the creation of higher net DTA.