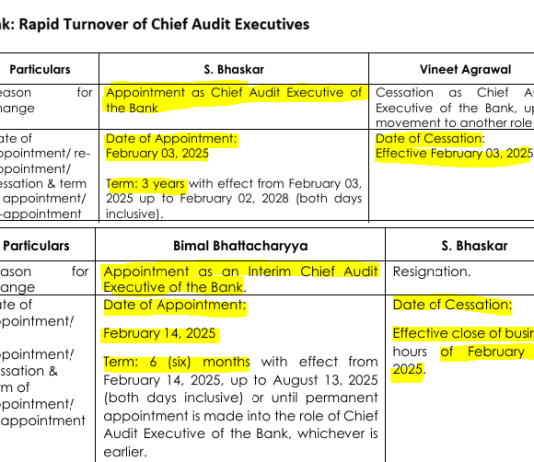

On February 3, Axis Bank got a new Chief Audit Executive (CAE); on February 12, it changed its CAE once again; in six months, it will do so yet again. This is a farcical saga of inappropriate selection procedures, reflecting poorly on the bank’s human resources, as well as...

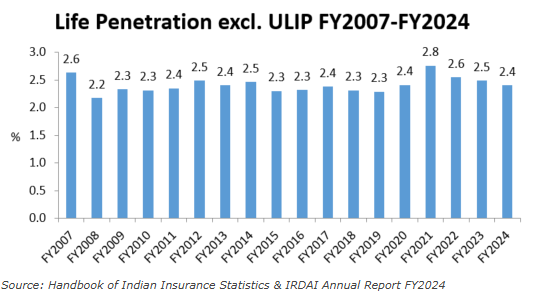

Does anyone remember why India opened up the insurance sector to private, including foreign, investment at the start of this century?

A quarter of a century has passed since then. At the time, the government claimed that private sector/foreign investment in the life insurance sector would accelerate life insurance penetration...

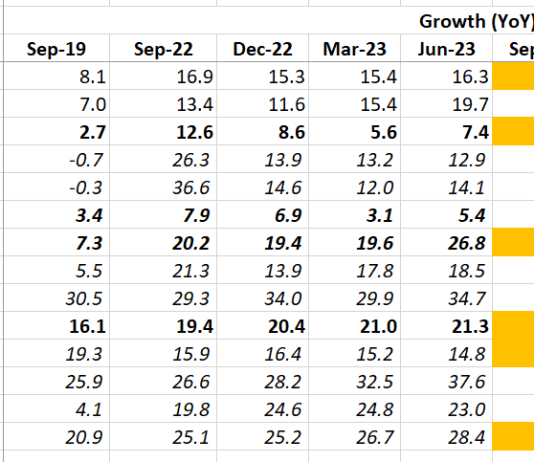

It is a commonplace that banks are a proxy for the economy. When the economy does poorly, one would expect banks to do poorly, since their main activity is intermediating funds between lenders and borrowers, and it is harder to find good borrowers when the economy is stalling.

With India’s...

India’s capital markets regulator, the Securities and Exchange Board of India (SEBI), on September 19, 2024 passed an interim order on Axis Capital (a 100% subsidiary of Axis Bank), barring the merchant bank from undertaking any debt transactions. An unusual feature in this order was the citing of this...

Few people are looking at the connection between two developments.

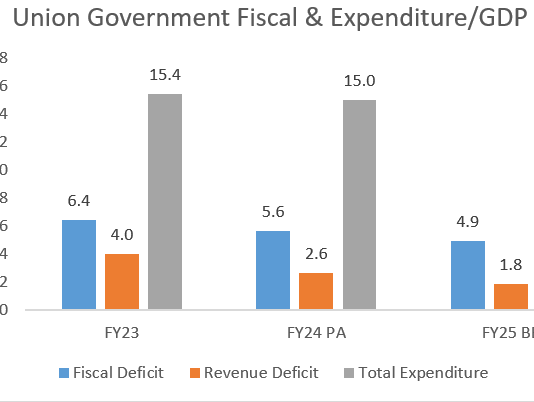

-- First, India’s Finance Minister has been steadily bringing down the Central government’s fiscal deficit as a share of GDP. In fact, she has been so firm in this effort that total Central government spending/GDP has been falling in the...

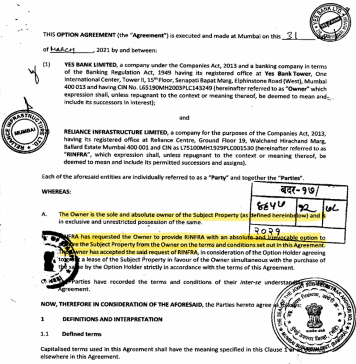

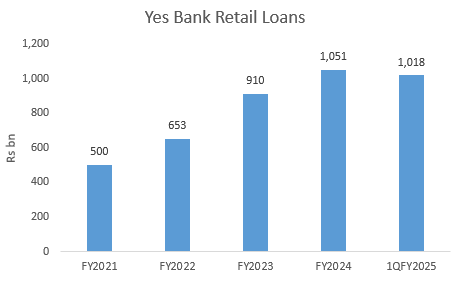

Yes Bank’s 1QFY2025 results which revealed the fall in outstanding retail loans as compared with March 31, 2024 and the sacking of at least 500 staff, with more forced exits expected in the near future (as reported by The Economic Times, dated June 25, 2024), is an admission that...

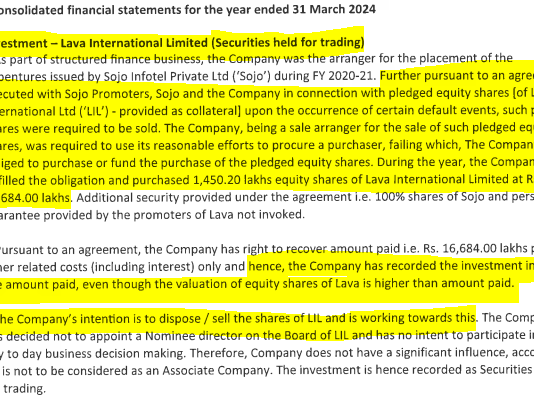

The Reserve Bank of India (RBI) on May 29, 2024 imposed restrictions on ECL Finance (ECL) and Edelweiss Asset Reconstruction (EARC) for extensive mismanagement, confirming the grave concerns felt by some sections of the financial sector regarding the Edelweiss group for at least a decade. The RBI directed ECL...

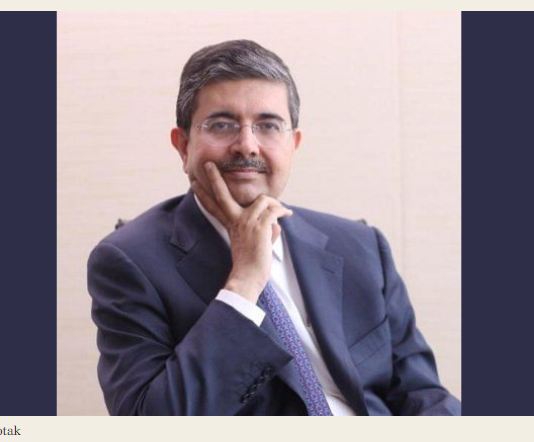

For the last 5 years, the capital market in contrast to the Bank Nifty has been signalling a major concern with Kotak Mahindra Bank (KMB), with a stagnant share price and a secular de-rating of the bank’s price-to-book value multiple. But it is only now that sell-side analysts and...

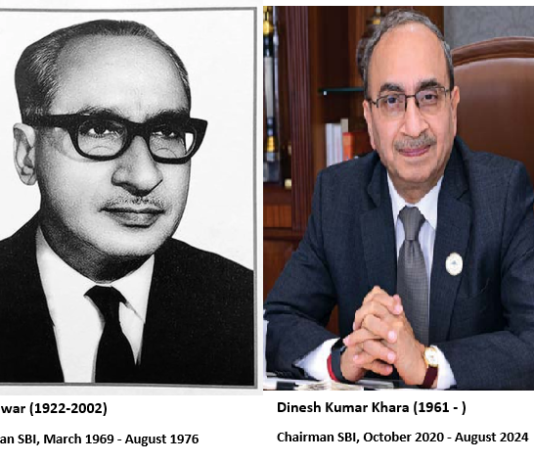

The State Bank of India (SBI) is India’s largest bank by assets and the government’s most prestigious bank. Formerly the Imperial Bank of India under British rule, the SBI long remained something of an empire, its chairmen exalted figures ruling over an army of 235,858 employees. Unfortunately, the SBI...

A Kotak family entity, Infina Finance Private Ltd. (Infina), purchased electoral bonds totalling Rs 1.3 billion – which is more than twice the amount disclosed by the State Bank of India (SBI) to the Election Commission of India (ECI) during FY2019 to FY2022.

In FY2020, the company purchased Rs 760...