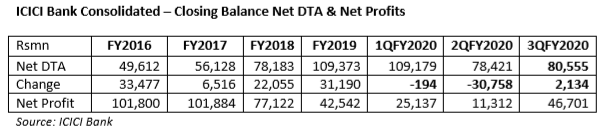

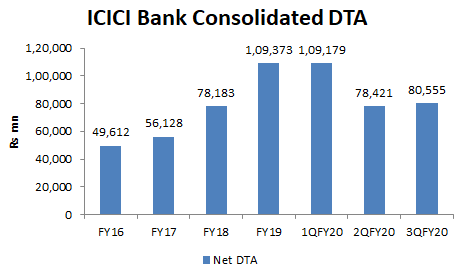

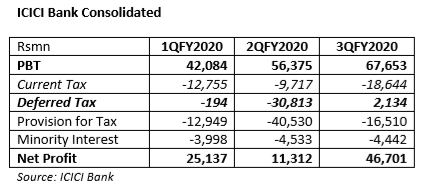

EXECUTIVE SUMMARY. Although ICICI Bank reported a strong performance in 3QFY20, the market has ignored the increase in the deferred tax asset (DTA) which inflated the net profit by Rs 2 bn. It would have been more prudent for the bank to continue with its earlier practice in 1QFY20 and 2QFY20 in reducing the DTA. The bank has an outstanding consolidated DTA of Rs 80.6 bn (as compared with 9 months ended December 31, 2019 consolidated net profits of Rs 83.1 bn) which eventually at some future date will have to be reversed and charged to profits. A positive feature in ICICI Bank is that it discloses the DTA figure in its quarterly results, unlike other prominent banks, and hence analysts can regularly track it, but as usual nobody chooses to analyse or comment on its implications.

ICICI Bank has disagreed with this writer’s contention that creation of DTA inflates profits and has stated that “the increase in consolidated deferred tax asset in Q3-2020 is in the normal course.” It is time the Reserve Bank of India took notice of the industry practice and insisted on a timeline for reducing DTA, as banks are merrily increasing this intangible asset to report higher profits to meet market expectations.