Privatisation is supposed to increase competition, usher in greater efficiencies, unleash animal spirits, and enrich stakeholders. IDBI Bank’s board of directors appear to have started with the tiniest component of the last of those, by enriching the Chief Executive Officer (CEO) and two Deputy Managing Directors (DMDs are executive board directors). All this appears to be done with the blessings of the promoters and the banking regulator. It would be nice if, at some point in the future, the board of directors could get started on the other aims of privatisation, too.

IDBI Bank is an interesting case study, as it has been operating as a hybrid: with respect to some regulations, it is like a government-owned bank, while in other respects it is operating as a private sector bank. Even though IDBI Bank was classified as a private sector bank on January 21, 2019, the bank continues to come under the jurisdiction of The Right to Information Act, 2005 and the Central Vigilance Commission (CVC). Furthermore, the bank continues to be under the scrutiny of the Standing Committees of Parliament. The reservation policy (providing quotas for direct employment for scheduled castes, scheduled tribes and backward classes) in government banks is also applicable for IDBI Bank.

But when it pertains to determining the remuneration of the senior executives, only the CEO and the executive board directors, the “private sector” classification gives the board of directors complete freedom to set their pay scales (though with the final approval of the banking regulator). From the post of Executive Director (in IDBI this position is not a board post and is equivalent to a chief general manager/general manager in a government bank) down, the pay scales are in effect bench-marked with the Indian Bank Association (IBA) pay scales, which govern the government and the old private sector banks. IDBI Bank also has an incentive scheme which is more attractive than the government banks for its officers.

IDBI Bank’s Whole-Time Directors (Executive Board Directors)

Rakesh Sharma, a State Bank of India (SBI) cadre executive and formerly the CEO, Canara Bank, took charge as the CEO, IDBI Bank on October 10, 2018. IDBI Bank was classified as a private sector bank on January 21, 2019, consequent on the Life Insurance Corporation of India (LIC) purchasing majority ownership.

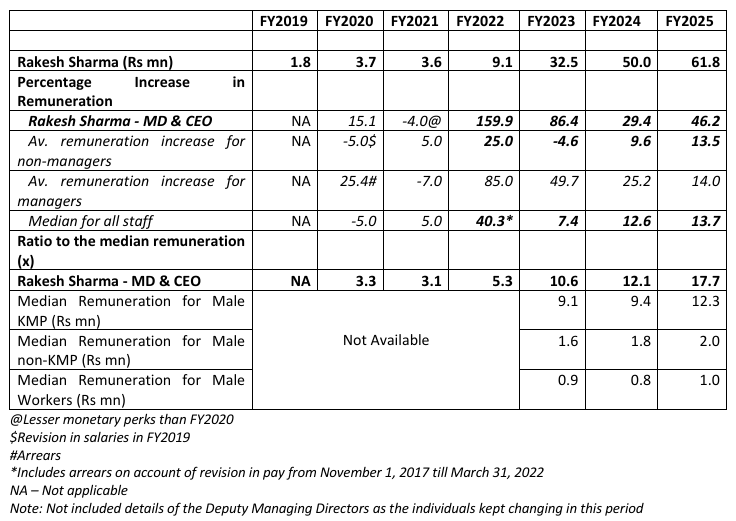

FY2020 was Rakesh Sharma’s first full year as CEO, and his remuneration was Rs 3.7 mn. By FY2025, his remuneration (including deferred bonus) increased 16.7x to a stupendous Rs 61.8 mn. This largesse on account of privatisation by the IDBI Bank’s board of directors to its CEO was not extended to the rest of the staff. Their average annual increase in remuneration was much less than that of the CEO. What is interesting to note is that, despite Sharma’s high base of remuneration as compared with the rest of the staff, his annual percentage increase was much higher from FY2022 as compared with the managers and non-managers. As a result, Sharma’s remuneration ratio to the median remuneration of the staff rose from 3.3x in FY2020 to 17.7x in FY2025.

Remuneration (inclusive of deferred bonus) Details

Source: IDBI Bank

Source: IDBI Bank

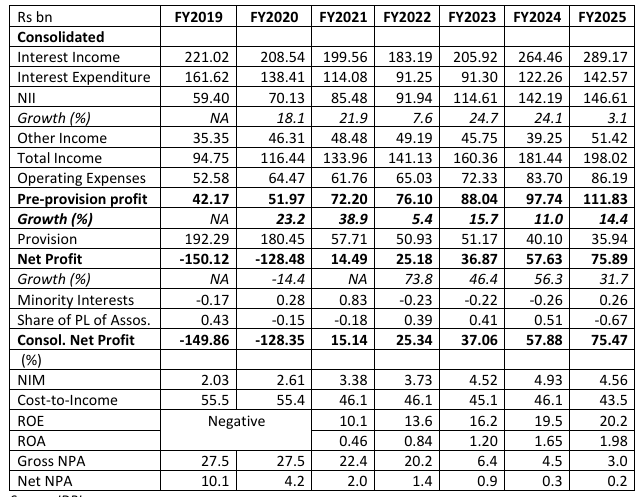

Can the huge and consistent increase in the remuneration for the CEO be justified on account of the improvement in the bank’s financials? At first glance, it appears there is a case for doing so. In FY2019 IDBI Bank reported a consolidated loss of Rs 149.86 bn, and by FY2025 the bank reported a consolidated net profit of Rs 75.47 bn. In the same period gross non-performing assets (GNPAs) declined from 27.5% to 3% of gross loans.

No doubt the improvement in the bank’s net interest margin (NIM) and profitability ratios are impressive, but the significant improvement was on account of the huge increase in equity capital from the Government of India and the Life Insurance Corporation (LIC).

IDBI Bank’s Financials

In FY2019 and FY2020, a total of Rs 388 bn in equity capital was injected in the bank by the Government of India (Rs 124.4 bn) and LIC (Rs 263.7 bn). In FY2021, the bank had a qualified institutional placement of equity of Rs 14.4 bn with 34 investors. Hence from FY2019 to FY2025, the bank received an equity capital infusion of Rs 402.4 bn., the overwhelming majority of which was from a majority government-owned institution and the Government of India.

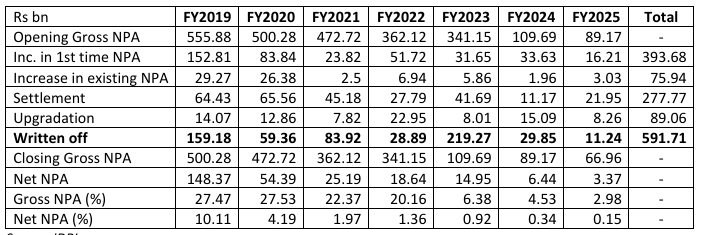

Any significant equity infusion in any lending institution improves the NIM, as funds are lent without a corresponding interest cost; assuming yield of 8.5% per year, IDBI Bank would earn Rs 34 bn per year on this count as interest income. But further, the lender can borrow more against its equity and thereby expand its overall business and profits. Finally, in the same period, IDBI Bank wrote off Rs 592 bn of its gross NPAs, which significantly reduced its gross NPAs from Rs 500.3 bn in FY2019 to Rs 67 bn in FY2025. Such a huge write-off would not have been possible without the preceding significant infusion of equity capital. IDBI Bank reported losses from FY2016 till FY2020 and it was on account of it being classified as a government bank and a quasi-government bank when LIC took majority ownership that depositors retained their faith in the bank and did not pull out their deposits. Hence, the stability and the improvement in the bank’s financials in this period is on account of government ownership and Government-directed infusion of equity funds, and the senior management can by no means take complete credit for the turnaround.

IDBI Bank’s Non-performing Assets (NPAs)

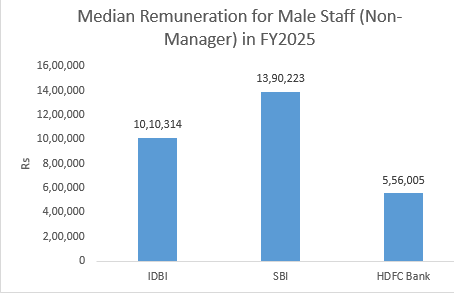

One justification for the huge increases in salaries of the CEO and the whole-time directors of the board could be that the intention is to bring their remuneration on par with that of the CEOs and whole-time directors of the private sector banks. At lower levels, it is the staff of government banks who are paid higher than their private sector peers. From the few banks which disclose median remuneration of staff, we can see a sharp difference between government and private sector banks. However, we must exercise caution in comparing the data of government banks and private sector banks, as, in private sector banks, the costs associated with outsourced and contract labour and direct sales agents, recovery agents, banking correspondents etc. may not be reflected in their staff cost, and their headcount is not disclosed.

While the median remuneration of staff is higher in government banks as compared with private sector banks, in the senior management, from the equivalent of around general manager in government banks the private sector banks pay a much higher remuneration. However, post privatisation in IDBI Bank the remuneration of only the whole-time directors (executive board directors) has been sharply revised upwards and not from the equivalent of general manager.

If the board had selected a CEO from one of the private sector banks, where senior executives are paid higher, then there could be a justification for the higher pay, as such individuals would not join IDBI Bank for a lower salary. But in this case, when Rakesh Sharma was selected, he was paid in accordance with the earlier IDBI Bank CEO’s remuneration, and it was comparable with that in government banks. At the time, Sharma evidently had no hesitation about working for such a salary. It is only when the regulator changed the classification of IDBI Bank from government to private sector bank and after a 2-year gap that the yearly huge increases in Sharma’s remuneration commenced.

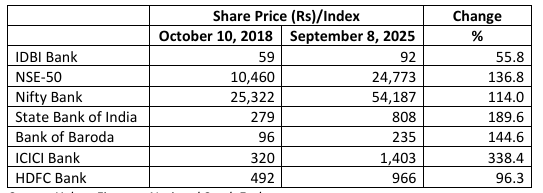

It is claimed that in the free market, apart from profitability and performance indicators, the share price movement of the company under the leadership of the CEO also plays an important role in determining the CEO’s remuneration. In IDBI since October 10, 2018, when Rakesh Sharma took charge as CEO till September 8, 2025, not only has the bank under-performed the NSE-50, Bank Nifty, large private sector banks like HDFC Bank and ICICI Bank, but it has also under-performed government banks like State Bank of India and Bank of Baroda. IDBI Bank’s share price under-performance vis-a-vis the government banks is particularly disappointing, since the remuneration levels of the CEOs of these banks are much lower than what the IDBI Bank’s board of directors has been giving to Rakesh Sharma (in FY2025, government banks’ CEOs and the SBI chairman received around Rs 7.4 mn as remuneration, compared to Sharma’s remuneration of Rs 61.8 mn).

IDBI Share Price Performance Vs Peers and Indices

In IDBI Bank, the massive infusion of equity capital by the LIC and the Government of India has played a critical role in the improvement of the bank’s balance sheet and its profitability indicators. This critical equity infusion would have come to the bank regardless of which individual was the CEO. For the board of directors and especially the Nominations and Remuneration Committee (NRC) which evaluates whole-time directors performance and recommends remuneration increases to determine that only the CEO and the whole time directors should get the credit for the bank’s improvement, and on this basis keep increasing their pay scales handsomely and consistently since FY2022 is unfair. Worse, the bank’s share price has under-performed the major indices and even government banks in this period.

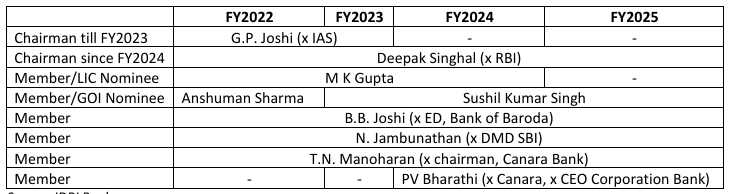

Nomination and Remuneration Committee (NRC) of IDBI Bank

Source: IDBI Bank

Examining the composition of IDBI Bank’s NRC since FY2022 when the sharp increases in remuneration commenced for the CEO and the Deputy Managing Directors reveals that 3 members had earlier ties with Rakesh Sharma when he was in SBI and in Canara Bank. T.N. Manoharan was non-executive chairman, Canara Bank when Sharma was the CEO while PV Bharathi was his junior in Canara Bank and J Jambunathan worked with Sharma in SBI.

Deputy Managing Directors of IDBI Bank Since FY2022

| FY2022 | FY2023 | FY2024 | FY2025 | |

| DMD 1 | Samuel Joseph Jebaraj (x EXIM Bank) | Jayakumar S Pillai (x Canara Bank) | ||

| DMD 2 | Suresh Khatanhar (IDBI cadre) | – | Sumit Phakka (x SBI) | |

Source: IDBI Bank

Even the current Deputy Managing Directors (DMDs) in IDBI Bank had earlier links to Rakesh Sharma. Jayakumar S Pillai was Sharma’s junior when the latter was CEO, Canara Bank while Sumit Phakka was not only Sharma’s junior in SBI but they both belonged to SBI’s Bhopal Circle.

IDBI Bank’s largesse to less than a handful of senior executives at the top is a lesson in what privatisation has come to mean in practice. The bank’s compliant board of directors, with the approval of the RBI, has determined that, after a massive injection of tax payer funds into a government bank, the fruits of privatisation should be reserved for a chosen few executives. It is also telling that the top leadership at IDBI Bank evidently believes in first handsomely rewarding itself and taking credit for the turnaround in this era of so-called privatisation.

________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in all the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.