Indusind Bank, one of the stock market darlings and foreign investor favourites, startled the capital market with a mere 5% rise in net earnings. Earnings rose to Rs 9.2 bn for the quarter ended September 30, 2018 (2QFY2019), as compared with the consensus estimate of Rs 11 bn. This was on account of a charge of Rs 2.75 bn for the fast collapsing IL&FS, an infrastructure developer and financer. What is shocking is that Indusind, a bank which trades at 4.2x P/BV, one of the most expensive multiples in the world, did not disclose its total exposure to the beleaguered leviathan.

More importantly, it had provided a bridge loan of a substantial amount to IL&FS 3 months ago, when a cursory analysis of IL&FS’s financials would have revealed it has been insolvent since FY2014. Apparently, a bank which reports unrealistically low non-performing loans, which investors enthusiastically lap up, provides large loans without either analysing the borrower’s financials or worse, analyses the accounts without comprehending the basics of financial analysis. Indusind Bank, under the leadership of Romesh Sobti, its CEO is now not only a serial mis-reporter (2 successive years of fudged accounts were detected by the regulator), but is also incapable of rudimentary financial analysis of corporate borrowers. It is time investors challenged whether such a bank deserves such steep valuation multiples.

On October 15, 2018, Indusind Bank shocked the market with a mere 4.5% growth in net profits to Rs 9.2 bn for 2QFY2019 as compared with the consensus estimate of Rs 11 bn. This is a far cry from the 25% yoy growth that it had been consistently reporting in the past. The consistency of its high growth in earnings and its pristine asset quality (gross NPAs around 1%) led to a premium P/B multiple of 4-5x. Investors and sell-side analysts also chose to ignore that the regulator had found that for 2 years in a row, FY2016 and FY2017, under the leadership of Romesh Sobti, the CEO, Indusind had been caught fudging its books. The unexpected charge of Rs 2.75 bn for its undisclosed exposure on IL&FS should be a wake-up call on how the bank lends public money.

Not only can Indusind Bank’s accounts not be trusted (although the bank claimed in its results conference call that for FY2018 the regulator may give it a clean chit), but it appears it is incapable of analysing a large borrower’s accounts. Just as it wants the public to have blind faith in its own accounts, it appears to extend the same faith when it lends public money to its borrowers based entirely on an external credit rating agencies ratings of the borrower.

IDFC Securities, an Indian broker, in their results report on Indusind Bank dated October 15, 2018 stated,

“We believe IIB [Indusind Bank] has an exposure of Rs24bn to IL&FS though management did not quantify. The exposure is broadly to two entities 1) ChenaniNashri Tunnel 2) IL&FS parent. Mgmt believes that there will be no haircuts on the first because the project is rated AAA (SO). The second exposure to the parent was taken very recently (3 months ago) and is rated D. This exposure was given as liquidity funding – akin to a bridge loan till IL&FS could complete its rights issue. But after the disbursal, IL&FS was downgraded and the rights issue has been delayed. Management believes that as soon as rights or a liquidity infusion happens, IIB will be repaid… We do not know the break up between the two [ChenaniNashri and IL&FS parent] but we believe a higher amount would have gone to the parent.”

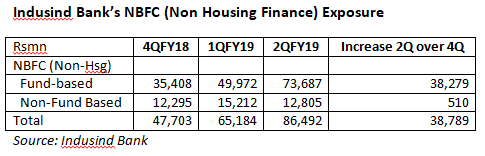

Assuming IDFC Securities’ estimate of Indusind Bank’s IL&FS exposure of Rs 24 bn is realistic, it is significant, as it constitutes nearly 10% of the bank’s capital and 2.4% of its corporate banking portfolio in 2QFY2019. It appears that a significant increase in the bank’s exposure to NBFCs in the non-housing finance category from 4QFY2018 was on account of IL&FS.

What is fascinating and very revealing is that on the results call, not a single analyst asked on what basis the bank had lent such a significant amount to a large non-bank finance company (NBFC). The IL&FS group had started defaulting on its dues in June 2018 and the first reports became public in early September. It is possible that the bank may have disbursed the IL&FS loan prior to these reports but it is inexcusable for the bank to have not analysed IL&FS’s publicly available financial accounts and only relied on the naïve credit rating agencies investment rating (here and here) on the company prior to giving the bridge loan.

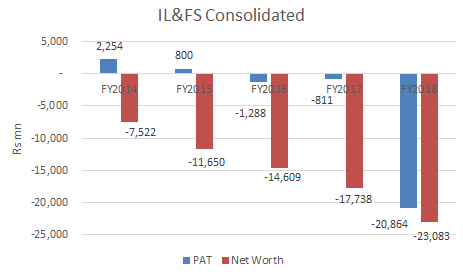

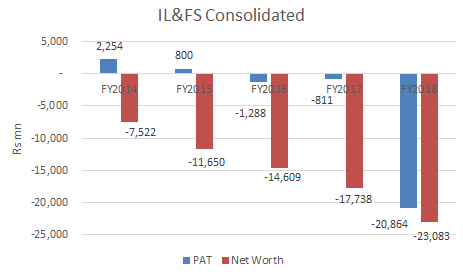

Source: IL&FS

A cursory analysis of the consolidated accounts of IL&FS which is available on its website would have revealed that the company was not only loss-making but that it was insolvent (according to regulatory guidelines, intangibles have to be reduced from equity capital) since FY2014 i.e. for the last 5 years. When Indusind Bank lent the funds around June 2018, IL&FS’s FY2018 accounts were not released, but the losses and its insolvency is clearly revealed from FY2014 till FY2017. It therefore appears that it lent a significant amount based entirely on the rating agencies rating or that the bank’s credit and risk departments are incapable of basic financial analysis.

If Indusind Bank had lent knowing that IL&FS was insolvent, it would have taken adequate liquid security, which clearly is not the case, as it has provided Rs 2.75 bn on an account which is currently standard. This entire episode reflects extremely poorly on Indusind Bank, its CEO, its board of directors and in particular its credit and risk management departments.

While it is true that other banks/NBFCs and mutual funds also exclusively relied on the woefully incompetent credit rating agencies’ rating of IL&FS without doing an independent analysis of IL&FS’s consolidated accounts, it is inexcusable for a bank which trades at 4-5x P/BV and reports around 1% gross NPAs to lend funds in such a negligent manner.

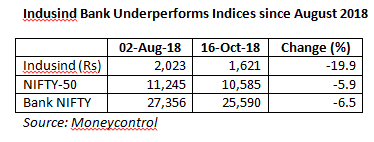

Investors in Indusind Bank received the first warning that all was not well with the leadership of Romesh Sobti when the bank disclosed that for two successive years, FY2016 and FY2017 the regulator had detected that the bank’s accounts were untrustworthy and had even fined the bank. Since August 2, 2018, Indusind Bank has severely under-performed the market. Now we know that the bank is incapable of undertaking basic financial analysis of companies and prefers to rely exclusively on credit rating agencies whose misdeeds were totally exposed in the sub-prime bubble. With its present antics revealed to all and sundry, investors in Indusind Bank should question the foundation of this glitzy bank, the darling of sell-side analysts. It may already be late in the day.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in any of the securities referenced in this Insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.