Romesh Sobti, CEO, Indusind Bank, is a veteran banker with 43 years’ experience. He recently went on record to defend the bank’s substantial bridge loan to the fast-collapsing IL&FS, a systemically important non-deposit-taking core investment company. Sadly, he found this writer’s earlier insight on Indusind to be “nasty” and “ill-informed”. In doing so, he publicly broadcast the state of his knowledge on critical areas of financial accounting and regulatory stipulations for computing solvency. If his views are shared by the important credit and risk management departments of the bank, shareholders should be concerned, as the bank trades at an expensive 3.8x P/BV. But further, the regulator should wake up and take notice.

Sonia Shenoy, senior editor, CNBCTV18, on October, 23, 2018, asked Romesh Sobti, CEO Indusind Bank the following question:

“On what basis did the bank lend to IL&FS, at the time when the lending was done were you aware that the company was loss-making and insolvent? I am just trying to understand whether the risk department [of Indusind Bank] had cleared it at the time?”

Romesh Sobti, CEO, Indusind Bank replied,

“Yes, somebody has written a nasty article on that. I think the ill-informed article saying that the company was insolvent. You just have to look at the balance sheet, somebody has to read balance sheets properly and understand when they talk about intangible for a holding company like IL&FS and what it means – these annuity flows and receivable had come from the SPVs [Special Purpose Vehicles]. If you look at the balance sheet of IL&FS, it was never insolvent. If it was insolvent, how is it that rating agency giving AAA for the last five years?”

That “somebody” was yours truly and the “nasty …ill-informed article” is the insight that this writer had authored on October 17, 2018.

This writer sent a questionnaire to Indusind Bank after Romesh Sobti’s interview with CNBCTV18. In it he inquired what estimate Indusind Bank’s credit and risk management department had made for IL&FS’s equity, and what Reserve Bank of India (RBI) notifications the bank could cite to defend Sobti’s views on intangible assets and IL&FS’s solvency in the interview.

Indusind Bank’s head of investor relations responded and said,

“Please do your regulatory analysis as that should be in the public domain and maybe so also should be the company’s auditor position too.”

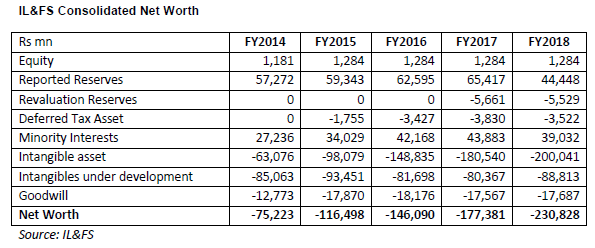

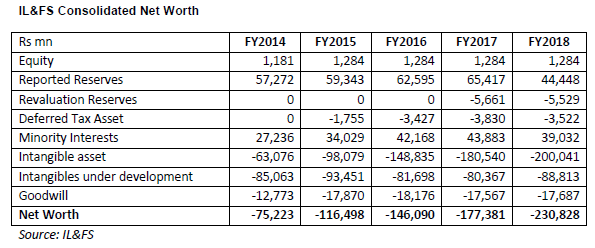

In an earlier article published in the media, on September 30, 2018, this writer had explained and provided the detailed workings of the calculation of IL&FS’s net worth and specifically stated,

In IL&FS the bulk of the intangible assets are rights under SCA which the annual report states,

“Under Service Concession Arrangement (SCA), where a Special Purpose Vehicle (SPV) has received the right to charge users of a public service, such rights are recognized and classified as “Intangible Assets”. Such a right is an unconditional right to receive consideration; however the amounts are contingent to the extent that the public uses the service.” (p. 262 FY2018 annual report).

The value of a right in a tangible asset which is based on annuity flows and receivables from an SPV which are readily quantifiable and arise out of expected cash flows can be materially different from those of an intangible asset for which cash flows are dependent on a number of contingencies. There is hence a distinct and material difference between annuity flows, receivables from a tangible asset and the value of a right to receive consideration in an intangible asset.

Management and auditors test the valuations of intangibles every year and write them down when necessary. The quality of IL&FS’s intangibles is evident as in FY2018, the company commenced marking down the intangibles. It booked Rs 2.95 bn as impairment of Service Concession Agreement (SCA), when it sold its entire (50%) stake in the NAM Expressway on August 16, 2018 (post the balance sheet date) for a mere Rs 600 mn to Ramky Infrastructure. This highlighted how over-valued this particular intangible was on its books (see p. 316 FY2018 annual report) .

Regardless of whether auditors have approved the valuation of intangible assets, the Reserve Bank of India’s regulations are clear that intangibles have to be written down from equity for the calculation of shareholder funds.

As per RBI’s Master Circular on, “Systemically Important Non-Banking Financial (Non-Deposit Accepting or Holding) Companies Prudential Norms (Reserve Bank) Directions, 2015”

2. (1) (i) “breakup value” means the equity capital and reserves as reduced by intangible assets [bold ours]and revaluation reserves, divided by the number of equity shares of the investee company;

2. (1) (xx) “owned fund” means paid up equity capital, preference shares which are compulsorily convertible into equity, free reserves, balance in share premium account and capital reserves representing surplus arising out of sale proceeds of asset, excluding reserves created by revaluation of asset, as reduced by accumulated loss balance, book value of intangible assets [bold ours]and deferred revenue expenditure, if any;

Reducing for intangibles in the calculation of IL&FS’s net worth clearly reveals that the company has had a negative net worth since FY2014 and it has kept deteriorating since then.

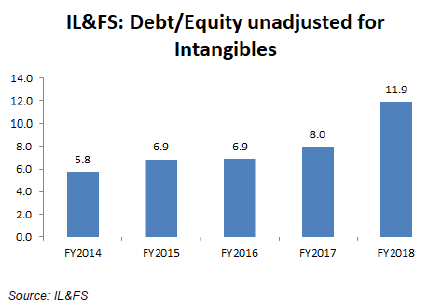

Another ratio to determine financial health is debt-equity. As per Para 12 of the RBI Master Circular, “Regulatory Framework for Core Investment Companies (CICs)” the debt equity of a company like IL&FS should not exceed 2.5 times. Even a liberal, unrealistic scenario of equity inclusive of preference debt, and not adjusting for intangibles, reveals that IL&FS’s consolidated debt-equity significantly exceeded 2.5 from FY2014.

It is very apparent that Indusind, in evaluating the creditworthiness of IL&FS, did not do any analysis based on RBI’s guidelines to determine the solvency of IL&FS; or that the bank’s critical credit and risk management departments are financially illiterate. In all likelihood, Indusind Bank gave a substantial bridge loan to IL&FS (estimated at around 10% of its own capital) based entirely on the incompetent credit rating agencies’ ‘AAA’ rating, and on the false assumption that the rights issue would be successful. Indusind may have also succumbed to the attractive upfront fees and high coupon on the loan it charged IL&FS, although the bank has declined to disclose these details.

Interestingly, T.T. Ram Mohan, (Professor, Finance and Economics at Indian Institute of Management, Ahmedabad) an independent director, Indusind Bank and columnist at Business Standard, in his article on IL&FS dated October 25, 2018 stated,

“With the public shareholders not subscribing to the rights issue, the prospects of a bailout [of IL&FS] appear to be fading. The decision to not subscribe makes sense. What shareholder would want more exposure to a company whose very solvency is in doubt?”

There appears to be a difference of opinion between the CEO of Indusind Bank’s view of the solvency of IL&FS and that of his own board member; or the solvency in IL&FS markedly deteriorated in the short span between Indusind Bank disbursing the bridge loan and the present moment.

From Romesh Sobti’s public utterances it appears he is unable to distinguish between valuation of rights to charge users of a public service, which is an intangible asset, and annuities and receivables from tangible assets. He and the bank also appear ill-informed on the regulator’s mandatory regulations on determining solvency for non-bank finance companies and systemically important non-deposit taking core investment companies. The fact the credit and risk management department of Indusind Bank could have approved such a large loan to IL&FS, and worse, that the CEO should continue to publicly defend it, hardly casts a good light on a bank which trades at 3.8x P/BV.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in any of the securities referenced in this Insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.