The language used in the writ petition filed by Kotak Mahindra Bank (KMB) in Bombay High Court against the banking regulator should have alarmed shareholders. They would be even more apprehensive if they read the language used by the Reserve Bank of India (RBI) in its reply. That a bank should take the regulator to court and publicly challenge its authority in order to prevent a dilution in its founders’ shareholding is itself telling of the founder-CEO’s excessive influence on the board. The harsh, critical language used by the RBI in its court filing (“wilful misrepresentation”, “mala fide intent” taking the regulator “for a ride”) indicates its extreme displeasure with the bank, and the troubles that await the bank if the High Court rules in the regulator’s favour. In such an event, the RBI would probably demand a restructuring of the KMB’s board of directors, and may even force the removal of the founder as a CEO.

In the war of words in the legal realm between the regulated and the regulator, KMB fired the first salvo when it stated that the RBI’s decision to compel the bank’s founders to reduce their shareholding in the bank was

“without jurisdiction, wholly illegal, ultra vires the BR [Banking Regulation] Act, manifestly unreasonable, arbitrary, unfair, without the authority of law, and unconstitutional…”

Such language to describe the regulator’s conduct displays the 15-year old KMB’s utter contempt for the venerable 84-year old RBI. No regulator in the world can allow its authority to be so brazenly challenged, that too by a new kid on the block. The RBI rightfully informed the court,

“The reliefs sought in the Petition if granted, shall result in making inroads into the RBI’s autonomy, and to permit the Petitioners and others (whose actions the RBI is meant to regulate) to become regulators of their own selves. Not only will this turn banking policy, as reflected in the BR Act [Banking Regulation Act, 1949], on its head, but will, in the respectful submission of the RBI, set an unhealthy precedent.” (para 7, RBI Reply).

Thereafter, the language used by the RBI to describe the conduct of KMB is of utmost concern to the bank’s stakeholders, as this is not a dispute between two commercial entities which can go their separate ways after the resolution of a dispute, but between a regulator, armed with punitive powers to regulate the banking system, and a regulated entity.

In para 10 in its reply to KMB’s Writ Petition, RBI states,

“… [KMB] has made several wilful misrepresentations of fact and raised arguments wholly irrelevant to the real matters in issues in order to obfuscate the latter. The Petitioners have by such misrepresentation, clinically singled out unrelated issues, attempting to portray an atmosphere of instability in the financial regulatory systems of the RBI. I say that the Petitioners are also guilty of suppressio veri and suggestio falsi.”

In para 135, the RBI explains to the court how KMB informed the RBI of the issuance of Non Convertible perpetual non-cumulative preference shares and states,

“…It is submitted that the Petitioner bank is well aware that the Department of Banking Regulation [DBR or erstwhile DBOD] is the Department which handles the issuance of licenses, operations of banks, dilution of promoters’ shareholding etc. Knowing fully that DBR of RBI is the Department with whom the Petitioner is in constant touch for the last 14 years, it would have been that Department which ought to have been consulted. However, Petitioner No. 1, with mala fide intent sent a mail on August 2, 2018 at 9:47 AM to another officer of the RBI who is not involved with the work relating to DBR of RBI. A copy of the mail sent to Shri R K Moria, General Manager is annexed as Exhibit “Y”. This act of the Petitioner bank clearly establishes how it tried to take the Regulator for a ride and the conduct of the Petitioner bank amply demonstrates the scant regard it has for the statutory regulations stipulated by the RBI.”

On making enquiries, this writer has found out that R K Moria is the Senior Supervisory Manager (SSM), from the Department of Banking Supervision (DBS) for KMB. SSM are in-charge of all the issues dealing with supervision and inspection of the concerned banks. Importantly, the department of Supervision is different from the Department of Banking Regulation and the issue of promoter holding was managed by the DBR and not DBS.

When the banking regulator in a notarised legal document not only accuses a bank of blatantly lying, of having dishonest intent, taking the regulator “for a ride” but also disrupting and undermining the regulatory systems of the regulator, it amounts to saying that the regulator believes that the bank under the existing management is a threat to the financial system.

The media and sell side commentary thus far have completely ignored the regulator’s valid concerns on KMB and published reports have favoured (here and here) KMB and its larger than life founder-CEO Uday Kotak. Business media, with the exception of Bloomberg andThe Wire, have not bothered to inform the public regarding the contents of the RBI’s Reply to the KMB’s Writ Petition.

However, the contents that this writer has highlighted from RBI’s Reply, which have been published in The Wire, show the seriousness of the RBI’s case for reducing the promoters’ stake. The RBI has cracked down hard on founder-driven banks like Yes Bank in relation to corporate governance concerns and mis-reported accounts; their denying Rana Kapoor another term as CEO caught Yes Bank shareholders by surprise, and the share price is still below what it was prior to the regulator’s announcement to that effect.

Last 1-year Share Price History of Yes Bank

Banking is all about trust, and the regulator’s language in court filings undermines the credibility of KMB and its founder-CEO. Despite the media and the sell-side ignoring the seriousness of RBI’s argument against KMB, the language used by the regulator indicates RBI’s extreme displeasure with KMB. If the Bombay High Court rules in RBI’s favour, shareholders should expect strong action against the bank, which may entail the restructuring of its board of directors and even the removal of the CEO. KMB trades at a premium valuation on account of the market’s perception of its founder, Uday Kotak, but if the regulator compels him to step down, there will be a severe de-rating of the bank. In such a case, the founder and the major shareholders will only have themselves to blame for allowing such a situation to have developed.

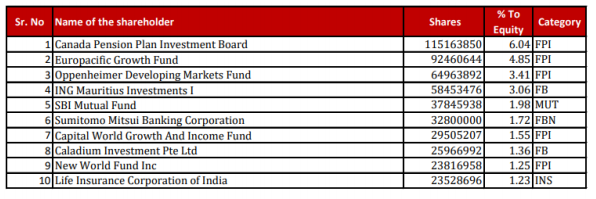

KMB Shareholders (Public) holding more than 1% as on 31st December 2018

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in Kotak Mahindra Bank and Yes Bank securities. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.