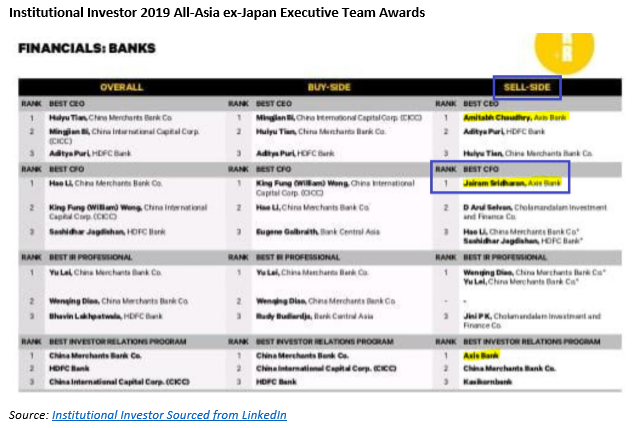

EXECUTIVE SUMMARY. The prestigious Institutional Investor 2019 All-Asia ex-Japan Executive Team Awards have been announced. Remarkably, sell-side analysts selected Jairam Sridharan (Axis Bank) as the ‘Best CFO [Chief Financial Officer]’ in the banking category. This should be deeply troubling to the capital market. In effect, these highly experienced analysts are loudly and proudly proclaiming that a CFO who has a history of certifying two consecutive years of fudged accounts (in FY2016 and FY2017) should be rewarded with the best CFO award. One would expect that when the regulator has exposed a bank’s accounts as misleading, not once, but twice under the same CFO, the sell-side would have collectively bayed for his blood. They ought to have demanded his immediate dismissal, as he had misled them. Hence their future estimates, based on their discussions with him, were useless, as were their price targets. But that would be asking for too much from a profession which primarily engages in corporate public relations and corporate access in the guise of research. Fortunately for the capital market, the buy-side were more discerning, and as a result in the overall ‘Best CFO’ category, Jairam Sridharan did not make it to the top 3.

In this selection, the conduct of the sell-side is telling. In a free market, they are supposed to be the sentinels, warning and punishing errant companies and indicting senior officials for misbehaviour, and especially for fraudulent accounts. More so in India, where the Banking Regulation Act, 1949 considers wilful mis-reporting of information by banks to be a criminal offence punishable with a jail term for the indicted officials. Sadly, in reality, the sell-side are lapdogs and as this example lucidly illustrates, the sell-side not only fails to bark when it is supposed to but also conveniently suffers from collective amnesia when it comes to garlanding an individual with the ‘Best CFO’ award.