By Rahul Satija October 1, 2019, 6:28 AM GMT+5:30 Updated on October 1, 2019, 2:10 PM GMT+5:30

- Some companies see rating cuts of 10 levels after the default

- Questions on quality of ratings may keep some investors away

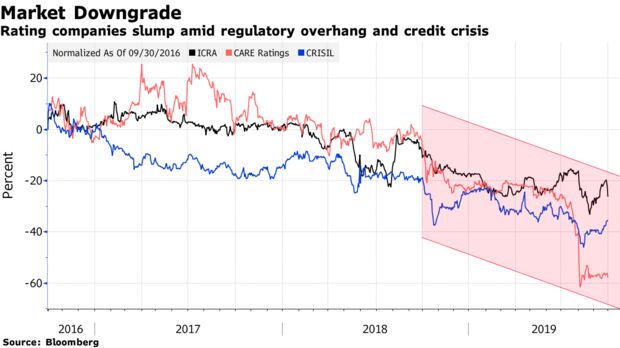

Mounting debt failures in India have been catching rating companies off guard, underscoring continued challenges a year after the landmark failure of shadow bank IL&FS increased scrutiny of the industry.

Defaults at companies including Dewan Housing Finance Corp., Cox & Kings Ltd. and Altico Capital India Ltd. have occurred even as their long-term ratings indicated very low to moderate risk of non-payment.

“Raters have not been able to detect stress in time,” said Ashutosh Khajuria, chief financial officer at Federal Bank Ltd. “Cutting credit profiles after the defaults is no rocket science.”

Read about how Indian credit raters missed an epic failure

There’s a lot at stake as India tries to navigate a shadow-banking crisis and expand its debt market. The lack of more forewarning on payment problems has fueled questions about the quality of ratings, and could keep some investors away from corporate bonds, hindering market development.

India’s major rating firms include Crisil, the Indian unit of S&P Global; ICRA, the local unit of Moody’s Investors Service; Fitch-owned India Ratings & Research; and Care Ratings.

Crisil declined to comment on industry practices, adding that it didn’t rate most of the large credits that defaulted recently. ICRA, Care and India Ratings & Research didn’t immediately comment.

“Indian rating companies are reluctant to give poor ratings to companies before the default happens,” said independent analyst Hemindra Hazari, who writes for the Smartkarma platform. “They fear losing their clients.”

The securities market regulator strengthened disclosure rules earlier this year after rating firms failed to give ample warning on IL&FS group’s defaults from 2018, which triggered a prolonged cash squeeze in the nation. They now have to reveal annual default rates among the companies they evaluate.The new rules are set to improve the quality of ratings in the industry over time, said Somasekhar Vemuri, senior director at Crisil.

The regulator also started probes on whistle-blower complaints against two of the raters. Amid those investigations, ICRA decided to terminate the employment of Naresh Takkar as managing director in August while Care sent Chief Executive Officer Rajesh Mokashi on leave in July until further notice.

Rating companies have been looking at ways to improve the quality of their assessments. For instance, Care’s board said that its interim CEO will not be part of rating operations to ensure the independence of ratings.

Read about ratings company share slumps

Some observers say the industry’s problems, in India and elsewhere like in the U.S., are more fundamental. The norm of firms charging issuers for ratings has been a target of criticism since the global financial crisis.

“Ultimately conflict-of-interest remains as long as the issuer pays for his ratings,” according to J N Gupta, managing director at Stakeholder Empowerment Services.

Here are major moves by rating companies in the past year:

| COMPANY | RATINGS BEFORE DEFAULT/DELAYED PAYMENTS | RATINGS AFTER DEFAULT/DELAYED PAYMENTS |

|---|---|---|

| Altico Capital India | Care Long Term AA- | B |

| India Ratings Long Term A+ | D | |

| India Ratings Short Term A1 | A4 | |

| Cox & Kings | Care Long Term AA- | C |

| Dewan Housing Finance | Care Long Term BBB- | D |

| Reliance Home Finance | Care Long Term BBB+ | C |

| ICRA Short Term A2 | D | |

| Reliance Commercial Finance | Care Long Term BBB+ | C |

| ICRA Short Term A2 | D | |

| Note: Ratings are noted a week before and after downgrade/delayed payments |

(Updates with analyst comment in seventh paragraph.)