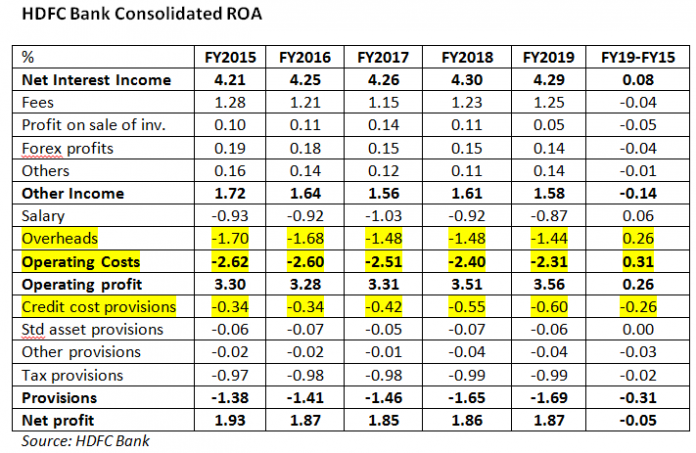

EXECUTIVE SUMMARY. On the eve of HDFC Bank’s 2QFY2020 results (October 19, 2019), an analysis of its profitability for the last 5 years reveals that, while its ROA marginally declined as credit costs increased, it was the leveraging of operating costs which compensated to maintain the bank’s excellent profitability. It appears that the bank has been able to successfully generate higher business through re-engineering its processes, and its digital strategy has contributed to this achievement. The bank has been able to sweat its labour force and existing infrastructure to achieve higher business. The critical issue remains whether the bank can continue with this strategy of leveraging its operating cost in the future. In the current faltering economy, the bank is unlikely to increase its net interest margin and its fees to compensate for the expected higher credit costs and if it is unable to continue with its earlier strategy, shareholders should expect a decline in its profitability.

Recent Posts

Most Popular

Axis Capital Reports Shares of Illiquid Unlisted Firm as ‘Held for Trading’

India’s capital markets regulator, the Securities and Exchange Board of India (SEBI), on September 19, 2024 passed an interim order on Axis Capital (a...

SEBI bars Axis Capital as banker for new debt issues

The regulatory action started after a report by a SEBI-registered analyst Hemindra Kishen Hazari highlighted concerns about Axis Capital’s high-risk transactions earlier this year.

Explained: What prompted SEBI to flag Axis Capital’s underwriting activity & guarantee

SEBI's action followed the release of a report written by eminent research analyst Hemindra Kishen Hazari.

Sebi’s action on Axis Capital: Research Analyst’s article tipped off the regulator about “high-risk...

A registered research analyst's article had flagged the irregularity in Axis Capital's (ACL's) handling of a non-convertible debenture issue to the market regulator.

It was...