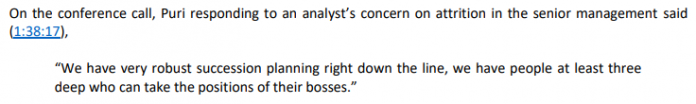

EXECUTIVE SUMMARY. The Chief Executive Officer (CEO) succession fiasco at HDFC Bank, coupled with the tweets of an anonymous source on the abrupt and controversial exits of senior level bank staff (which the bank had no intention of disclosing), has clearly unnerved the senior management of the bank. Aditya Puri’s final annual general meeting and the analysts’ conference call for 1QFY2021 results saw the CEO attempting a robust defence of HDFC Bank’s succession planning, claiming that the bank had “at least 3” individuals at any moment of time to replace their bosses.

Sadly, the strategic failure of HDFC Bank’s board of directors has been succession planning, starting from finding a worthy successor to Puri. And although Puri claimed he was clear on who will succeed him in the last 25 years, that clarity was not visible to the capital market. That such a strong CEO, who presided over the bank for a quarter of a century, could not convince the board on his internal choice of successor, and that the bank had to finally appoint an outside agency to identify external candidates, reveals the actual state of succession planning at the bank.

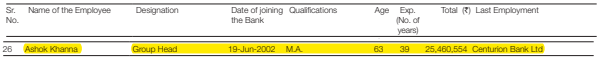

Ashok Khanna, the Group Head – automobile loans, who should have retired in 2017 when he achieved the bank’s retirement age of 60, but was given annual extensions. This reveals that there was no succession planning for his post, and it appears he was considered irreplaceable by the board. The improper practices detected in this division expose the leadership of this vertical and the board of directors’ blind faith in Khanna.

Puri states that Munish Mittal, the Chief Information Officer who quit on July 10, had given notice a year ago; but his replacement has still to be announced. A professionally managed bank should have announced his replacement the day he was relieved, as his post is extremely important in this technology age of banking, and especially for a bank which prides itself on ‘digital banking.’

Despite Puri’s voluble defence, these instances only heighten concerns on succession planning, starting at the top and trickling down to critical posts in the bank. It raises doubts about the quality of governance at the bank, and the justification for the bank’s premium valuation in the market.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own HDFC Bank equity shares. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

If the bank is ready for an internal candidate then former Dy MD Paresh Suthankar should not have left but should have been a natural successor. Reportedly he left as Bank was looking for an external candidate.