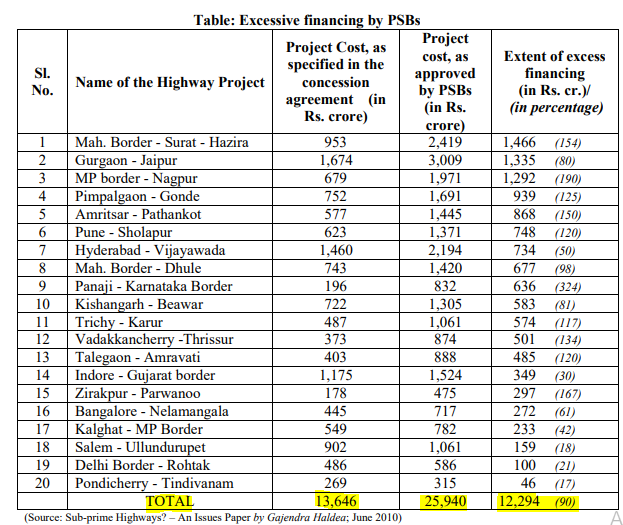

EXECUTIVE SUMMARY. The Covid-19 outbreak and the resulting lockdown have caused widespread economic devastation, particularly in urban and commercially developed centres. Taking into account the loss of revenue faced by different types of businesses, the Reserve Bank of India (RBI) plans to come out with a one-time restructuring package for personal loans, micro and small and medium enterprises and for large companies (loans exceeding Rs 15 bn). While it is necessary for banks to provide relief, given the unprecedented situation, special caution must be taken regarding restructuring loans to large companies, as Indian banks (especially government-owned ones) have taken huge losses in financing private sector infrastructure investments, as well as in other large corporate loans. In these instances, inflation of project costs, siphoning of funds by founders/promoters, and using debt instead of equity to finance high-risk ventures were rampant. The earlier restructuring schemes were unsuccessful: most companies which implemented them finally had to be classified as non-performing, and the banks were laden with the losses. To prevent such a recurrence, the RBI must ensure that, prior to additional bank loans disbursed or a haircut on bank loans to the large companies, a forensic audit is done for companies rated below ‘AA’. This must be done in a time-bound manner, to avoid prolonged uncertainty. They must insist that companies raise equity to maintain the leverage prior to the Covid-19 situation. If haircuts have to be taken, companies must first write down equity, subordinate debt, and unsecured loans prior to the write down of secured bank loans. The reform process in India and the privatisation of infrastructure have been characterised by the socialisation of losses and the privatisation of profits, and the government and the RBI must ensure that this disastrous history is not repeated.