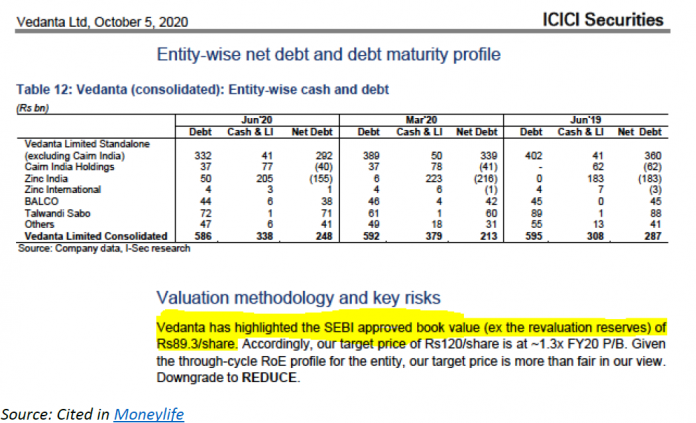

EXECUTIVE SUMMARY. On the opening date of Vedanta’s delisting offer (October 5, 2020), ICICI Securities (I-Sec) issued a results research note on Vedanta with the following bizarre statement: “Vedanta has highlighted the SEBI [The Securities and Exchange Board of India] approved book value (ex the revaluation reserves) of Rs 89.3/share.” I-Sec, a listed subsidiary of ICICI Bank, is an investment bank and sell-side firm. The report was authored by Abhijit Mitra (with 8 1/2 years sell-side experience) and Udaykiran Paluri. Even a novice analyst would know that a company’s accounts are certified by the auditor, and the capital market regulator has no role to approve or disapprove a company’s book value.

In any credible sell-side firm, the maker-checker (or “four eyes”) principle requires that a supervisory analyst approve the research note prior to publication. Normally, an editor reviews the note for grammar, sentence construction, logic and overall flow. An experienced sell-side editor would have rectified the “SEBI approved” phrase, as the terminology is not used in sell-side research. In a domestic firm like I-Sec Manoj Menon, as the head of institutional research, should have signed off as the supervisory analyst, and this phrase should have been immediately flagged. All research reports also have to be approved by the compliance department prior to publication. It is a mystery how in a prominent sell-side firm, majority-owned by a leading bank, such a phrase slipped through these quality control measures.

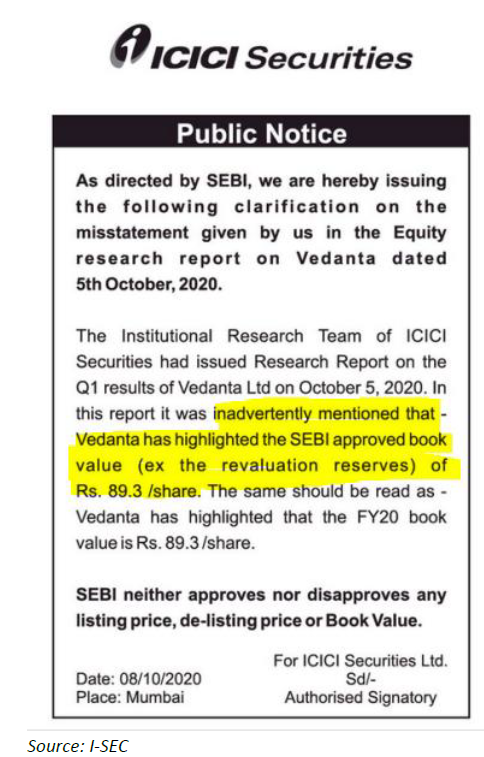

Despite being a listed company, I-Sec has displayed a complete lack of transparency in clarifying how such an appalling lapse took place. SEBI directed the company to issue a public statement, which was carried in the prominent newspapers, whereby the company acknowledged that the phrase should read as “Vedanta has highlighted that the FY20 book value is Rs 89.3/share.” I-Sec declined to clarify to the media as well as to this writer how its internal systems could have failed, permitting such a statement to be published in a research report.

An alternative explanation is that, even though I-Sec was not involved in the Vedanta delisting offer as an investment bank, it was trying to support the founders of Vedanta by persuading the company’s minority shareholders that, since the regulator had “approved” the book value, it was an appropriate floor price for the issue. Media reports, citing sources, say that SEBI may launch a probe on the timing of the I-Sec report. The Vedanta delisting offer was controversial, as the management depressed the book value by taking huge write-offs of Rs 174 bn. Moreover, the management had chosen not to pass on the dividend of Hindustan Zinc to shareholders, contrary to the promises in its dividend distribution policy.

Whatever the explanation, the credibility of I-Sec, and particularly its research, has been tarnished by this episode. To date no action has been taken on the concerned officials who had approved the phrase. The public ignominy of issuing an erratum in prominent media agencies may just be the beginning, and further penalties may lie in store.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own equity shares in ICICI Bank and Vedanta. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.