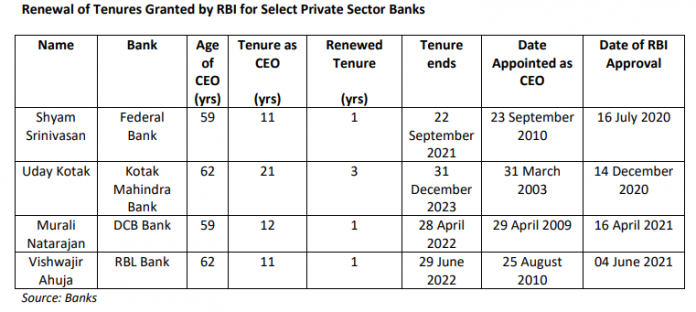

EXECUTIVE SUMMARY. The Reserve Bank of India (RBI)’s decision to grant a 1-year extension to Vishwavir Ahuja, Chief Executive Officer (CEO), RBL Bank is similar to the 1-year extensions it provided to Murali Natarajan, CEO, DCB Bank and Shyam Srinivasan, CEO Federal Bank. In recent times, Udak Kotak, CEO-founder, Kotak Mahindra Bank (KMB) enjoys the unique distinction of getting a 3-year extension by the regulator, despite having been a CEO for over 15 years, contradicting RBI’s policy regarding the maximum tenure for bank CEOs.

There are three issues raised by RBI’s conduct. Firstly, the decision to favour Uday Kotak and KMB is plainly partisan, undermining the credibility of the banking regulator. Secondly, by granting three private bank CEOs only a 1-year extension, is the regulator indicating to the banks its displeasure with the existing CEOs and the need to find a replacement in the course of the year? Although the RBI granted Shyam Srinivasan a second 1-year extension last year, the Federal Bank board of directors has sought a 3-year extension when his term ends on September 29, 2021, indicating that the bank has chosen not to read the regulator’s tea leaves – or that the RBI did not give any such indication to the bank to look for a successor. If the RBI were to approve a further term to Shyam Srinivasan, it would raise questions about the regulator’s competence; what was the justification for repeated 1-year extensions? Thirdly, RBI’s policy of renewing CEOs with 1-year tenures unnecessarily introduces uncertainty in a bank’s future strategy: the existing CEO and the bank can plan for only one year, as the RBI may insist on a replacement at the end of the year. Such short-term planning, especially in the current environment of economic stress, can be disruptive to the bank and its stakeholders, and it is unfortunate that it is being caused by the regulator’s decision to approve only 1-year extensions, without any explanation to the public.

The capital market plays an important role for private banks, and the regulator must either be more transparent in explaining its decisions or it should reconsider its policy of granting 1-year extensions even when the candidates are conforming to the regulator’s norms of age and tenure for the CEOs. It is tragic that the RBI’s credibility as an impartial regulator has reached a nadir. Latest developments — the favoured treatment it has meted to Uday Kotak, and its inability to comprehend the significance of its decision to renew CEO tenures for only one year — take its credibility even lower.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I have no exposure to the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.