RIDHIMA SAXENA SEP 14, 2021, 13:31 IST

- As part of the merger, Clix Capital Services will also need to take on Suryoday Small Finance Bank’s gross bad loans worth ₹381 crore. That’s nearly a quarter of Clix Capital’s own net worth.

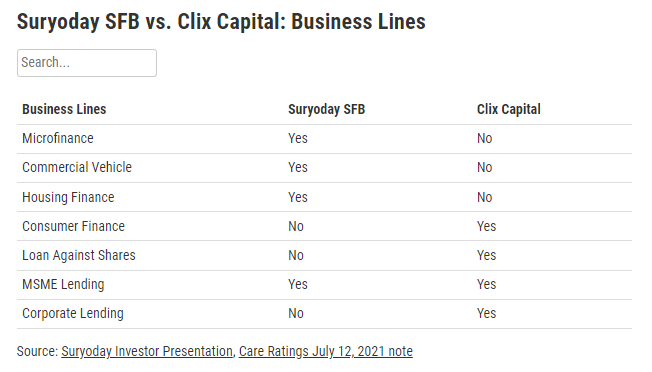

- Both the entities are into completely different lines of business. Suryoday SFB is essentially a micro-lender, while Clix Capital is a non-banking financial company that is into MSME and consumer lending.

- Besides Clix Capital getting an indirect banking licence, the deal would help Suryoday SFB diversify its loan book and strengthen its digital presence.

AION Capital-backed Clix Capital Services Pvt. Ltd., a non-bank lender, has been out in the market to acquire a banking licence since last year. After a failed attempt to acquire distressed Lakshmi Vilas Bank in November last year, it has now set its eyes on another bank — Suryoday Small Finance Bank Ltd.

The proposed merger, according to a source directly aware of the development who spoke on condition of anonymity, is in advanced stages, with Centrum Capital acting as an advisor to the deal. The development was first reported by Business Standard on Sep. 13 that said, citing unnamed sources, that both parties were engaged in due diligence for the transaction.

Even as the deal would help micro-lender turned banker Suryoday to expand its loan book, the deal comes at a heavy price for Clix Capital. This, as the Gurugam-based non-bank lender will also have to absorb Suryoday’s gross bad loans worth ₹381 crore.

That’s nearly a quarter of Clix Capital’s own net worth. The cost of the merger, and its own deteriorating asset quality due to the pandemic, will be over and above that.

But experts are divided on the benefits of the merger.

“There are no visible synergies between Suryoday SFB and Clix Capital, as both have completely different business models,” said Anand Dama, research analyst at brokerage firm Emkay Global Securities.

“The only plausible explanation for the deal is that it would help Clix Capital indirectly acquire a banking license, while Suryoday will be able to diversify its lending portfolio. But a regulatory approval for the deal could be an arduous task,” he said. There are others who believe Clix Capital will benefit from both cheaper capital, thanks to the banking licence, and new set of borrowers.

After the deal was reported, Suryoday SFB’s stock jumped almost 20% to close at Rs 179.40 apiece on the BSE on Monday.

What’s On The Table?

Suryoday SFB is essentially a micro-lender with close to 68% of its loan book worth ₹4,004 crore dedicated to providing micro-loans to women in urban and semi-urban areas, under the joint liability group model.

Clix Capital, on the other hand, is mainly into small business and consumer lending that form 82% of its loan book worth ₹4,249 crore.

The proposed merger, said Siji Philip, senior research analyst at Axis Securities, may mean a riskier loan book with possible pressure on asset quality metrics, which would need to be resolved over time.

“If a deal fructifies, it would also mean that the combined loan book of Suryoday and Clix Capital could face asset quality headwinds and more clarity is awaited on this front. Besides, the merger will create a loan book comprising microfinance from Suryoday, and MSME (micro, small and medium enterprises) and consumer finance from Clix, which have been some of the heavily impacted segments during the pandemic,” she said.

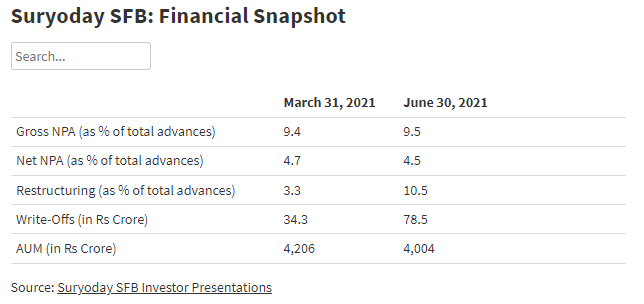

As of June 30, Suryoday reported gross non-performing assets at 9.5% of its total advances, while it wrote-off loans worth nearly Rs 79 crore. Its GNPA in the quarter ended March, too, was largely the same at 9.4%.

“Delinquency in the portfolio increased due to the impact of the second Covid wave. Collections were difficult in the majority of the places across the country in April and May which led to increased PAR (portfolio-at-risk),” said Baskar Babu Ramachandran, managing director and chief executive at the bank during its earnings con-call on Aug. 12.

Compare that to Clix Capital, which had gross NPA at 3.37% as on March 31, or about Rs 143 crore, as per a June 29 note by Care Ratings. The asset quality numbers as on June 30, 2021 were not available in public domain for Clix Capital.

The Road Ahead

As the contours of the deal get worked out, combining Suryoday and Clix Capital may even help the two entities build a more resilient loan book, said Hemindra Hazari, an independent banking analyst.

“Suryoday SFB would need to expand its loan offerings beyond microfinance to build a more resilient loan book, and a deal with Clix Capital would help it do just that,” he said.

AdvertisementBesides helping with loan book diversification, the merger would also help Suryoday improve its digital capabilities and lower its operating costs, said Philip.

Whereas Clix, said Hazari, will be able to take advantage of lower cost of funds available to a bank. “At a time when non-bank lenders are struggling with liquidity constraints, a merger would go a long way in bringing down the cost of funds,” he said.

So far, Suryoday, focused on Maharashtra and Tamil Nadu, has expanded its book into commercial vehicles, affordable housing and small business loans. But since a bulk of its business is unsecured micro-loans, its asset quality has remained weak.

Clix, however, managed to shrink its stressed corporate loan book to 18% as of fiscal 2021, compared to 27% in fiscal 2020. But despite being more efficient with its lending, the cost of capital has increased to 4.53% of total assets, as against 1.23% in the previous fiscal.

The credit costs, Care Ratings said in its July note, inched up mainly due to higher provisioning costs amid the pandemic that affected the businesses of its underlying MSME and retail borrowers.

The deal, said Hazari, is borne more out of need than synergy between the two lenders.

“Though the Reserve Bank of India has been conservative in granting banking licences to NBFCs, acquiring or merging with a bank has become a convenient backdoor entry for some. For Clix, this is a similar opportunity, even if it means absorbing the bad loans of another bank,” he said.