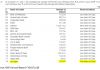

Shares of Zomato, Paytm parent One 97 Communications Ltd and Nykaa owner FSN E-Commerce Venture have fallen to their lowest levels since listing.

MarketEdited by Prashun TalukdarUpdated: January 24, 2022 1:30 pm IST

New Delhi: Shares of Zomato, Paytm parent One 97 Communications Ltd and Nykaa owner FSN E-Commerce Venture have fallen to their lowest levels since listing. Except for Paytm, both Zomato and Nykaa stocks registered massive gains despite posting weak quarterly numbers after strong listings. Paytm made a tepid debut at the exchanges and has plunged more than 58 per cent from its issue price of ₹ 2,150.

Here’s Your 10-Points Cheatsheet To This Big Story:

- Shares of online food delivery platform Zomato cracked as much as 19.38 per cent to hit its all-time low of ₹ 91.70. The stock got listed at ₹ 116, a premium of ₹ 53 per cent compared to the issue price of ₹ 76.

- Zomato’s net loss widened to ₹ 429.6 crore during the September quarter, mainly on investments in the growth of its food delivery business.

- Cosmetics-to-fashion retailer Nykaa dives 12.66 per cent to hit a record low of ₹ 1,740.05. It made a stellar debut and got listed at ₹ 2,001, up 79 per cent from its issue price of ₹ 1,125 per share.

- Today, Paytm fell as much as 6.14 per cent to hit an intraday low — which is also its lifetime low — of ₹ 901.

- Paytm has been sliding after announcing the closure of its Canada B2C (business-to-consumer) app from March 14.

- “Since their listing, these companies (Zomato, Paytm and Nykaa) have been over-valued, which was obvious as compared with their profits. Listing essentially benefitted the early investors who sold out at the IPO (initial public opening) time,” Independent Banking Analyst Hemindra Hazari told NDTV.

- Also, PB Fintech Ltd, the owner of Policybazaar and Paisabazaar, slipped as much as 11.39 per cent to hit an intraday low of ₹ 766.

- A massive sell-off in the technology stocks has also spooked investor sentiment.

- Start-ups and technology companies are witnessing tremendous selling pressure.

- Meanwhile, the benchmark BSE Sensex and broader NSE Nifty were trading more than 2 per cent lower, respectively, in the afternoon deals.