EXECUTIVE SUMMARY. In the ongoing Indusind Bank microfinance saga, we earlier learned of a “technical glitch” whereby the bank generously disbursed loans to customers without their consent. Now comes the bank’s claim of a “procedural lapse” whereby the bank received repayments of large numbers of loans, and disbursed new loans to the same accounts, on the same day, and in cash.

Intriguingly, on November 6, 2021, Sumant Kathpalia, CEO Indusind Bank, on an analyst call stated that the bank had an approved product during Covid-2, whereby the cooling period between repayment of earlier loans and the disbursal of new loans to the same customers was reduced from 30 days to within the “same day and three days”. The revised policy was fraught with risk. The bank claimed it was concerned to ensure that the repayment of the earlier loan should precede the disbursal of the new loan. But when the policy apparently permitted both transactions to take place within the same day, and also allowed for the transactions to be done in cash, it eventually led to a situation where the bank was unable to determine the timing of the repayment of the old loan and the disbursal of the new loan. In other words, borrowers may have funded their repayment with a fresh loan from the bank. The “procedural lapse” was therefore the direct result of a product approved by the risk management committee of the bank.

The ongoing investigation will therefore have to probe the role of the senior executive management, which approved the product and permitted the repayment of earlier loans and disbursal of new loans being done in cash on the same day. As this was an unusual revision in the policy, it needs to be probed not only by the external consultant, but also by the regulator. When senior executive management of a bank play a critical role in an episode of irregularity, the credibility of external consultants engaged by the bank becomes doubtful, and it requires the banking regulator to undertake an investigation.

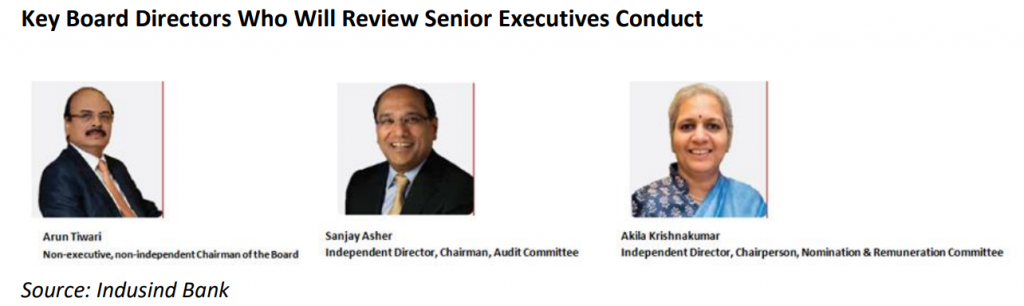

It remains to be seen how the Indusind Bank board of directors, especially the chairpersons of the board, audit committee and nominations and remuneration committee, review the “technical glitch” and the “procedural lapse”, both of which reflect poorly on the executive leadership at Indusind Bank.

The Indusind Bank shareholders should be concerned, as the Reserve Bank of India (RBI) has been flexing its considerable muscle on small and mid-sized private sector banks, and apparently removed Vishwavir Ahuja as CEO, RBL Bank at end-December 2021. Depending on how seriously the regulator views the “technical glitch” and “procedural lapse”, shareholders should not take Kathpalia’s continuance at the helm of the bank for granted.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in Indusind Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.