It is Uday Kotak’s swan song year as chief executive officer of Kotak Mahindra Bank (KMB), and the theme of the bank’s FY2023 annual report is “Acceler@ting Change”. In line with this, the bank’s “strategy emphasises on building younger [italics ours], diverse and future-fit talent at the Group.” Perhaps this explains how Jay Kotak pole-vaulted to become joint head of the bank’s 811 initiative at the tender age of 32.

Junior apart, the bank does indeed need a young, committed workforce to manage operations and deliver on its ambitious growth strategy. A casual reader of KMB’s annual report might assume that such a workforce is in place: KMB proudly displays, among its awards, the “Employee Excellence Award 2022” at the Economic Times Excellence Summit. It claims that four out of five employees find the bank a “great place to work”.

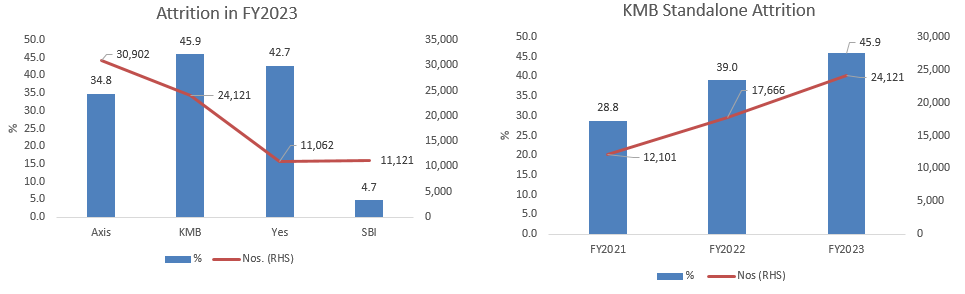

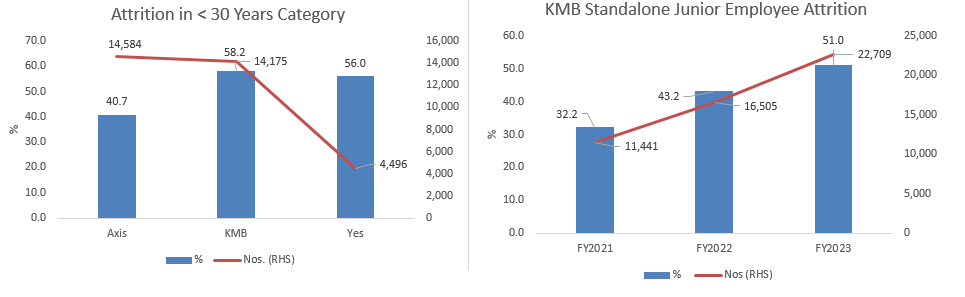

What KMB fails to mention in the annual report’s “Message from Uday Kotak”, the “Directors’ Report” and “Management’s Discussion and Analysis” is that employee attrition is accelerating at a pace well over the speed limit — overtaking Axis Bank and even Yes Bank. KMB appears to be on the fast track for the crown for highest attrition in FY2023, with nearly one in two employees leaving in the course of FY2023. This achievement needs to be prominently displayed in KMB’s awards gallery.

Source: Banks

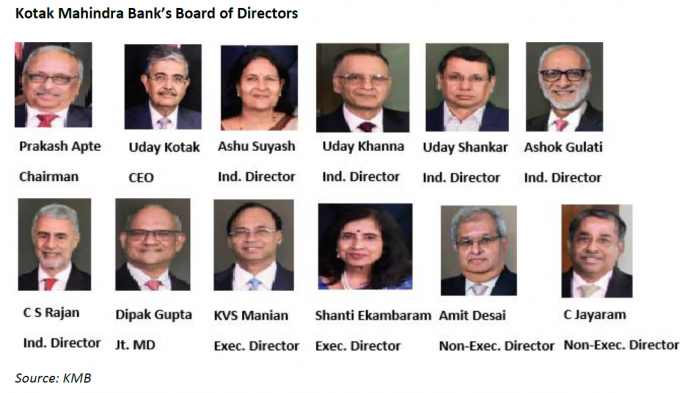

In October 2017, as chairman of the Committee on Corporate Governance, Uday Kotak had highlighted the two styles of corporate management in India – the “Raja” (Monarch) model, where promoter interest precedes the interest of other stakeholders (Praja); and the “Custodian” (Trusteeship) model, which corporate India needs to imbibe, and where the board of directors act in the interests of all stakeholders (shareholders, employees, staff et al). Presumably, Uday Kotak believes that, even though he is the “Raja” of the bank which bears his family name, the board of directors at KMB practises the “Custodian” model.

It is hardly a sign of good governance that, not only is the attrition of KMB’s employees galloping, but the board of directors under the chairmanship of Prakash Apte, and the executive leadership of Uday Kotak and Dipak Gupta, are unwilling to even acknowledge it to their shareholders.

Perusing KMB’s FY2023 annual report, the reader might be seduced by the bank’s overt commitment to its employees. For example, a survey reveals that 79% of employees believe the bank is “a Great Place to Work” (up from 77% in the previous year). Shareholders are also educated on “Drona”, the bank’s “flagship managerial capability development programme” to assess a manager as an assessor, trainer, mentor and coach.

KMB’s public commentary to non-discerning shareholders paints a picture of employee contentment and loyalty to the bank. Its reporting of the “Drona” programme suggests that youngsters are likely to pursue long-term careers in the bank.

The facts speak otherwise. KMB’s disclosures on attrition in the under-30 years category and in the category of junior employees (there are overlaps between the two categories) reveal that attrition in junior employees in FY2023 is 51%, and in the under-30 years category, it is at an even more shocking 58.2%. It is worth recalling that, in the Mahabharata, Drona demands and receives the thumb of his disciple Ekalavya as Guru Dakshina. Perhaps the present generation of Ekalavyas at KMB prefer to quit their jobs instead.

Source: Banks

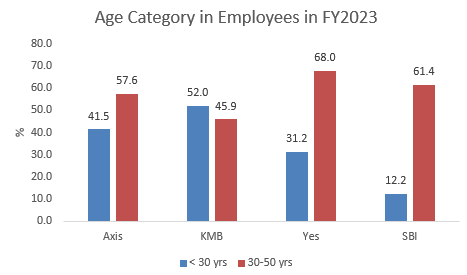

The extremely high attrition rate in the under-30 years category is a huge concern for the bank, since that constitutes 52% of its total employees in FY2023. This is the highest amongst Axis Bank, Yes Bank and SBI. Hence the high attrition in this category impacts KMB much more than the others. As 84% of the bank’s under-30 years category are new hires, the high attrition of 58.2% in this category also indicates high mortality of new hires.

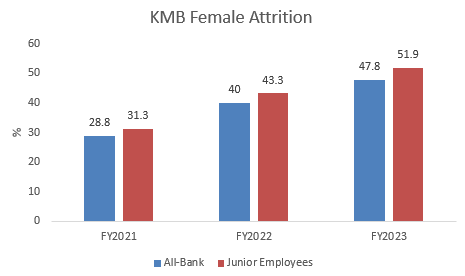

Commenting on gender equality in KMB, the board of directors publicly reaffirm that the bank is an equal opportunity employer, and there is significant women participation in the workforce. But what the directors do not throw any light on is why the bank is a more than equal dis-employer: female attrition is higher than overall attrition in the bank, and is rising steeply. Axis Bank also reported a similar trend in female attrition, but in the absence of any acknowledgement by both banks, stakeholders can only conclude that these workplaces are not conducive for female employees.

The lack of any commentary on such a critical issue is despite KMB proclaiming that “your bank adheres to the highest standards of corporate governance which includes disclosure, transparency and responsiveness.”

KMB’s claims of transparency and responsiveness ring hollow as this analyst sent the bank specific queries pertaining to attrition, its likely causes and the lack of any commentary by the board but the bank like Axis Bank has declined to respond.

There is a huge attrition issue in private sector banking. HDFC Bank, the largest private sector bank, stated at its 1QFY2024 results call that in FY2023 the bank had overall attrition of 30%, and that, at the entry level, attrition was around 40-50% (HDFC Bank has not yet released its FY2023 annual report). In FY2022, HDFC Bank reported overall attrition at 27.6%; in the under-30 years bucket it was 40.6%; and in sales it was 43.7%. ICICI Bank, the second largest private sector bank, has historically not disclosed attrition, and as with HDFC Bank, its FY2023 annual report has not yet been released. The normally highly voluble Uday Kotak uses public platforms to promote the superior efficiency of the private sector, and he is a leading advocate of further privatisation of government banks. But he appears to have taken a vow of silence on why private sector banking, and KMB in particular, have much higher rates in attrition as compared with the government banks.

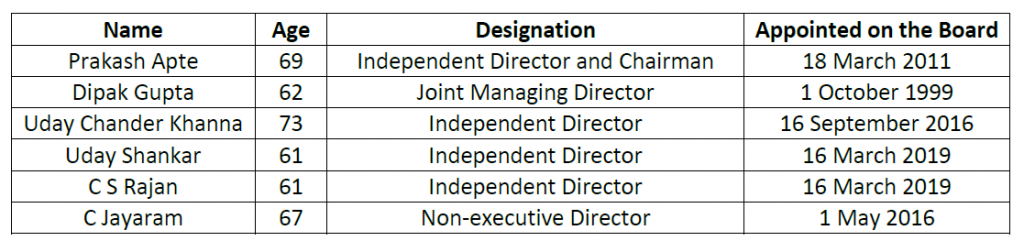

Taking its cue from the promoter-CEO, the board of directors of KMB has also dutifully remained silent in the Directors’ Report and the word “attrition” is not to be found in the section on human resources. Perhaps they believe that employee attrition is a non-issue in a bank ‘acceler@ting’ to going digital. The supposed ignorance of KMB’s board of directors regarding the welfare of a key stakeholder in banking is startling, as, out of a 12-member board, 6 members, including its independent chairman and joint managing director, have reported that they possess a specialisation in human resource management.

KMB Board Directors Having a Declared Specialised Skill of Human Resource Management

When nearly 46% of the entire workforce, and an astounding 58% of the under-30 years age category (which forms the majority of the employees) rushes to the exit door, and the board treats it as a non-event, what does it say about the competence of KMB’s board of directors? Even a non-specialist in HR on any corporate board of directors would be cognisant of such appalling attrition. That it constitutes an operational risk was even publicly recognised by M K Jain, the then deputy governor, Reserve Bank of India in speeches to the directors of banks in end-May 2023. By remaining silent, the directors of KMB have cast doubt on whether they are fit to serve on any corporate board of directors, especially in the strategic and sensitive sector of banking.

KMB has richly rewarded equity shareholders since its listing, and Uday Kotak as promoter-CEO deserves considerable credit for this accomplishment. As he steps down from his executive role in the bank he founded and nurtured, the board of directors must review the attrition, as employees are also important stakeholders in the bank. The negligible presence of employee unions and officer associations in KMB where only 2.7% of the employees are members may possibly explain the high attrition at the lower levels. Uday Kotak’s core senior executive team has remained loyal, but a bank cannot be managed by having a stable senior executive team while at lower levels every second employee will have fled by the year-end. Such a high attrition, even at lower levels, is disruptive to operations, customer service and to training and hiring costs and the board either needs to be revamped or devote considerable efforts to lower the attrition. KMB’s proud proclamations that it follows the highest standards of corporate governance, transparency and accountability, carries little credibility when its board remains mum about such massive employee flux. The issue requires intervention by the regulator before a major disruption occurs in the bank.

Note: A questionnaire was sent to Kotak Mahindra Bank on 16th July but despite reminders the bank declined to respond.

An edited version of this article was published by The Wire and can be read here.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in all the banks mentioned in this report. HDFC Bank subscribes to this analyst’s research and a member of this analyst’s family is employed with HDFC Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: