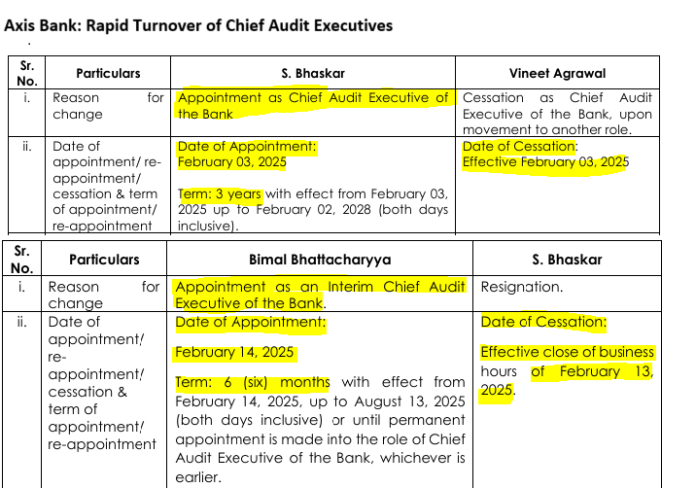

On February 3, Axis Bank got a new Chief Audit Executive (CAE); on February 12, it changed its CAE once again; in six months, it will do so yet again. This is a farcical saga of inappropriate selection procedures, reflecting poorly on the bank’s human resources, as well as the Nomination and Remuneration Committee and the Audit Committee of the board of directors. Further, it raises questions about why the selected individuals left before the completion of their respective terms.

The CAE in a bank (or ‘Head of Internal Audit’ as per the Reserve Bank of India [RBI] terminology) is an important post in the bank’s senior management. It is an integral component of the assurance function, ensuring that operations are functioning safely, within the confines of regulations and the law, and in an ethical manner. Internal audit also verifies all the procedures and hence is the chief protector of operational risk in a bank.

On January 31, 2025, Axis Bank informed the exchanges that,

“a) Vineet Agrawal will be taking up another role within the Bank and accordingly cease to be Chief Audit Executive and senior management [bold ours] of the Bank, effective February 03, 2025.

b) S. Bhaskar has been appointed as Chief Audit Executive of the Bank for a period of three years with effect from February 03, 2025, up to February 02, 2028 (both days inclusive), in place of Vineet Agrawal.”

There are major ramifications of this announcement which, unfortunately, have not been probed by either the media or analysts, who are meant to enlighten the public and the capital market about such developments.

On January 7, 2021, the RBI had issued a circular highlighting the importance of the internal audit function and the role of the Head-Internal Audit. The circular stated,

“3. To bring uniformity in approach followed by the banks, as also to align the expectations on Internal Audit Function with the best practices, banks are advised as under:

a) Authority, Stature and Independence – The internal audit function must have sufficient authority, stature, independence and resources within the bank, thereby enabling internal auditors to carry out their assignments with objectivity. Accordingly, the Head of Internal Audit (HIA) shall be a senior executive of the bank who shall have the ability to exercise independent judgement [bold ours]…

b) Competence – Requisite professional competence, knowledge and experience of each internal auditor is essential for the effectiveness of the bank’s internal audit function [bold ours]. The desired areas of knowledge and experience may include banking operations, accounting, information technology, data analytics and forensic investigation, among others. Banks should ensure that internal audit function has the requisite skills to audit all areas of the bank [bold ours].

c) …

d) Tenor for appointment of Head of Internal Audit – Except for the entities where the internal audit function is a specialised function and managed by career internal auditors, the HIA shall be appointed for a reasonably long period, preferably for a minimum of three years [bold ours].

e) Reporting Line – The HIA shall directly report to either the Audit Committee of the Board (ACB) / MD & CEO or Whole Time Director (WTD). Should the Board of Directors decide to allow the MD & CEO or a WTD to be the ‘reporting authority’ of the HIA, then the ‘reviewing authority’ shall be with the ACB and the ‘accepting authority’ shall be with the Board in matters of performance appraisal of the HIA. Further, in such cases, the ACB shall meet the HIA at least once in a quarter, without the presence of the senior management, including the MD & CEO/WTD.”

The organisational structure for heads of assurance functions such as internal audit is designed to have an adversarial relationship with the business arms, and to create an environment of creative dissonance within the organisation. One of the major roles of the Audit Committee is to ensure that the CAE is independent of the CEO and executive directors and is not put under pressure by them or by business heads.

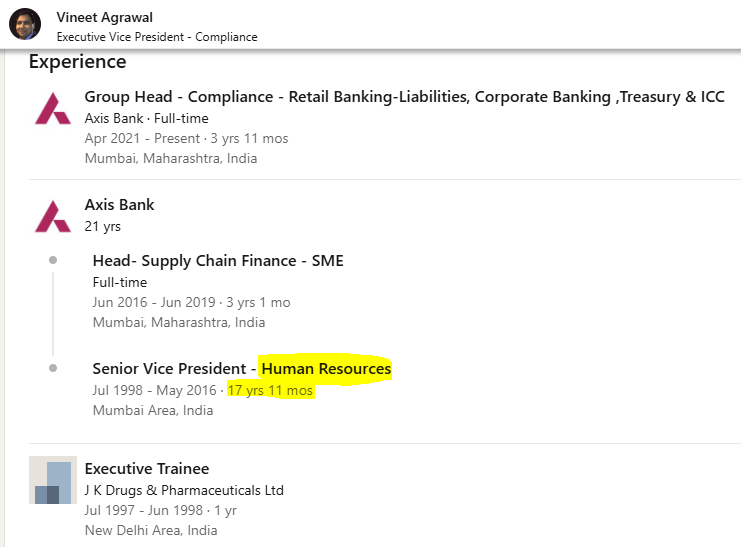

Vineet Agrawal was appointed Chief Audit Executive on April 28, 2023, over 2 years after the RBI issued the circular. As per his Linkedin profile, at that time he would have been in Axis Bank for nearly 25 years (he joined the bank on July 4, 1998), of which nearly 18 years were in the human resources department. Even though the nature of his immediate prior assignment to being appointed CAE was in compliance, his expertise till then had been primarily in human resources, with no significant exposure to internal audit. Moreover, his educational qualification was a Master in Business Administration (MBA), and not as a Chartered Accountant (CA), which is more suitable for a role in audit. Therefore it was unusual for the human resources department and for the then Nominations and Remuneration Committee (NRC) and Audit Committee of the board of directors to select such an individual for the critical post of Head-Internal Audit.

Vineet Agrawal’s Linkedin Profile

Even though the RBI had suggested a minimum period of 3 years for the post of internal audit, Vineet Agrawal’s tenure as CAE was for less than 2 years. Moreover, as per the bank’s own disclosure, in his new assignment he will no longer be considered as being in the senior management. Therefore his new posting is a demotion from the position of CEA. Clearly, there must have been an important reason for the bank to remove him from the post.

Normally, a person may be removed from the sensitive post of CAE on account of one of 3 reasons:

- A normal transfer to a lateral position or a promotion to a higher post. This appears remote, as he had not completed a minimum of 3 years, and his new posting is a demotion.

- The Audit Committee (reporting/reviewing authority for the CAE) losing confidence in the CAE and demanding his/her removal.

- The RBI ordering the removal of the CAE. This would be on the basis of its finding, during its inspection of the bank, incompetence, inadequate internal audit processes, or a lack of independence on the part of the CAE. If the RBI orders the removal of the CAE, it demonstrates a significant failure of the Audit Committee of the board, as it is the responsibility of this committee to ensure the competence of the individual and the independence of the CAE from the executive.

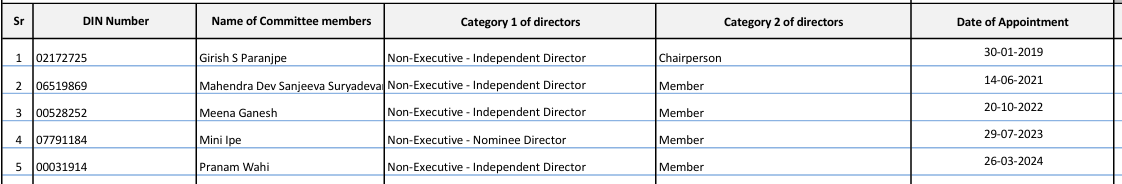

Audit Committee of Axis Bank

The selection of S Bhaskar as the successor to Vineet Agrawal was as strange as the latter’s original appointment as CAE. Although S Bhaskar’s educational qualification as a CA made him eligible for the post of CAE, his Linkedin profile reveals that he had never worked in a bank. Although he has a history of carrying out internal audit, especially in his prior posting as Head-Internal Audit, Tata Capital, a bank is far more complex in its operations and is more heavily regulated than a Non-Bank Finance Company (NBFC) or a Core Investment Company. The nuances in banks’ operational procedures and familiarity with the regulator’s notifications and regulations require prior work experience in banking audits. Furthermore, the regulator mandatorily conducts onsite inspection every year apart from the normal off-site inspection for banks. As bank funding is mainly from unsecured retail depositors, unlike NBFCs which mainly resort to wholesale borrowings, depositor protection requires stringent internal audit procedures.

S Bhaskar superannuated/retired from Tata Capital on August 31, 2024 after completing 4 decades of service. The question is, why would a bank hire an individual who has no prior experience in working in a bank, and who has retired, for the critical post of CAE? The only possible explanation is that the removal of Vineet Agrawal was so abrupt that the bank could not find an immediate replacement, and therefore had to appoint a retired individual, who did not have to serve the mandated 1-6 months’ notice/gardening leave with regard to his/her existing employer (this is especially so in the case of senior officials).

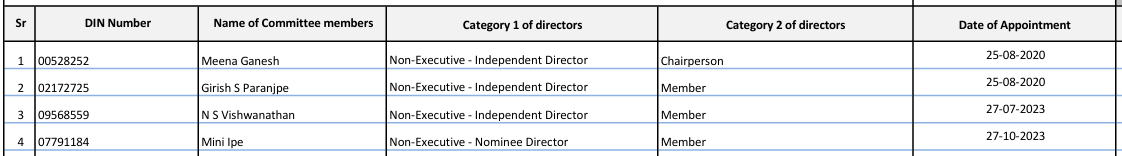

The appointment of an outsider for the post of CAE starkly reveals the absence of succession planning for the sensitive post of CAE in Axis Bank. That the bank, in desperation, had to select a retired individual with no prior experience in working in a bank indicates that it could not readily find any individual suited for this role. This again reflects very poorly on the bank’s human resources planning and on the Nomination and Remuneration Committee of the board of directors.

Nomination and Remuneration Committee

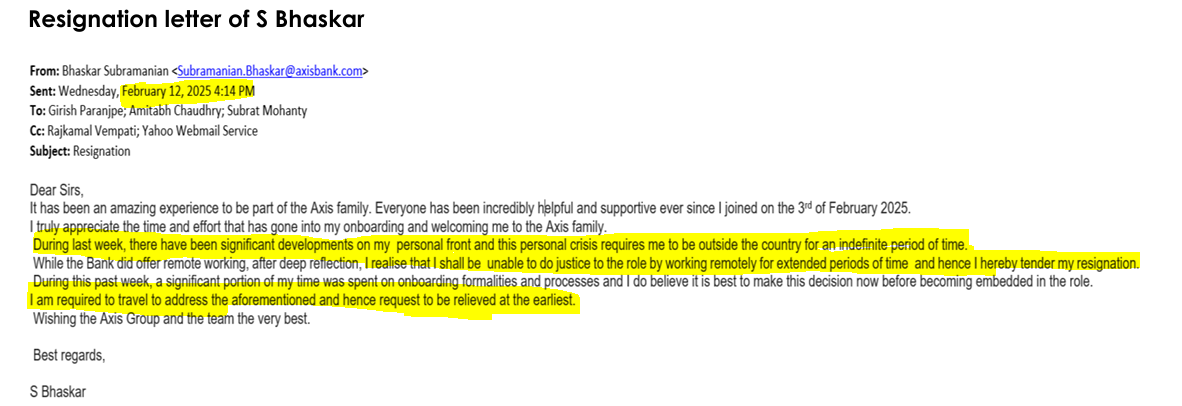

The farcical saga of Axis Bank’s CAE appointments took yet another turn when S Bhaskar, after serving 10 days in Axis Bank, reported a personal crisis which required him to be outside the country for an indefinite time. This resulted in him submitting his resignation on February 12, 2025. An interim internal candidate replaced him from February 14, 2025, for a period of six months.

Axis Bank seems to be ill-starred. It is hardly reassuring for it to appoint a person to such a senior and critical post, on which the bank’s reputation itself rests, and for that person to undergo a sudden personal crisis within 10 days of joining, and prematurely exit.

Bhaskar’s successor, Bimal Bhattacharyya, is a Chartered Accountant employed with Axis Bank since March 1995 and with more than 15 years’ experience in compliance, accounts and corporate banking in Axis Bank, as per his Linkedin profile. While Bimal Bhattacharyya’s educational and work experience fits the profile of CAE, he has only been appointed to the role as an interim measure for 6 months, till the bank finds a permanent replacement. Such an interim measure confirms the complete failure of succession planning for the post of the CAE in Axis Bank.

This turmoil in Axis Bank’s internal audit, and its dismal succession planning, have taken place despite the presence of two former senior RBI officials on Axis Bank’s board of directors. The chairman of the Axis Bank board, and a member of the NRC, is N S Viswanathan, a former RBI deputy governor; while G Padmanabhan was a former Executive Director in the RBI. One would have expected that their presence on the bank’s board would have ensured better assurance functions, especially in internal audit.

Internal audit is the steel frame for all banking operations in a bank, and the CAE is a highly sensitive post. Along with the Audit Committee, the CAE is responsible for the audit edifice. That is the reason the banking regulator has put stipulations regarding the CAE’s competence, work experience, seniority and independence from the executive. The abrupt departure of two CAEs in quick succession, and the nature of their backgrounds, raise serious concerns regarding the state of Axis Bank’s internal audit and the extent of its independence from the executive arm.

Note: This analyst requested a meeting with Axis Bank to discuss the issue of the CAE but the meeting was not forthcoming.

________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594), BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in Axis Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: