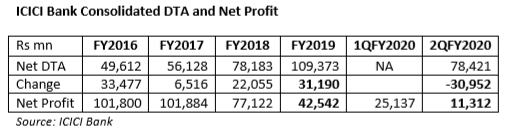

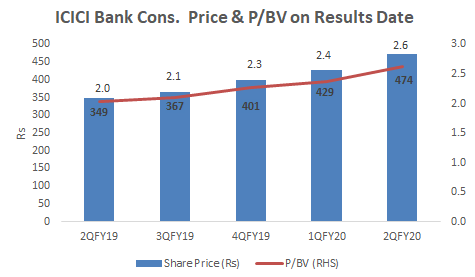

EXECUTIVE SUMMARY. Since 2QFY2019, the stock market has been kind to ICICI Bank. It has rewarded the bank with a consistent rise in the share price and an equally consistent re-rating in its P/BV. With such a strong performance in the share price, the sell-side has bent backwards to justify its bullish outlook; even as CLSA has downgraded future earnings estimates, it simultaneously increased its price target for the bank! No doubt the bank’s operational performance and asset quality have improved, but the residual deferred tax assets (DTA) still hang ominously over future earnings. Nevertheless, for the sell-side, the DTAs are invisible. While retail non-performing assets (NPAs) appear manageable, the sharp rise in unsecured retail loans at a time of economic distress is likely to result in worsening asset quality in the future. But the party is on, the music is blaring, and everyone has to dance – at least, till the music stops.