It appears the Government and the Reserve Bank of India (RBI) have given the green light to foreign investors to take significant stakes in Indian private sector banks: in May, Sumitomo Mitsui Financial Group Inc.’s banking unit agreed to pay $1.6 bn for 20% of Yes Bank; Emirates NBD Bank PJSC announced plans to invest $3 bn in RBL Bank; and now Federal Bank has announced that Blackstone will invest around $700 mn to take a 9.99% equity stake in the bank. News reports indicate the Government is even contemplating raising the cap on foreign investment in public sector banks to 49%.

Assuming that the Government is doing this to strengthen the banking sector, and not merely boost the foreign exchange reserves, we need to consider: when the ownership of banks shifts to foreign owners, how do they perform? Though the data available are limited, they do raise pertinent questions.

As banking is a sensitive sector in all economies, opening to foreign investment in the sector is not done casually or automatically. Countries usually have reciprocal arrangements in permitting foreign banks/institutions taking significant stakes in domestic banks. What is unusual in the recent announcements mentioned above is that there appears to be no public announcement of expanding Indian banks presence in those nations whose institutions are taking stakes in Indian banks. Hence it appears that there are no reciprocal arrangements with these countries to increase the presence of Indian banks, and these steps are taken unilaterally.

In two cases, foreign investors took majority control in distressed Indian private sector banks. In 2018, the Fairfax group invested around Rs 14 bn in CSB Bank for a 51% stake, and in 2020 DBS India amalgamated Lakshmi Vilas Bank (LVB).

The Fairfax group’s majority control of CSB Bank, and its retail strategy for growth, form an interesting case study on how metro-oriented retail bankers are attempting to modernise a local small bank and convert it into a national bank. The Fairfax group acquired a 51% stake in the bank at Rs 140 per share, and they are already sitting on considerable unrealised gains at the current share price of Rs 419. In line with RBI stipulations, the Fairfax group sold 9.7% from their stake at Rs 352.75 on June 27, 2024, thereby reducing their stake in the bank to 40%. Their investment in CSB Bank has thus been very profitable. The progress of the bank’s transformation can be monitored over several quarters to track how a strategic foreign investment in a bank is unfolding.

CSB Bank, originally named Catholic Syrian Bank, was established in 1920. Like many Indian banks which served particular communities, CSB Bank catered to the banking requirements of the Catholic Syrian Christians in Kerala, who numbered around 4-5 mn (around 12.5% of the state population) in the 2011 census. The bank’s main loan product was gold loans. After the Fairfax takeover, the bank has had two CEOs, CVR Rajendran (a former government banker, appointed as CEO in end 2016) and Pralay Mondal, who took effective charge from FY2022. Since taking charge, Mondal has laid out his SBS (Sustain, Build, Scale) 2030 strategy for the bank, which envisages the bank becoming a national bank by 2030. From the beginning of his tenure he has prioritised growth over profitability, as he believes that once the tools are in place by FY2026, the bank will take off from FY2028 onwards. The bank will have a suite of multiple retail loan products and fees, compensating for any decline in the net interest margin, and thus sustaining its Return on Assets (ROA).

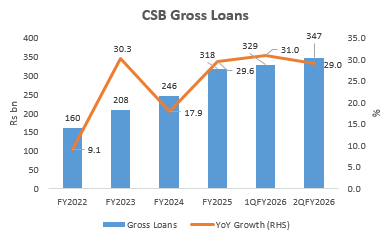

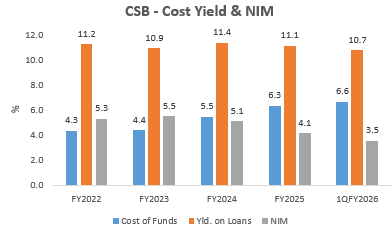

Under Mondal’s leadership CSB has grown at a scorching pace, and its gross loans rose from Rs 160 bn in FY2022 to Rs 347 bn in 2QFY2026. But the cost of doubling the loans has been high: the bank’s cost of funds has shot up from 4.3% in FY2022 to 6.6% in 1QFY2026 as the bank has resorted to raising high-cost bulk deposits and more expensive borrowings. The decline in yield on loans is also on account of regulatory changes of reporting penal charges as fees and not as interest income. As the yield on loans has marginally declined, the net interest margin has shrunk from 5.3% to 3.5% in the same period.

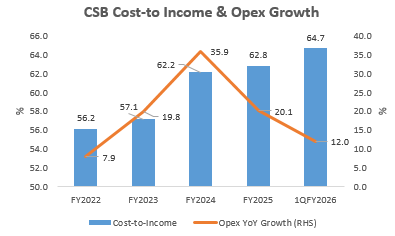

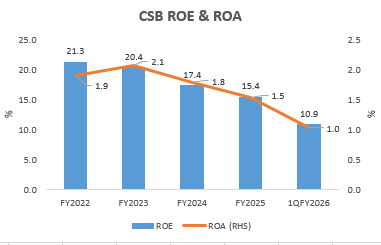

As the bank is also simultaneously investing in branches, executives, technology and systems in order to become a national retail bank, operating expenses have outpaced growth in the net interest income, and the cost-to-income ratio for the bank has increased from 56.2% In FY2022 to 64.7% in 1QFY2026.

With the Net Interest Margin (NIM) and cost-to-income under significant pressure, it is no surprise that the bank’s critical profitability ratios have collapsed, with Return on Equity (ROE) nearly halving to 10.9% in 1QFY2026 from 21.3% in FY2022, and ROA falling steeply to 1% from 1.9% in the same period. The sharp fall in profitability despite the shift of penal charges from interest income to fees, which should have been profitability neutral, demonstrates that the huge increase in cost of funds and operating expenses has been the major driver of reduced profitability for the bank.

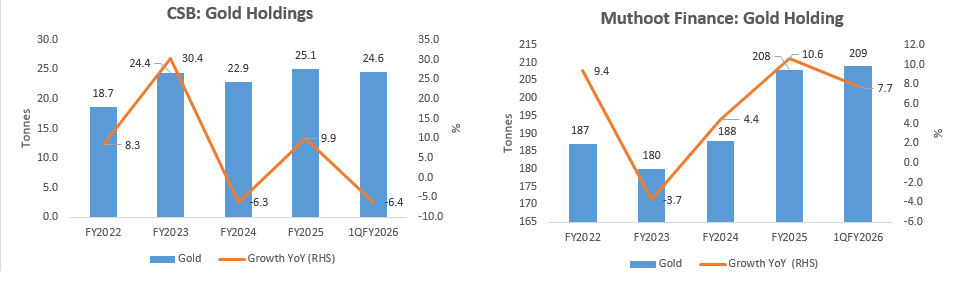

An unusual feature in CSB Bank is the growth in gold loans which forms around 44%-47% of its total loans. While gold loans have increased from Rs 97 bn in FY2023 to Rs 149 bn in 1QFY2026, the increase is mainly on account of the rise in the price of gold as in tonnage it has grown only from 24.4 tonnes to 24.6 tonnes. In contrast, Muthoot Finance in the same period has grown from 180 tonnes to 209 tonnes. Gold loans is the single largest loan product of CSB Bank and it is surprising that despite increase in branches (from 703 in FY2023 to 834 in 1QFY2026), increase in staff (from 6,841 in FY2023 to 7,616 in FY2025) and operating expenses (from Rs 9.4 bn in FY2023 to Rs 15.4 bn in FY2025) the tonnage growth in gold has been marginal.

Commenting on ROA and NIM guidance in the 4QFY2025 results on April 28, 2025, Pralay Mondal, CSB CEO said (pgs. 13/15),

“I think we are hitting our bottom on the NIM. I don’t think coming down further anymore. Our overall guidance will be somewhere around 4% – in between what our quarterly NIM and yearly NIM was. Yearly NIM is 4.13%, quarterly NIM is 3.75%. Our next year guidance is somewhere in between of this – around 4%.

…On return on assets, our guidance is between 1.5% to 1.8% and return on equity between 15% to 17%. RoA will be closer to 1.5% for the immediate 1 or 2 more quarters. This quarter, return on equity went up a little bit. But for the full year basis, we are slightly higher than 15% (p. 13).

…our ROA will come there not through NIM, but through fee income and cross-sell and supply chain and all of this for which we are building systems (p. 15).”

While the fee income growth has been impressive, investors however, need to be cautious, as the bank’s 1QFY2026 NIM (3.54%), ROE (10.9%) and ROA (1.03%) have continued to slide. To achieve the guidance given on the 4QFY2025 results call, the bank has to considerably boost its NIM and fees in the remaining 3 quarters of FY2026, which is a tall order, as banks’ results in 2QFY2026 are under pressure (CSB Bank will report 2QFY2026 results on November 5, 2025).

As the deterioration in CSB Bank appears structural, it will be extremely difficult to reverse in a short time period. Moreover, the take-off period is only 1-2 years away, and by now there should have been some improvement. Instead the metrics have continued to deteriorate. A vertical take-off from a declining trend may appear achievable in a power point presentation but it is extremely difficult to achieve in practice.

Cost of funds is critical for any bank, and once the cost of funds rises sharply by issuance of bulk deposits and borrowings to finance the huge growth in loans and a bank is unable or unwilling to increase the yield on loans it creates a significant concern, as the cost of funds cannot be brought down suddenly. If profitability ratios continue to deteriorate, the only solution is to either raise interest rates on loans or slow down the unprofitable growth in loans.

CSB Bank Branches

| FY2022 | 1QFY2026 | Increase | |

| Metro | 123 | 220 | 97 |

| Urban | 121 | 165 | 44 |

| Semi-urban | 309 | 387 | 78 |

| Rural | 50 | 62 | 12 |

| Total | 603 | 834 | 231 |

| Kerala | 264 | 270 | 6 |

| Tamil Nadu | 113 | 134 | 21 |

| Andhra Pradesh | 53 | 108 | 55 |

| Maharashtra | 60 | 91 | 31 |

| Karnataka | 42 | 57 | 15 |

| Others | 71 | 174 | 103 |

| Total | 603 | 834 | 231 |

Source: CSB Bank

Another significant issue is CSB’s branch expansion plan under Mondal’s leadership. CSB has its roots in Kerala as a community bank serving the Syrian Christian community, which is a religious minority in the state. The bank had survived more than a century prior to Mondal’s leadership by staying close to its roots. By contrast, the branch expansion since FY2022 has focused on metropolitan centres in non-southern Indian states.

To catapult CSB Bank from being a bank known only in Kerala to setting up branches in the north and in metro centres, where the public is ignorant of the bank, is stretching the resources of the bank very thin. Banking is all about trust and presence, and to attempt to become a national bank and compete with the large government and private sector banks in regions where the bank had a negligible presence is a high-risk strategy. Instead, a more viable strategy could have been to concentrate resources in areas where the bank was already known, and deepen and increase the bank’s market share in the southern states prior to venturing into northern and other geographical areas. Such a strategy for a small bank could have been more cost effective and yielded results in a shorter time frame.

When leaders brought into small, local banks disregard the inherent strengths that the banks have in their respective regions, and instead chalk out a national roll-out high-operating-cost strategy in areas where the bank has no visibility, success will be limited. Establishing a retail strategy takes time, as low-cost retail liabilities increase incrementally, and customers have to be comfortable with the bank to invest their savings as well as to be sold retail loan products. When banks take short-cuts by either spending disproportionately to acquire current and savings account deposits (CASA), or raise high-cost bulk deposits and give priority to balance sheet size at the cost of profitability, problems start compounding.

Yes Bank in its post-moratorium phase is an outstanding example of how a retail strategy can backfire when a bank focuses on growing retail loans at a high pace while ignoring the high operating costs. From FY2022 to 2QFY2026, the bank reported retail losses of Rs 41 bn; including unallocated expenditure, retail losses spiralled to Rs 87 bn.

Karnataka Bank is another bank where a CEO recruited from outside (he quit on July 15, 2025) rolled-out a retail strategy. From 2QFY2024 the NIM plummeted and the cost-to-income soared, resulting in a steep fall in profitability ratios. There, too, the management indicated that profitability would soar at a future date, once the required investments bore fruit.

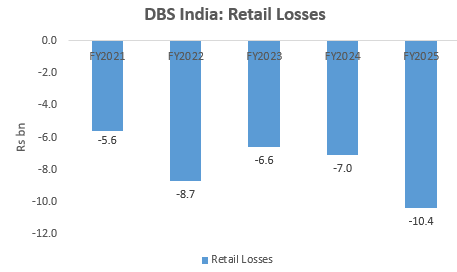

DBS India acquired LVB but as the Singapore bank is not listed, it is difficult to monitor in granular detail its progress. The bank acquired LVB to leverage the latter’s 566 branches to expand into retail and Small and Medium Enterprises (SME). The bank’s segmental results reveal that since FY2021 retail has been burning a huge hole in its balance sheet as the bank has been unsuccessful in its retail strategy. The bank has been bailed out by its corporate and treasury division which is the strength of most prominent foreign banks operating in India. The DBS India acquisition has remained stillborn, as the corporate banking, metro–oriented DBS has found it difficult to leverage SME, rural and trader accounts of the erstwhile LVB.

All these misadventures are the work of CEOs who ignore the inherent strengths and limitations of the banks that they lead, and roll out major retail strategies entailing recruiting high-cost executives and making major investments in technology and systems. Unfortunately, combined with a high and unsustainable asset growth, results in a heavy toll on profitability, as revenue growth fails to meet expectations.

The Government and the RBI have apparently approved a policy whereby foreign banks/institutions can make strategic investments in Indian private sector banks, in the expectation that their expertise and capital can make these banks more efficient and profitable. However, the examples of the Fairfax Group’s investment in CSB Bank and the DBS acquisition of the erstwhile LVB reveal that such a turnaround is an uphill task for the foreign investor. While the Fairfax investment in CSB Bank stabilised and turned around the bank, the retail strategy being currently implemented is throwing up warning signs, which are visible in the quarterly results. The LVB acquisition demonstrates that DBS India is clueless on how to leverage a local bank’s strengths and establish a profitable retail business in India.

Investors need to exercise caution when foreign entities take strategic investments in Indian banks. The banking landscape is highly competitive, and the leadership needs to be grounded and in tune with particular bank’s capabilities. To establish a viable retail banking business takes time and is extremely difficult. Investors need to be alert to deteriorating trends in existing performance metrics, and not assume that foreign investors know best. Pots of gold promised at some far off date may fast turn to coal.

This article was also published in The Wire and can be read here.

__________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in CSB Bank and Yes Bank mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.