EXECUTIVE SUMMARY. An internal memo of an anonymous former senior official of ICICI Bank’s risk management department, publicised by the Indian Express, provides a damning indictment of the credit appraisal and monitoring processes at the bank. It reveals how basic banking processes were violated, and public and shareholder funds frittered away by reckless and greedy bankers. While government banks are blamed for indulging in ‘telephone banking’ (acting on instructions from politicians and bureaucrats to favour particular industrialists), the above memo completely exposes how a prominent private sector bank, manned by professionals, was conducting banking.

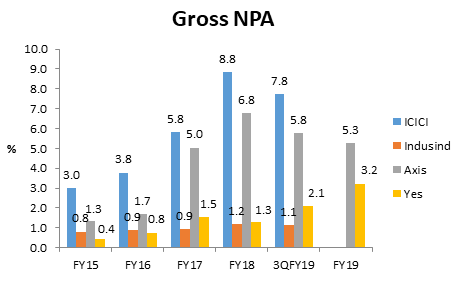

Unfortunately, such conduct may not be restricted to ICICI Bank alone. Rather, it may also explain how other banks such as Axis Bank, Yes Bank and Indusind Bank have taken high-risk corporate exposures. While the new managements at ICICI Bank, Axis and Yes Bank are restructuring their processes to avoid a repeat of their mistakes, Indusind Bank seems to have considerable faith in their existing CEO, who is responsible for some large ticket corporate loans gone sour. The broom which is currently in vigorous use at ICICI, Axis and Yes banks has yet to be taken out of the closet at Indusind Bank.