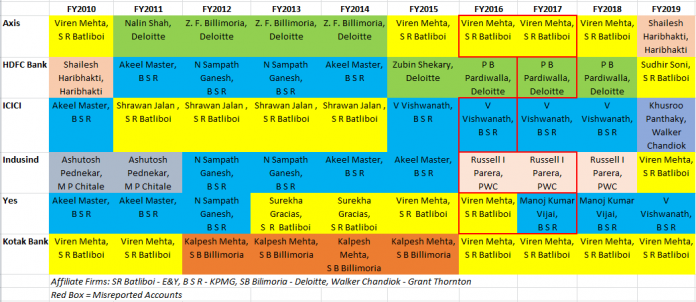

EXECUTIVE SUMMARY. In a stunning rebuke to audit firm S.R. Batliboi (SRB), a member firm of Ernst & Young, the Reserve Bank of India (RBI) barred the firm from taking any bank audit for 1 year commencing from April 1, 2019. The public humiliation of a leading audit firm for “lapses” in a bank audit also highlights SRB’s dominance of private sector bank audits and the pivotal role of its partner, Viren H. Mehta, in certifying accounts which the regulator subsequently found to be misleading. Despite SRB and its partner scoring a hat-trick by certifying 3 years of fudged accounts in Axis (FY2016 & FY2017) and Yes Bank (FY2016), prominent private sector banks such as HDFC Bank, Indusind Bank and Kotak Mahindra Bank not only appointed/continued with SRB as their auditor, but the latter two banks had Viren H. Mehta to sign off on their accounts. The unflinching faith in a Big 4 auditor by prominent banks owned by marquee institutional investors, despite regulatory disclosures exposing the poor quality of audit done by SRB, once again demonstrates the abysmally poor standards of corporate governance practised by the board of directors and institutional shareholders in private sector banks. If it had not been for the banking regulator barring SRB, these private sector banks would have continued to reward a disgraced audit firm with their audits just as they did when they reappointed Shikha Sharma and Rana Kapoor at Axis and Yes Bank for another term as CEOs, only to have the RBI disallow it.

SRB, though, is not the only Big 4 audit firm whose competence and/or complicity stands exposed. In the IL&FS fiasco, daily media reports are highlighting rampant ever-greening of bad loans and gross management misconduct which was overlooked by its long-serving auditor, Deloitte Touche Tohmatsu and other auditors like SRB and B S R (affiliated to KPMG). While misconduct of audit firms is not new, what should be of concern is how banks and financial institutions, with full support from their board of directors and shareholders, continue to have faith in the erring audit firm and in the same partner whose conduct has been thoroughly and publicly exposed by the regulator in other banks. It is a tragedy that in a free market, which supposedly also has non-regulatory checks and balances, misconduct and malpractice are rewarded by blue-chip companies, and it is the regulator who is forced to step in.

Good Article Hemu