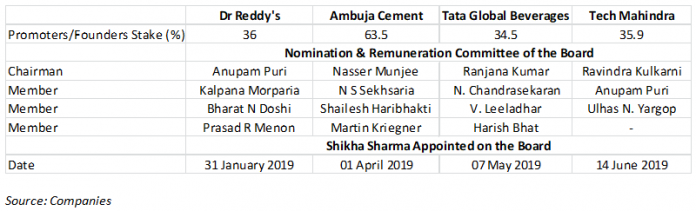

EXECUTIVE SUMMARY. On June 14, 2019, Tech Mahindra joined the ranks of Tata Global Beverages, Ambuja Cement and Dr Reddy’s in appointing Shikha Sharma as an independent director. Private equity firm KKR had also appointed Sharma as an adviser for their alternative investments. The irony of publicly-owned and listed blue-chip companies eagerly seeking Sharma for the prestigious position of independent director on their boards is that she had a poor track record and an unceremonious exit as chief executive officer (CEO) of Axis Bank. On her watch in Axis Bank, senior management personnel were rewarded for epic mismanagement, poor operational risk controls led to staff being arrested for money laundering, whistle-blowers were persecuted, and accounts for two consecutive years were fudged, which finally led to the banking regulator effectively booting her out as CEO. Any one of these issues should have disqualified her for any prominent position in publicly-owned and listed companies. Indeed, with such an embarrassing exit, the private corporate sector should have boycotted her, but instead she has been welcomed with open arms to join their boards of directors. Her appointments on prestigious boards lays bare how corporate governance is actually practised in India, where a candidate with such a dismal track record is eagerly sought after to grace boards.

Recent Posts

Most Popular

Is Yes Bank Providing Custodial Services to RInfra for Its Valuable Property?

A high-profile bank collapses on account of high-risk, bulky non-performing corporate loans. With the intervention of the Reserve Bank of India (RBI), the errant...

Karnataka Bank board showed who’s the boss

As Hemindra Hazari, a Sebi-registered independent research analyst, has pointed out in his report, “Bank boards have clear-cut policies on the approval powers of all...

Economist – Prof R Ramakumar’s Speech at Tarakeswar Chakraborti Memorial Lecture – 1

https://www.youtube.com/watch?v=l72vK9c1RFg

Hemindra Hazari Speech at Tarakeswar Chakraborti Memorial Lecture – 2

https://www.youtube.com/watch?v=eXiLiqh6tuo

Memorial Lecture Held on June 14, 2025, at the Walchand Hirachand Hall, Indian Merchants Chamber, Churchgate, Mumbai

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and...

Official Trailer | The Great Indian Illusion | a Film By Varrun Sukhraj ।...

https://www.youtube.com/watch?v=nuJUMCz7yI8