Even in a rowdy game of soccer, two yellow cards result in dismissal from the field of play. Indian banking, though, adheres to lower standards. For two consecutive years, Axis Bank has been exposed by the regulator for mis-reporting in its financial statements; yet the bank’s board of directors has allowed the same CEO (Shikha Sharma), chief financial officer (Jairam Sridharan) and auditor (Viren H. Mehta, partner S. R. Batliboi, member firm of E&Y) to continue in their posts. Apparently, the banking regulator has a high tolerance for banks disregarding its instructions and under-reporting non-performing assets, as to date no action has been taken against the concerned individuals at Axis Bank. Even normally docile analysts could be heard openly questioning the management during the 2QFY2018 results conference call on the numbers reported by the bank; one implied whether the bank might score a hat trick in misreporting its financials for FY2018 as well. With such a dismal track record, analyzing the bank’s results becomes meaningless.

Sell-side analysts were caught by surprise when Axis Bank reported results for the quarter ended September 30, 2017 (2QFY2018), as they expected the bank to repeat the performance of 1QFY2018, when it declared net profits of Rs 13 bn and slippages to gross non-performing assets (NPAs) of Rs 39 bn. Instead, the bank reported a net profit of a paltry Rs 4.3 bn and slippages to gross NPAs of Rs 89.4 bn. Worse, the bank disclosed that as per the Reserve Bank of India’s (RBI) inspection, it had under-reported its gross NPAs for the year ended March 31, 2017 by 27% and overstated net profits by 24%, the second consecutive year of mis-reporting its financial statements.

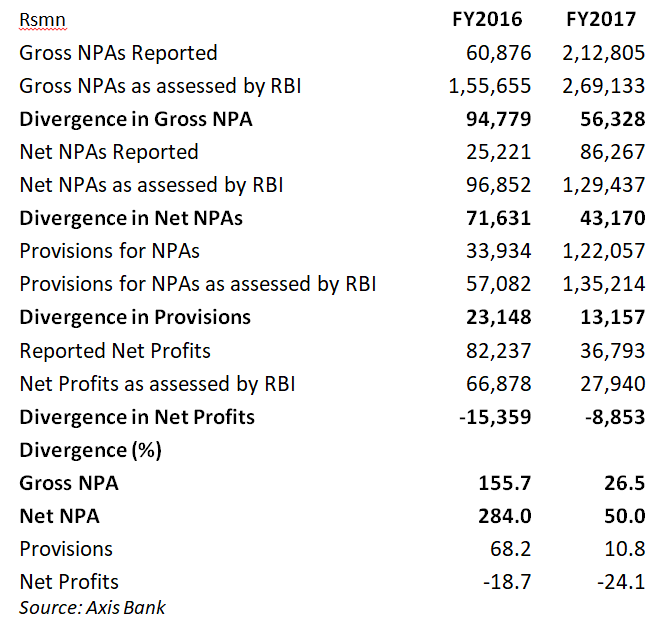

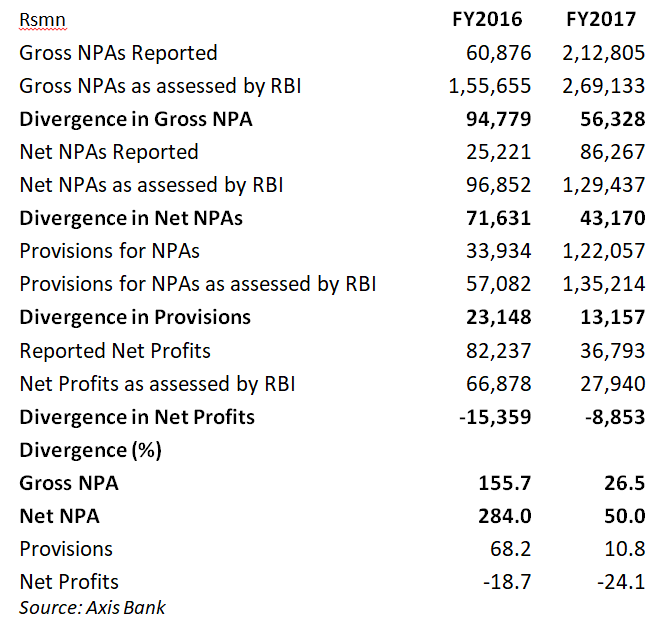

Divergence in Axis Bank’s Asset Quality, Provisioning and Net Profits

A RBI notification on April 18, 2017 entitled “Disclosure in the ‘Notes to Accounts’ to the Financial Statements- Divergence in the asset classification and provisioning ,” is causing tremendous discomfort to Axis Bank, by providing some transparency regarding the quality of its financial statements. An excerpt of the notification states,

“There have been instances of material divergences in banks’ asset classification and provisioning from the RBI norms, thereby leading to the published financial statements not depicting a true and fair view of the financial position of the bank… it has been decided that banks shall make suitable disclosures as per Annex, wherever either (a) the additional provisioning requirements assessed by RBI exceed 15 percent of the published net profits after tax for the reference period or (b) the additional Gross NPAs identified by RBI exceed 15 percent of the published incremental Gross NPAs for the reference period, or both.”

As some banks were not transparent in quantifying or even revealing the divergence at the time of announcing their FY2017 results (mandatory disclosure only in annual report), the Securities and Exchange Board of India (SEBI), the capital markets regulator, in its circular dated July 18, 2017 compelled banks to file the divergence disclosures with the stock exchanges,

“along with the annual financial results filed immediately following communication of such divergence by RBI to the bank.”

The only saving grace, if any, in the divergence of FY2017 for Axis Bank is that in percentage terms and absolute amounts it was lower than FY2016 for NPAs and provisions; however, the net profit divergence in percentage terms was higher in FY2017.

In an earlier insight, “Axis Bank – A Crisis of Credibility,” dated May 5, 2017, this writer had highlighted how Shikha Sharma, CEO, Jairam Sridharan, CFO and Viren H Mehta, auditor, S.R. Batliboi & Co, a member firm of Ernst & Young, had certified the FY2016 accounts, yet had continued in their posts for FY2017 and FY2018. This writer had stated,

“The wide divergence between the regulator’s assessment and the bank’s audited NPAs for FY2016 reflects poorly on the CEO, CFO, audit committee and the auditor. To safeguard the reputation of the institution, the board of directors and the regulator should have replaced the individuals once the RBI detected the huge variance in the NPAs. But, in a bizarre development, Axis Bank’s FY2017 accounts have been signed by the same CEO, CFO and certified by the same auditor, raising significant concerns regarding the credibility of the bank’s FY2017 asset quality, earnings and capital adequacy.”

It is therefore no surprise that the regulator detected significant divergence in FY2017 financial statements as the board and indeed the regulator itself permitted the same individuals to continue in their crucial posts. For any bank to report divergence in excess of the RBI’s liberal tolerance levels (up to 15%) is a matter of shame; for a bank to report a divergence for two consecutive years reveals a lack of accountability and professionalism by the senior management of Axis Bank.

The repeated divergence at Axis Bank has finally shaken the docile banking analysts. During the bank’s 2QFY2018 results conference call, Nilang Mehta, a buy-side analyst from HSBC Asset Management asked,

“what is the risk of FY18 springing up more surprises …otherwise…these numbers seem meaningless.”

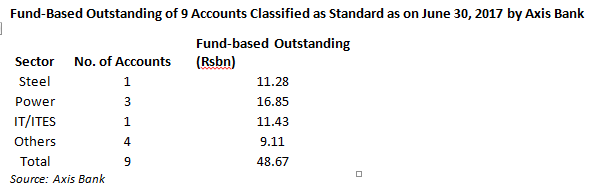

Axis Bank’s defence of the latest divergence says the RBI reclassified 9 corporate accounts (around 9.5% of Axis Bank’s capital in FY2017), which were classified as standard by most consortium banks as on June 30, 2017. However, interestingly, around 6% of the banks classified these accounts as NPAs. The very fact that some banks had already classified the accounts as NPA is a sufficient indicator of the quality of these accounts. In one of the 9 accounts, Axis Bank was the sole banker to an unnamed IT/ITES company, and the outstanding was Rs 11.43 bn, as compared with its aggregate outstanding to 3 power sector accounts (out of the 9 reclassified accounts) aggregating to Rs 16.85 bn. Axis Bank expects recovery in the IT/ITES account and stated,

“A significant part of this [IT/ITES] account is expected to get repaid soon, post a business sale transaction, for which a binding agreement is already in place.”

The high exposure to an IT/ITES account, which normally has negligible fixed asset security apart from real estate, throws some light on the bank’s risk and credit appetite.

The NPA divergence in FY2016 was not a universal phenomenon. The highest mis-reporting was from the new private sector banks: Yes, Axis and Indusind. Pertinently, government banks with considerable corporate loan exposure, such as State Bank of India, Bank of Baroda, Bank of India and Union Bank of India, did not report divergence, which shows the credibility of their accounts.

The domestic media and analysts publicly responded to the divergence in Axis Bank in 2QFY2018 by saying it was an industry-wide problem, as the bulk of the bankers in the 9 corporate accounts (industry outstanding of around Rs 400 bn) classified the accounts as standard. However, such a view cannot exonerate Axis Bank or any of the other bankers who had classified the accounts as standard. As Andy Mukerjee, the Bloomberg columnist scathingly remarked,

“Even now all Axis has to say in its defense is that it’s not the only one lying…”

These accounts were obviously of suspect quality, as some bankers had classified them as non-performing. Some financial intermediaries have made ‘evergreening’ of corporate accounts into an art, and it is possible the RBI decided to make an example of these 9 accounts. More clarity may emerge of the other banks involved in these accounts when they publish their 2QFY2018 results.

Jairam Sridharan, Axis CFO, whose main responsibility is the integrity of accounts, has not only been found wanting but is either ignorant of the asset quality or is misleading investors. In 1QFY2018, when the bank reported an annualised credit cost of 195 bhps, he gave a guidance of 175-225 bhps for FY2018; in 2QFY2018, annualized credit cost shot up to 316 bhps and he gave a revised guidance for FY2018 of 220-260 bhps. It is amazing how the board tolerates such competence.

Axis Bank is a prominent new private sector bank with majority foreign ownership (foreign institutional ownership at 46.3% plus GDR at 5.8%) and is audited by S.R. Batliboi & Co, a member firm of Ernst & Young. The bank’s senior management are given handsome remuneration, bonuses, stock options and annual pay hikes. Yet when the bank is found by the regulator to be mis-reporting its numbers for two consecutive years and no action is taken by the board or by the regulator against the senior management, it shows there is no accountability and corporate governance is merely a façade.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in any of the securities mentioned in this report with the exception. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.