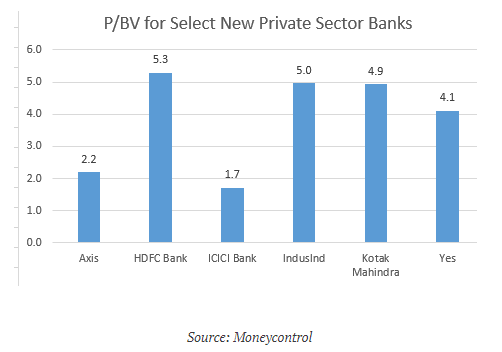

IndusInd Bank’s quarter ended March 31, 2017 (4QFY2017) was impacted by a “one-off” exposure to a company whose cement operations is in the process of being acquired by a top-rated company. While sell-side analysts regard it as a blip in the secular positive outlook on the bank, they are failing to appreciate that such a transaction is a reflection on the bank’s corporate credit underwriting and risk management. The obsession to report higher fees to command premium stock market valuation may be compelling banks to undertake such transactions which prudent banks may not consider. IndusInd Bank’s premium valuation currently reflects its superior asset quality and earnings growth but in the light of this disclosure, investors may need to reexamine the bank’s risk appetite.

IndusInd Bank, one of the darlings of the stock market reported its fourth-quarter results for the period ended March 31, 2017 (4QFY2017) on April 19, 2017. Although the bank reported a 21.2% yoy growth in net profits to Rs7.52bn, loan provisions shot up by 101% yoy on account of a

“one-off provision of Rs 122 crores [Rs1.22bn] against a large corporate account classified as ‘Standard Advance’ pursuant to specific RBI [Reserve Bank of India] advice in this regard. The Bank’s exposure which is due for repayment in June 2017 relates to a bridge loan for a Merger & Acquisition transaction in cement industry.”

Media reports identified the corporate exposure as Jaiprakash Associates’ (a stressed account in the banking industry) cement assets which were being sold to UltraTech Cement. IndusInd Bank and Jaiprakash Associates have till date not refuted these media stories. It appears that IndusInd Bank, (possibly with other banks) provided a bridge loan to Jaiprakash Associates to meet some claims of creditors who otherwise would not have agreed to the sale of the company’s cement assets to UltraTech and IndusInd Bank claims that post the deal, the bank’s bridge loan will have priority in the settlement.

Many prominent brokerage reports were dismissive of this one-off charge which the bank could absorb in the 4QFY2017 and they reiterated their “Buy” recommendation and raised the target price on IndusInd Bank.

Nomura, in its report dated April 19, 2017 said,

“Asset quality – a tad weaker [bold ours]: (1) INR1.2bn of provisions taken on standard loans which will be reversed in 1QFY18 – related to a short-term financing opportunity; …Maintain Buy and increase PT to INR 1,640 (3.5x FY19 BV) from Rs 1,400.”

While Kotak Institutional Equities in its report of April 20, 2017 stated,

“Slight blip [bold ours] due to high provisions. Gross NPL (0.9%) and net NPL (0.4%) ratios were stable qoq. However, provisioning cost was higher in the quarter at ~140 bps after including the Rs 1.2 bn standard asset provision against a bridge loan to fund M&A transaction in the cement sector. Maintain ADD. TP at Rs1,500 (from Rs1,400).”

While sell side banking analysts regard IndusInd Bank’s bridge loan exposure to Jaiprakash Associates as a “slight blip” unworthy of deeper analysis, it provides an insight into the credit underwriting culture and corporate credit risk management at the bank.

Jaiprakash Associates has a long history of financial overreach. CARE, a domestic credit rating agency, as on December 30 and 31, 2016, rated Jayprakash Associates short and long-term rating as ‘D” (default). The credit rating and the history of this company did not prevent IndusInd Bank from providing a bridge loan to clear some of the company’s creditor dues so as to facilitate the acquisition by UltraTech Cement. To settle select creditors’ dues to permit the acquisition to be finalised, the existing consortium of bankers could have extended further funds or the banks could have financed ‘AAA’ rated and low-risk Ultratech Cement and it could have extended finance to Jayprakash Associates. As Jayprakash Associates was rated as default and had also defaulted on fixed deposits to the public what was the compulsion for IndusInd Bank to participate in such a transaction which finally resulted in the banking regulator to compel the bank to provide for it?

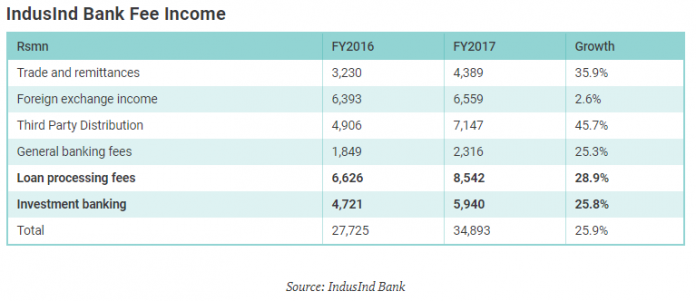

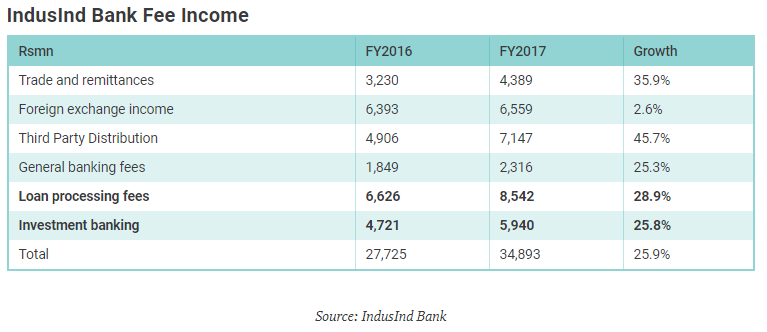

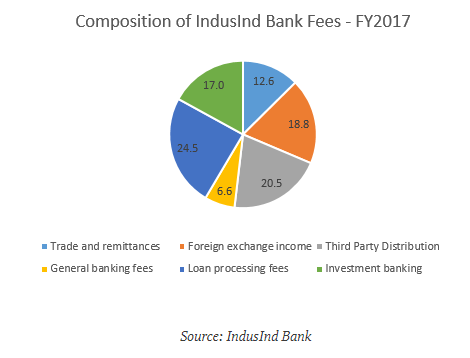

New private sector banks have an insatiable appetite for fee income as the capital market gives a premium valuation to banks which report high fee income on the mistaken belief that fees have less risk. Senior bank officials’ remuneration, promotion and stock options are also determined by the quantum of fees generated by them. When banks finance high-risk transactions they do so by charging a premium interest rate, significant fees and demanding more collateral. However, in the case of a company like Jaiprakash Associates, it is unlikely that the company would have been able to provide any collateral to IndusInd Bank as its numerous existing bankers would have already secured all the company’s assets. Hence IndusInd Bank for this transaction would have in all likelihood charged huge fees and a higher interest rate to compensate for the lack of collateral.

For the last 7 years, IndusInd Bank has been aggressively growing its fees from corporate business and analysts and the stock market rewarded the bank with a premium valuation as it was considered low-risk. The Jaiprakash Associates transaction and the banking regulator compelling the bank to provide for it is an indicator that the bank may be taking on higher risk than is warranted for its superior valuation.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have exposure to HDFC Bank & ICICI Bank equity securities referenced in this Insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.