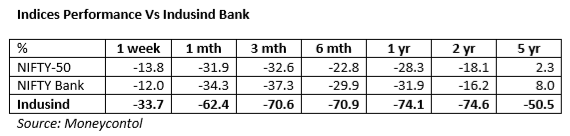

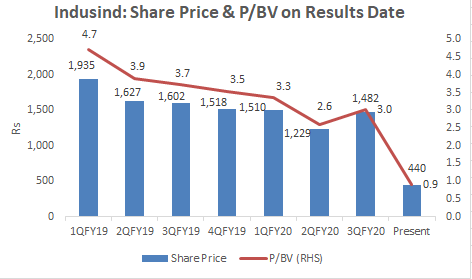

EXECUTIVE SUMMARY. The savage mauling of Indusind Bank’s share price in the last year, and especially in the last month, is a reflection of the unravelling of the bank’s high-risk asset and fee growth strategy. A bank which use to trade at 5x P/BV is currently reduced to being valued at below BV. This speaks of a complete loss of confidence among equity investors. Such an event should have led to a deeper introspection by the bank’s board of directors on the capability and competence of Romesh Sobti, chief executive officer (CEO), who will finally retire on March 23, 2020 after a stint of 12 years at the helm. With such a disastrous track record of share price under-performance stretching back 5 years, with depositors pulling out deposits from the bank, the board should have selected an individual from outside the bank and terminate all links with Sobti, once the latter completes his term.

Instead, the board of directors of Indusind Bank selected as Sobti’s heir Sumant Kathpalia, a Sobti acolyte who had joined the bank along with his mentor from ABN Amro in 2008. But even further, the board is likely to appoint Sobti as a “full-time advisor” to guide the bank in this tumultuous phase of Sobti’s own making. A CEO who was responsible for fudging two consecutive years (FY2016 and FY2017) of financial accounts (a travesty which is a criminal offence if proved to be “wilful”), betting nearly 10% of the bank’s capital in an unsecured loan to an insolvent IL&FS, and making the bank take high risk exposure to stressed business groups in real estate, media and telecom should have been removed by the board, rather than rewarded by allowing him to influence business decisions as an “advisor”. This is the pathetic state of corporate governance practised by private sector bank boards in India, and institutional investors and the banking regulator remain silent spectators to this charade.

___________________________________________________________

The Economic Times on March 20, 2020 interviewed Romesh Sobti, CEO and Sumant Kathpalia, CEO-designate, Indusind Bank. Regarding Sobti’s future association with the bank Kathpalia stated,

“[Sobti] will play some role in the organisation and we continue to believe that he will mentor us and be an advisor to the bank as we move forward”

Sobti also clarified,

“Basically, it is a full-time advisorship. It is an absolute non-executive role and mentorship in areas that both the management and the board will finalise…in the next few days”

Sometimes a board of directors likes to retain the expertise of CEOs who have rewarded shareholders and stakeholders and have an impressive track record of performance. On the completion of their tenure, the board may appoint such a person as an advisor to the company or advisor to the board. However, the share price of the Indusind Bank since mid-2018 has been on the decline, and it has fallen off the cliff since early February 2020, as the market has significant concerns regarding the high-risk exposures of the bank in the telecommunications, real estate and media sectors.

In April 2017, when Indusind Bank was trading at Rs 1,453 (PBV 5x), this writer was the first (and unfortunately the only) analyst on the street to raise the red flag on a high-risk loan which the sell-side brushed aside as a “blip”. I had explicitly cautioned,

“The Jaiprakash Associates transaction and the banking regulator compelling the bank [Indusind Bank] to provide for it is an indicator that the bank may be taking on higher risk than is warranted for its superior valuation.”

Thereafter this writer consistently continued to highlight and warn the shareholders of the mismanagement at the bank. The issues ranged from fudged accounts, which is a criminal offence if proved to be wilful, to the sheer incompetence of the bank’s credit and risk departments in providing an unsecured loan constituting around 10% of the bank’s equity to the insolvent IL&FS. I had exposed Sobti’s ignorance in publicly defending the IL&FS loan. This writer again exposed the inadequacy of the bank’s credit and risk department in providing loans to the investment companies of the founder of Zee media business group. Indusind Bank’s significant exposure to Vodafone, estimated at Rs 40 bn (13% of CET1 as on 3QFY20), and the adverse Supreme Court judgement on Vodafone and other telecommunication companies has further compounded the problems for Indusind Bank.

All these major issues which are senior management-inflicted, with the possible exception of the Vodafone expose the leadership of Sobti. The issues confronting Indusind Bank have finally led to the bank being traded at below BV and Sobti as the CEO is to be held directly responsible. In the opinion of this writer, the board of directors should have removed Sobti in early 2018, when the regulator had detected the 2 consecutive years of mis-reported accounts. That was the time for the board to bring in a seasoned banker from outside. Instead, the board not only selected a close confidante of Sobti to succeed him when he retires, but is also likely to finalise an apparently lucrative assignment for Sobti to be appointed as an ‘advisor’ to the bank. This also raises the possibility that Sobti may continue to steer the bank as an advisor.

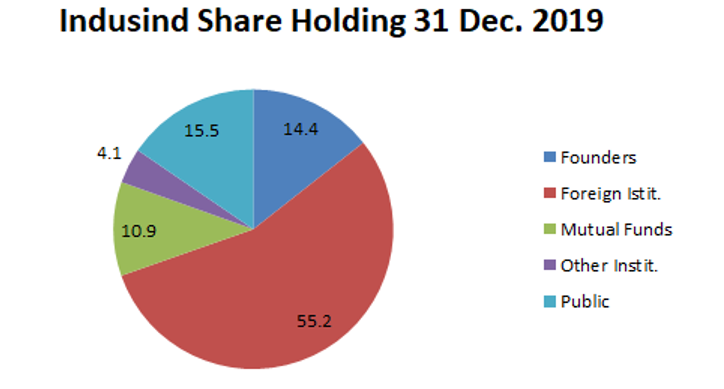

While the Indusind Bank board of directors and the founders seem to have a special affinity for Sobti, the non-founder shareholding (the majority), which includes prominent foreign and domestic institutional investors and the Reserve Bank of India, should ensure that Sobti has no further role in Indusind Bank once he retires as CEO.

Source: Indusind Bank

Rewarding bank CEOs for poor performance appears to be the norm in India’s prominent private sector banks. In July 2017, the Axis Bank board of directors decided to reappoint Shikha Sharma for her fourth term as CEO despite considerable documented mismanagement at the bank. Fortunately the Reserve Bank of India truncated her fourth term, and the bank selected an outsider to succeed Sharma. On June 12, 2018, the Yes Bank shareholders with an “overwhelming majority” approved the reappointment of another term for Rana Kapoor, the founder-CEO, despite the bank reporting 2 consecutive years of fudged accounts in FY2016 and FY2017. The Reserve Bank of India rejected the board’s choice. Currently Rana Kapoor is in judicial custody for allegedly receiving kickbacks of Rs 50 bn ($660 mn), and the bank has just emerged from a moratorium and a bailout led by State Bank of India. What is pertinent to note is that Axis Bank, Yes Bank and Indusind Bank are prominent banks in the capital market, with significant institutional and foreign ownership, and are well covered by sell-side analysts. But, despite documented mismanagement in all 3 banks, there was no outcry of objections from the shareholders and the analysts with regard to reappointing Shikha Sharma and Rana Kapoor as CEOs; nor is there any concern regarding the continuance of Romesh Sobti as an advisor to Indusind Bank.

The experience with Yes Bank is a stark warning of the dangers of a founder-CEO who was allowed to take disastrous decisions without any board censure, and the current valuation of Indusind Bank is clearly revealing the capital market’s complete lack of confidence. In such a bleak economic scenario compounded by the corona virus pandemic, Indusind Bank will do well to break all ties with Sobti and completely restructure the senior management, and reverse Sobti’s high-risk asset growth strategy if it wants to restore investor and depositor confidence in the bank.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in any of the securities referenced in this Insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.