Source : SIFY Author : Finance Desk Last Updated: Tue, Feb 18th, 2020, 15:27:53 hrs

India’s most trusted, rich, and successful banker – Uday Kotak is alleged to have made gains of Rs 23,000 crores. The allegation has been made by financial analyst Hemindra Hazari, a SEBI registered analyst and columnist.

For those of you unaware of Mr Uday Kotak’s credentials – the fourth richest Indian (as reported by Forbes real time Index) holds a net-worth of $15 billion at the time of updating this story. He is also the Chief of the Kotak Mahindra Bank (KMB) and the banker that the government turned to when crisis struck IL&FS. Kotak was appointed as the Chairman of the IL&FS board in October 2018.

Hazari writing for his personal blog alleged that Kotak’s gain was made on the back of relaxation in rules made by none other than the Reserve Bank of India.

The gains are a whopping Rs 23,000 crores or $3.3 billion.

Hazari’s, SEBI registered analyst and a columnist with The Wire, allegations on the Reserve Bank of India and Kotak have been premised on calculations and press releases shared by the RBI and KMB’s correspondence with the Bombay Stock Exchange.

In a blog titled “Defy Regulator, Win $3.3 bn: Kotak Laughs All the Way to the Bank,” Hazari alleges “major relaxation given to only one bank, Kotak Mahindra Bank, has seriously undermined the credibility of the Reserve Bank of India.”

He adds, “In a surprise capitulation, the Reserve Bank of India (RBI) has relaxed its rules regarding the ceiling on the percentage of shares held by founders of a private bank. But it has carved out this exception for just one bank, Kotak Mahindra Bank (KMB), which has been permitted to reduce the founders’ stake to 26% (from the existing 30%) within 6 months from the date of final approval of the RBI. Thereafter no timeline has been set by the banking regulator for the founders’ stake to be reduced to 15%. Prior to this decision, KMB had agreed to the RBI’s decision of reducing the founders’ stake to 15% by March 31, 2020; even this timeline was a major regulatory forbearance, as the original February 22, 2013 notification required the founders’ stake to be reduced to 15% by March 31, 2015. In late 2018, KMB had filed a case against the RBI to permit preference capital (essentially debt) to be included in paid-up capital, so as to reduce the founders’ stake in the bank. As part of the ‘settlement’ with the regulator, KMB will withdraw the case against the RBI.”

Hazari also contrasts KMB’s case with Bandhan Bank by stating the RBI made “stringent” action against Bandhan (when it did not reduce founders’ stake) by restricting opening of new branches. In a nutshell, Hazari has blamed the promoter at KMB, the Reserve Bank of India and the media (for supporting KMB when a case was filed against the RBI). He also shares charts to illustrate the gains made by KMB.

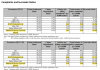

In this chart, Hazari shares how KMB’s promoters value and market cap has consistently increased since FY10.

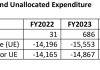

And here’s the chart that explains the gains:

Here’s the tweet from Hazari with the link to the story embedded:

Hemindra Hazari@HemindraHazari

The shameful capitulation by @RBI in @KotakBankLtd case has benefited a single individual @udaykotak at the cost to other shareholders. This shows the dangers of permitting owner-managers & their rising clout in the banking system. My article. https://hemindrahazari.com/2020/02/17/defy-regulator-win-3-3-bn-kotak-laughs-all-the-way-to-the-bank/ …Defy Regulator, Win $3.3 bn: Kotak Laughs All the Way to the Bank – Hemindra HazariHemindra Hazari, is a Securities & Exchange Board of India (SEBI) registered research analyst with over 25 years’ experience in the Indian capital markets. He has specialized in research on banking…hemindrahazari.com5112:24 PM – Feb 17, 2020Twitter Ads info and privacy33 people are talking about this

Click here to read the story on Hazari’s blog.

Although Hazari’s assertions merits a detailed introspection, Kotak Mahindra Bank has been an example of a succesfully managed bank despite several challenges on ownership. The ownership related policy itself has been debated and a 2019 report by the Centre for Economic-Policy research (CEPR) says that prescriptions on bank ownership are “contradictory and ambiguous” with different yardsticks for banks licensed under different conditions.

Meanwhile, here is the press release that KMB announced on Jan 30, 2020, clearly stating that writ petition no 3542 of 2018 filed in Bombay High Court has been withdrawn.

Disclaimer: The story is only for information purposes and should not be construed as a professional advice to buy/sell stocks of the companies mentioned.