EXECUTIVE SUMMARY. It is the season for long serving business head verticals to exit HDFC Bank. Following the abrupt departures of Abhay Aima (former Group Head – private banking) and Ashok Khanna (ex-Group Head – automobile loans) comes news of Munish Mittal (Group Head – Information Technology and Chief Information Officer [CIO]) quitting the bank on July 10, 2020.

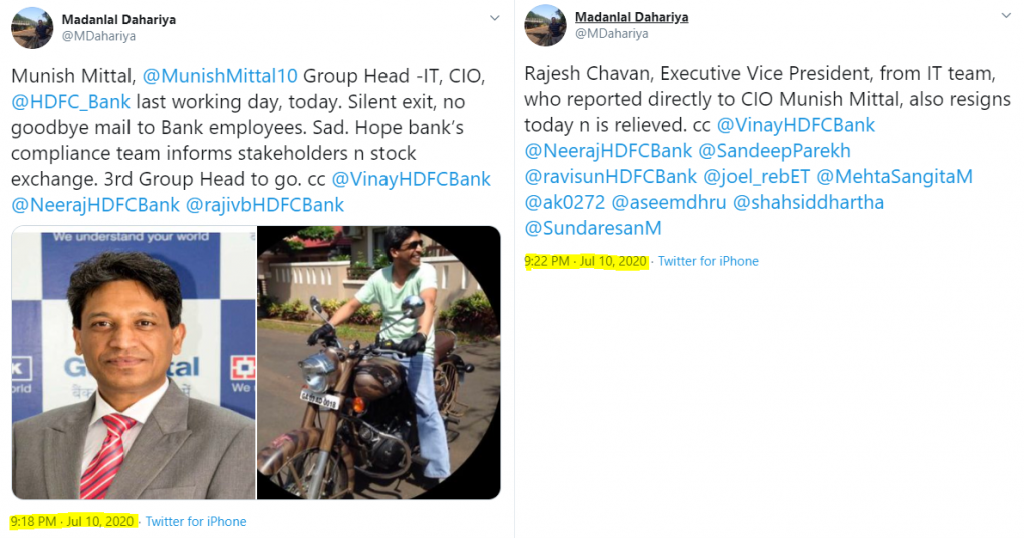

In the true tradition of recent senior-level departures at HDFC Bank, the bank’s highly visible and active communications department did not bother to inform stakeholders or even its own staff. Instead it was left to an anonymous source to tweet that Munish Mittal’s last date was July 10, 2020, as was the case for one of his deputies in the department. The business media as usual did not consider the departure of the CIO at India’s number 1 bank by market capitalisation (one which prides itself on its digital strategy) to be newsworthy, or found it too onerous to verify by querying the bank. Responding to a query by this writer, HDFC Bank said that the 51-year old Mittal, who joined the bank on August 1996 and rose to be the CIO, had decided to take a break, and wanted to enrol for a 2-year course at a foreign university.

There is something fundamentally wrong in the system when a prominent bank does not disclose senior level management exits, and it is left to anonymous sources or whistleblowers to inform the market. The business media, which exist to report such news, refuse to do elementary journalism and decline even to contact the bank to verify the news. In HDFC Bank it is all the more worrying as Aditya Puri, the CEO since the bank’s inception, is finally stepping down in October 2020, and the successor is not yet known to the market. In this situation, it adds to the uncertainty when we find heads of important verticals suddenly leaving.

Today, the largest bank by market capitalisation, in a country where the index has a significant weightage towards banking and the financial sector, declines to provide market sensitive information; the media chose to report only information which the company itself officially releases, and deliberately avoid reporting any information which may embarrass the company. The market is treading on dangerous ground when HDFC Bank is yet to officially acknowledge the controversial exits of Aima and Khanna, and the media has only just reported Khanna’s unceremonious exit; but nobody seems concerned that the market is deprived of market sensitive information by the institutions tasked with the universal disbursal of such information.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own HDFC Bank equity shares.

But ,is this news real because the website of HDFC bank still shows him as CIO