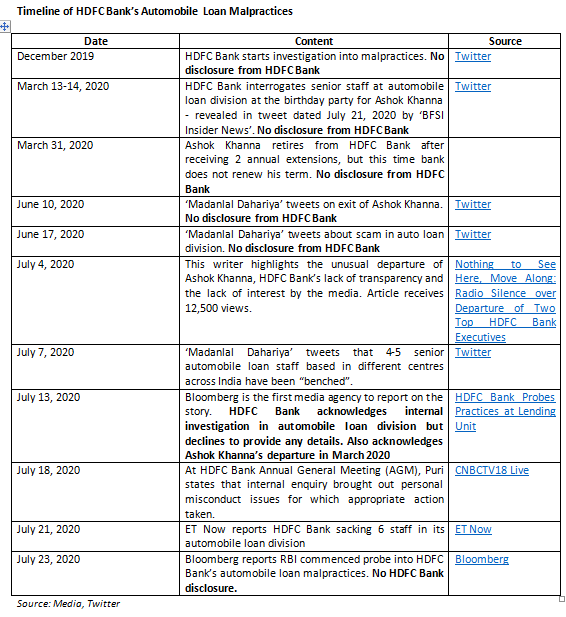

EXECUTIVE SUMMARY. US law firms, Rosen Legal, Pomerantz and Schall have filed class action suits (here, here and here) against HDFC Bank. The grounds are that HDFC Bank allegedly misled investors, provided inadequate disclosures and internal controls over financial reporting, and engaged in improper lending practices in its automobile loan division, resulting in a lack of credibility of its public statements. On Twitter, and subsequently in the media, there has been a consistent barrage of information on the improper practices in its automobile loan division. HDFC Bank has officially said that certain errant individuals in the automobile loan division were held to account, but has not publicly acknowledged the role of Ashok Khanna, the former head of the division. Khanna not only reported directly to CEO Aditya Puri, but was also given repeated extensions by the board of directors after his retirement. If Khanna is found to have been involved in the malpractices, it may also expose Aditya Puri to vicarious liability.

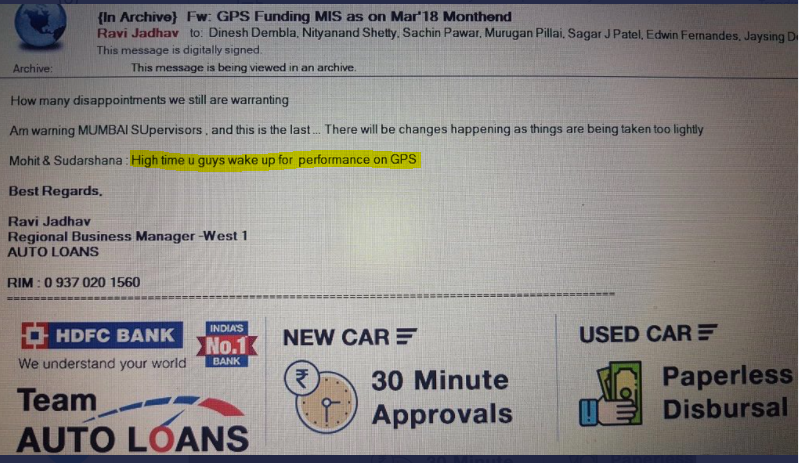

Email by Official in Auto Loans to Juniors on GPS Sales Targets

On Twitter, correspondence of HDFC Bank staff reveal that the bank was brazenly and possibly forcibly selling overpriced Global Positioning System (GPS) devices made by Trackpoint Private Ltd. under the brand name ‘Matchpoint’ to its automobile loan customers. It was part of the loan disbursement documentation. Ambitious sales targets were given to HDFC Bank staff to sell the product, and they were rewarded directly by the vendor. It remains a mystery how only a few errant officials could be held responsible when it was a product approved by the bank’s internal systems and where the bank earned a commission. This raises a major concern, as cross-selling GPS devices and forcing the product on its automobile customers is a violation of the Banking Regulation Act, 1949 which explicitly specifies what business activity a bank can undertake. While the banking regulator is also investigating this fiasco, HDFC Bank needs to publicly explain how the bank’s policies permitted the selling and earning of commission on a non-financial product packaged within its automobile loan, in apparent violation of banking law. It needs to explain how its internal audit and vigilance systems could not detect that an outside vendor was directly rewarding bank staff for selling the product. It is these policies and practices, and the lack of timely disclosures, which should cause concern among HDFC Bank stakeholders. It hardly befits India’s most valuable bank, which trades at a significant premium valuation to its peers, to have been engaged in such activity; but even more worrying is its lack of transparency once these malpractices came to light.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own equity shares in HDFC Bank. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.