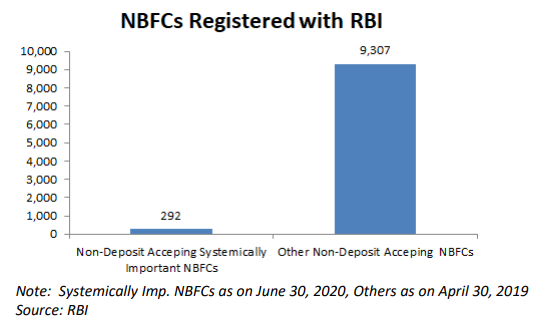

EXECUTIVE SUMMARY. A newly-appointed (on October 9, 2020) deputy governor of the Reserve Bank of India (RBI) has proposed, for discussion, that large systemically-important non-bank finance companies (NBFCs) either convert themselves into banks, or that they contract assets, in order to protect financial stability. This proposal not only has major implications for prominent NBFCs some belonging to industrial houses, but also highlights the regulator’s present lack of capability to regulate such companies. Instead of arguing for the large NBFCs to either become banks or face an eventual demise by setting on a path to shrinking their size, the regulator should be examining how to improve its own regulation and supervision of large NBFCs. The collapses of IL&FS (here) and DHFL (here) were not only a failure of corporate governance and the economic slowdown, but also the consequence of a severe shortfall in regulatory supervision.

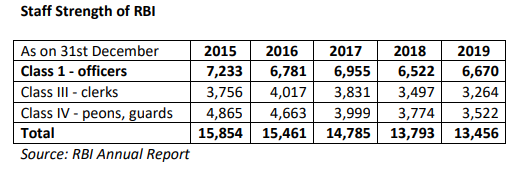

Financial deregulation and the entry of more players in the strategic financial sector require a more vigilant, intrusive regulator armed with the necessary systems, processes and human resource talent to effectively regulate and supervise the sector. Sadly, the total officer strength of the RBI is currently below the levels of 2015, and it needs to invest in more resources for regulating the NBFC sector instead of proposing to compel large NBFCs to become banks. NBFCs cater to specific needs of the economy which the banks, for whatever reasons, have been unable to address, and while some NBFCs may want to become banks, others owned by industrial houses may not even be permitted to get bank licenses, and some may not even want to become banks. In such a scenario it is imperative for the regulator to implement systems and processes to regulate large NBFCs instead of floating such proposals in the public domain.