Author Gaurav Raghuvanshi Rebecca Isjwara

DBS Group Holdings Ltd.’s ambitions to grow in India may get a leg up after the nation’s central bank proposed it take over Lakshmi Vilas Bank Ltd., an ailing local lender, by infusing 25 billion rupees of additional capital.

LVB, a 94-year old lender based in Chennai in south India, was placed under moratorium for 30 days by the Reserve Bank of India on Nov. 17 after it was unable to raise adequate capital to address its negative net worth and continuing losses. In the absence of any viable strategic plan, declining loans and mounting nonperforming assets, its losses are expected to continue, the central bank said. The lender is also experiencing continuous withdrawal of deposits and low liquidity, the RBI noted.

The proposed deal marks the second time the central bank has stepped in to rescue an ailing private lender this year after it asked State Bank of India to take over YES Bank Ltd. in March as it sought to prevent the failure of the private sector lender from becoming a systemic problem. The troubles at some private sector lenders have been accentuated by the coronavirus pandemic, the effects of which plunged the Indian economy into its steepest contraction in four decades. The RBI has tried to keep a closer watch on faltering lenders and act proactively to protect the banking system from contagion effects.

“When the economy is doing badly, there are bound to be bank failures. If the market can’t find a solution, the regulator has to step in,” said Hemindra Hazari, an independent banking analyst in India. The central bank has acted to protect the depositors, “and that is what you try to do in any economy,” Hazari told S&P Global Market Intelligence. For systemic risks the the Indian banking system due to the pandemic, he said it would require some time to see the full impact of one of the strictest lockdowns in the world on the country’s businesses.

Build scale

The proposed amalgamation will allow DBS Bank India, a wholly owned subsidiary of DBS, “to scale its customer base and network, particularly in south India, which has longstanding and close business ties with Singapore,” the biggest bank in Southeast Asia by assets said in a Nov. 17 press statement. It will also “provide stability and better prospects to Lakshmi Vilas Bank’s depositors, customers and employees following a time of uncertainty,” it said.

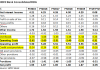

DBS Bank India has a “healthy balance sheet, with strong capital support,” the RBI said in a separate statement on the same day. It’s total regulatory capital was 71.09 billion rupees as on June 30 and capital to risk weighted assets ratio was comfortable at 15.99%, against the 9% needed, the central bank said. Common equity Tier-1 capital was 12.84%, also well above the required 5.5%, it said, adding that the combined balance sheet of the bank after the merger will remain healthy.

“The assessment of LVB’s stress loans will be the key for DBS’ profitability,” Jefferies wrote in a note for clients. The merger will make DBS the biggest foreign bank in India by number of branches and supports its focus on retail and on the small- and medium-scale enterprise segments, Jefferies said. The bank had only 35 branches two years ago, and the deal will help it grow that number close to 600, Jefferies said.

DBS, which converted its India operations into a locally incorporated unit in March last year, now has presence in 24 cities across 13 Indian states, according to the company.

“The exposure to the Indian market will help DBS set itself apart from its peers, that offers plenty of growth opportunities in the longer term as the local economy flourishes,” said Tay Wee Kuang, a research analyst at Phillip Securities Research. “We have seen the bank focusing more efforts into growing its franchise in India, albeit at a more reserved pace. As such, the potential acquisition may present itself as an opportunity for DBS to establish itself across more segments of the Indian economy.

The main concern for the bank must be to ensure capital adequacy and maintain asset quality to ride the crisis, especially at the current “critical juncture” in assessing the overall impact on the economy, Tay said, adding: “I do not believe that DBS will go on the aggressive to acquire distressed assets for the sake of growth.”

Lakshmi Vilas Bank negotiated with other suitors and tried to raise capital to improve its finances in recent months. However, talks with Clix Finance India Private Ltd., Clix Capital Services Pvt. Ltd. and Clix Housing Finance Pvt. Ltd. for a potential merger were stuck on valuation grounds, The Times of India reported, citing Shakti Sinha, the RBI-appointed director on LVB’s board.

As of Nov. 17, US$1 was equivalent to 74.43 Indian rupees.