EXECUTIVE SUMMARY. According to the grand theory of capitalism and the free market, competition anoints the customer as king. In the capital market, it is argued that increasing the number of players would improve price discovery, and greater scrutiny of managements’ conduct would discipline them. Thus the market would self-regulate. In this Utopian world, investigative business media and seasoned gold-plated analysts would grill and expose errant corporate executives, and demand explanations for any shortcoming. For fear of punishment by the markets (in the form of a falling share price), companies would stick to the straight and narrow.

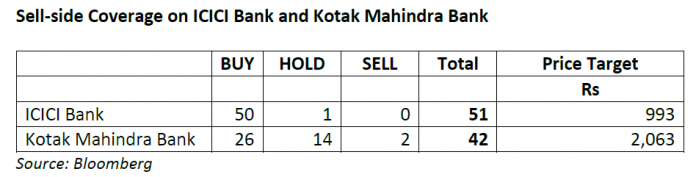

According to Bloomberg, both ICICI Bank and Kotak Mahindra Bank (KMB) are actively covered by sell-side analysts: the former is tracked by 51 analysts, while the latter is covered by 42 analysts. By contrast, JP Morgan Chase, the largest US bank by market capitalisation, is covered by only 24 analysts.

On June 30, 2022, the Securities and Exchange Board of India (SEBI) released its order, wherein it imposed monetary penalties on Kotak Mahindra Trustee Company (KMT) and the senior executives of Kotak Mahindra Asset Management Company (KMAMC), including Nilesh Shah, the high-profile managing director and a member of the Economic Advisory Council to the Prime Minister and the debt investment team.

On July 23, 2022, KMB declared its 1QFY2023 results. In the analysts’ conference call, Nilesh Shah even commented on the asset management business (p. 11-12 in transcript) without making any reference to the SEBI penalties on him and his debt team. As KMB had not publicly commented on the SEBI order, the 1QFY2023 conference call was an opportunity for analysts to question the KMB management on how such events took place, why there was a failure in oversight, what measures had the company taken to prevent such lapses in the future, and what disciplinary measures had been taken on the concerned individuals, including Nilesh Shah. When all the senior executives of the debt investment team, the compliance officer and even the trustee company are penalised by the capital markets regulator for mis-management, and there is no disciplinary action against the concerned individuals by the board of directors, there is a systemic issue in the group. One would have expected the analysts to grill the officials, including Nilesh Shah, but not a single question on this subject was posed by the analysts to KMB.

On July 19, 2022, the media reported a major theft by an ICICI Bank employee from the bank’s integrated currency chest in Dombivali (suburb of Mumbai). It was the largest theft from a currency chest in India. This was a major development, one which reflected poorly on ICICI Bank’s security protocols. The bank did not issue any press release to clarify what had happened. Four days later, ICICI Bank declared its 1QFY2023 results, and in its analysts’ conference call not a single analyst asked a question pertaining to the theft from a high security currency chest of the bank.

Pertinently, even the media at the results press conferences of both banks (which, unlike the analysts’ conferences, are not recorded) did not ask any queries on these issues.

When an army of well-paid and experienced guardians refuse to probe companies based on public reports from regulators and the police, what primary investigation or in-depth critical research can they undertake? A pack of guard dogs are of no use when they choose to muzzle themselves.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in ICICI Bank and Kotak Mahindra Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.