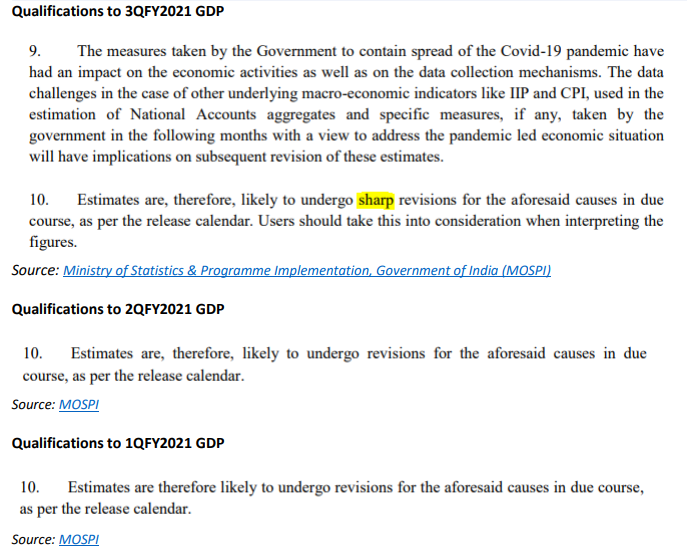

EXECUTIVE SUMMARY. A noteworthy feature in the 3QFYGDP estimate is its dubious credibility, as indirectly admitted by the official statistical agency itself. In the 1QFYGDP and 2QFYGDP, while the National Statistical Office (NSO) had acknowledged that, on account of the lockdown, the estimates are “likely to undergo revisions” the 3QFYGDP press note specifically qualifies that the revisions are likely to be “sharp.” This is a fair indication of the unreliability of the estimate, and the turnaround of positive growth therefore has little credibility. The press note acknowledges data collection issues on account of the lockdown.

The reliability of the estimate of private final consumption expenditure (PFCE), the single largest component at 58.6% of 3QGDP by expenditure, is anybody’s guess. Economists like Pronab Sen (here) and Arun Kumar (here) had earlier highlighted that demonetization, implementation of the Goods and Services Tax (GST) and the lockdown had severely impacted the informal/unorganised sector relative to the formal/organised sector, and therefore the normal method of estimating the value added in the informal sector from the formal sector had broken down. In the absence of fresh data on the basis of which to quantify the new relationship between the formal and informal sectors, using the old formula produces GDP estimates for the informal sector that are unreliable.

The estimates of government final consumption expenditure (10% of GDP), exports and imports for the preceding quarters are also subject to revision, but they at least are based on actual data. The estimate for gross fixed capital formation (33% of GDP) too includes a large component of household fixed capital formation, and hence is dubious. Since the largest components of expenditure, namely, PFCE and gross fixed capital formation lack credibility, no meaningful conclusions can be drawn from such unreliable GDP data.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.