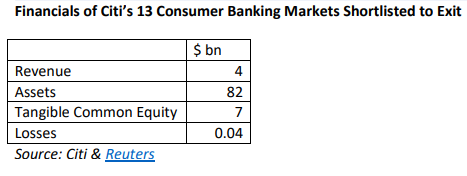

EXECUTIVE SUMMARY. Citi’s decision to withdraw from consumer banking in 13 geographies, including India, and focus instead on corporate/institutional banking, is a lesson in missed opportunities, at least in the case of India. Citi India was the pioneer in consumer banking, in products such as mortgages and credit cards, but it flourished when there were only government banks. The post-1991 entry of the new private banks in India which concentrated on the retail and corporate customers of foreign banks, and the post-Lehman crisis in 2008, heralded the decline of foreign banks in India.

The present market capitalisation of the new private banks, and their significant footfall in retail banking in India, highlight the missed opportunity by foreign banks like Citi. The Reserve Bank of India (RBI) provided the foreign banks an opportunity from 2013 to set up Indian subsidiaries which could unfetter their network shackles and expand their branches, which is necessary for consumer banking, but the foreign banks preferred not to get tied down by the other regulatory and social commitments. Instead they focused on hiring direct sales agents to grow their consumer book. Although Citi developed a premium retail clientele franchise, the lack of a broader retail network and intense competition impeded their growth in retail. They preferred to remain focused on the corporate portfolio where, using their global balance sheet, creating structured products and handling treasury and foreign exchange transactions, they managed a lucrative business.

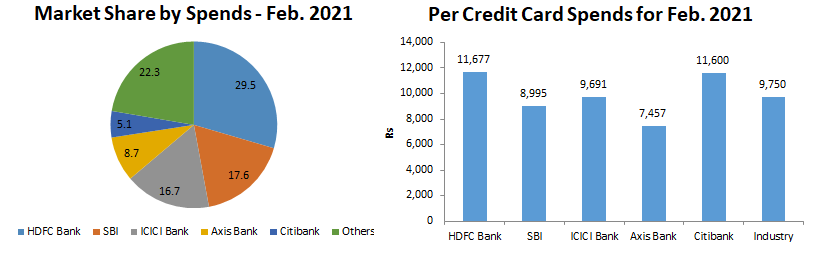

Citi’s 5% market share in credit cards remains the jewel in its retail consumer franchise in India, and its monthly credit card spends per customer are at the top of the league, and close to HDFC Bank. Many players are eyeing Citibank’s market share in credit cards and it remains to be seen whether Citi offloads it on a standalone basis, or sells it with its other retail franchise in India, or sells all 13 geographies to a global player.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in some of the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.