Axis Capital’s structured finance team is proud of its “unblemished track record of ‘No Default’ in any transaction with 100% investor money”. But the underwriting of Rs 2.6 bn of non-convertible debentures (NCD) of Sojo Infotel in March 2021 may result in its inaugural blemish on March 25, 2024, when the maturity date falls due. Stakeholders in Axis Bank, as well as financial sector regulators, need to analyse the anatomy of this deal to appreciate how Axis Capital and Axis Bank do underwriting and risk management.

Axis Capital, a 100% subsidiary of Axis Bank, is engaged in investment banking, institutional broking and distribution of financial products. Its innovative structured finance division has raised US$ 1 bn for companies and promoters in India. On March 25, 2021, Axis Capital structured and successfully privately placed with three investors Sojo Infotel 8.35% coupon per annum debentures of a total value of Rs 2.6 bn. The debentures had a call option on September 25, 2023 and redemption date of March 25, 2024. The credit rating agency, CRISIL assigned a provisional rating of ‘AAA (CE)’ with a ‘Stable outlook’ for the issue.

An unusual feature of the issue was that Axis Capital, as the sole arranger of the NCD issue, guaranteed repayment of the debentures. As Crisil Rating stated,

The underwriting commitment from Axis Capital is unconditional and irrevocable, and it covers the whole quantum of the repayment obligation that may arise on redemption of the NCDs (including entire principal + accrued coupon).

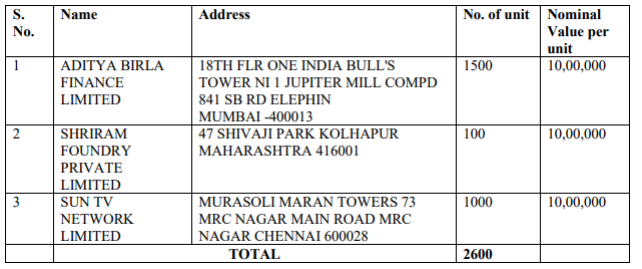

The debenture issue had a call option on September 25, 2023 which Sojo Infotel did not exercise. As a result it triggered an asset sale event, increasing the risk of the liability falling on Axis Capital if the company failed to meet the redemption on March 25, 2024. The holders of the NCD issue were Aditya Birla Finance Private Ltd, Shriram Foundry Private Ltd and Sun TV Network Ltd.

List of NCD Holders as on March 31, 2022

As per the Debt Memorandum of the issue a minimum 26% of the equity of Lava International, an unlisted subsidiary of Sojo Infotel were pledged to Axis Capital as security. The pledged shares were valued at three times the value of the debenture issue. Lava International’s Initial Public Offering (IPO) was scheduled to take place 15 months from the date of allotment of the debenture issue of Sojo International. Personal guarantees and assets of the promoters were also pledged for the issue.

Just before Lava International filed its draft red herring prospectus (DRHP) on September 27, 2021, UNIC Memory purchased a stake at Rs 110.67 per share from the promoters, valuing the company at around Rs 60 bn. The promoters utilised the proceeds to partly reduce the principal and interest repayments, thereby reducing the outstanding NCD amount to Rs 1.74 bn. Based on this valuation, Axis Capital had more than adequate coverage for its off-balance sheet exposure.

Unfortunately for Axis Capital, Lava International found itself unable to proceed with the IPO, as the capital market regulator raised some issues which the company was unable to address. As a result, the underwriting risk for Axis Capital significantly increased. The failure of the IPO resulted in the promoters being unable to honour the call option to redeem the NCDs on September 25, 2023, thereby triggering an asset sale event. Both these issues were compounded by the arrest of Hari Om Rai (single largest promoter and managing director of Lava International) by the Enforcement Directorate on October 11, 2023, on charges of money laundering. In such a scenario, the prospect of Soji Infotel redeeming the NCD appears to be bleak.

The last valuation of Lava International appears inflated, as Sojo Infotel and Axis Capital were unable to find buyers for Lava International prior to the call option, and the valuation after the expiry of the call option can only have worsened, since the main promoter is in judicial custody and to date no buyer has emerged. Therefore, while Axis Capital may, on paper, have adequate security to cover the default, in reality the value of the security may be lower than the loan amount.

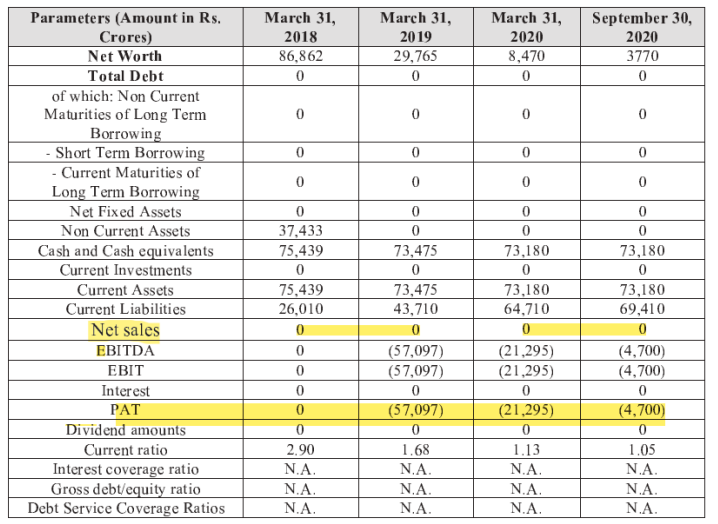

Stakeholders in Axis Bank need to evaluate the underwriting and risk management in Axis Capital and Axis Bank’s due diligence over its subsidiary. At the time of the issue in March 2021, Sojo Infotel was a loss-making holding company with marginal assets and no income, and by FY2022 the company reported a negative net worth of minus Rs 256 mn. The company was in no position to service the debentures raised, and hence the debenture holders required the underwriting commitment from Axis Capital if Lava International failed to have its IPO. In effect the debenture issue was a bridge loan to Sojo Infotel till Lava International had its IPO.

Financials of Sojo Infotel – FY2018-1HFY2021

Source: Information Memorandum of Sojo Infotel p. 20

The principles of prudent lending and credit risk management dictate that the underlying business should have robust cash flows and the collateral should be relatively liquid. A loan which depends solely on collateral, in the absence of any business and operating cash flows, is a poor quality, high-risk loan. In the case of Sojo Infotel, even the security was illiquid, as it was dependent on the prospective IPO of Lava International, which never materialised.

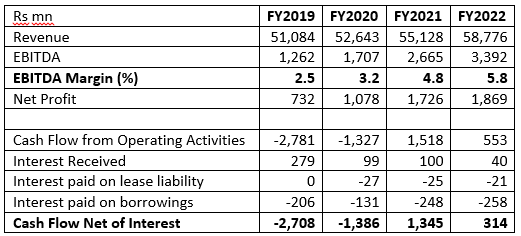

Lava International is a large domestic mobile handset and mobile handset solutions company. It was expected to be a beneficiary of the government’s production linked incentive scheme (PLI). However, while the company reported annual revenue of Rs 51-55 bn in FY2019 to FY2021, the EBITDA margin of the company was in the range of 2.5%-4.8% in the same period. The single digit margin indicated that the company was engaged in assembling and branding rather than manufacturing of mobile handsets. Moreover, the cash flows from operations were negative in FY2019 and FY2020; they turned positive in FY2021, when the company planned its IPO in late 2021. In FY2022, the company reported cash flow from operations, net of interest outflows, of only Rs 314 mn, as compared with a revenue of Rs 59 bn. Hence even the pledged security held by Axis Capital was not of high quality. The valuation was solely based on the size of the firm’s revenues, ignoring the low EBITDA margins and negligible cash flows.

Consolidated Lava International Financials

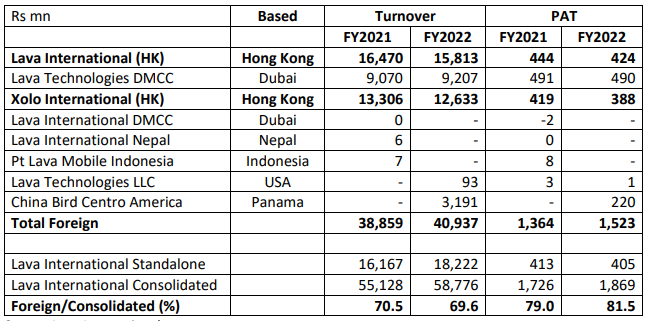

An unusual aspect in Lava International’s financials was that the bulk of its consolidated revenue and profit after tax were from foreign subsidiaries including two companies based in Hong Kong. The Indian government, especially after the border clashes with China in May-June 2020 has been extremely sensitive towards China’s business interests in India especially in the sensitive sector of telecommunications. It is also surprising that a company which professes to be a large domestic mobile handset and solutions company reports the majority of its revenue and profit from foreign subsidiaries. The implication of these concerns appear to have been ignored by Axis Capital and the arrest of the main promoter of Lava International on charges of money laundering by the Enforcement Directorate in October 2023 was on account of certain transactions with a Chinese entity.

Foreign Subsidiaries Contribution to Consolidated Lava International

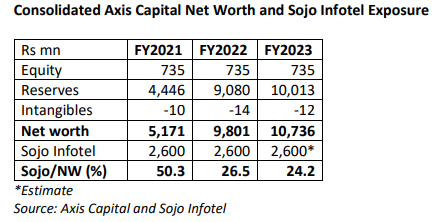

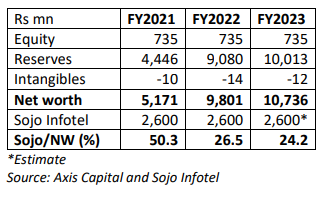

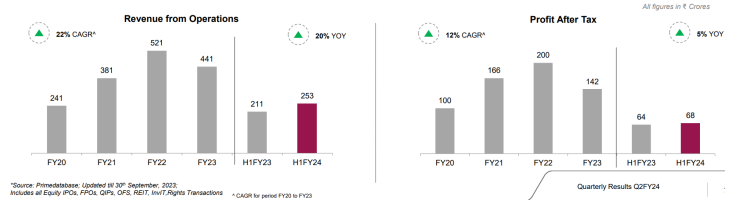

From a risk management standpoint, companies may engage in high-risk transactions if the security is liquid and/or the exposure is curtailed to an insignificant component of the lender/guarantor’s net worth. What is a major concern is that when Axis Capital undertook the transaction of underwriting the principal and interest of the Rs 2.6 bn Sojo Infotel NCD issue, this single transaction constituted 50% of the merchant banker’s net worth. As the current outstanding of the NCD is Rs 1.74 bn, the exposure is 16% of Axis Capital’s FY2023 net worth. Pertinently, Axis Capital reported total income of Rs 4.41 bn and a profit after tax of Rs 1.42 bn in FY2023.

Consolidated Axis Capital Net Worth and Sojo Infotel Exposure

Axis Capital Income and Net Profit

Another dimension to this transaction was that, since the issuer was a holding company with marginal assets and no income, and the security to be pledged was a company with negative cash flows from operations, the debenture may not have been rated as ‘investment grade’ by credit rating agencies. The opinion of CRISIL in justifying its rating on Sojo Infotel’s NCD is therefore highly revealing when it stated,

Axis Capital’s credit risk profile is expected to be strong driven the support it receives from Axis Bank Limited (rated CRISIL AAA/Stable/CRISIL A1+). Axis Capital is of strategic importance to the bank as it complements the latter’s product offerings. Axis Capital also benefits from the operational and managerial support from Axis Bank in formulation of policies, oversight on underwriting transactions, etc. Axis Capital’s board comprises senior functional executives from Axis Bank, which ensures strong supervision of its performance by the bank. CRISIL Ratings believes the close operational, managerial, and financial linkages, and sole ownership of by Axis Bank, imply a strong moral obligation on the parent to support Axis Capital in case of any exigencies [bold ours].

The ‘CRISIL AAA (CE)/Stable outlook’ given at the time of the issue, and reaffirmed after the asset sale event, when Sojo Infotel could not honour the call option, is on account of not just the explicit Axis Capital guarantee, but of the merchant bank being a 100% subsidiary of the bank. This high-risk transaction therefore derives its ‘AAA (CE)’ rating on account of Axis Bank putting its capital and reputation at risk.

While CRISIL provided a ‘AAA (CE)’ rating for the NCD issue of Sojo Infotel where the only recourse for repayment was the valuation of Lava International and the underwriting by Axis Capital, the standalone credit rating for Lava International by CARE was ‘BBB+’ for long-term and ‘A2’ for short-term. It was therefore necessary for Axis Capital to underwrite the NCD issue of Sojo Infotel and charge the issuer hefty fees for ensuring the ‘AAA (CE)” credit rating.

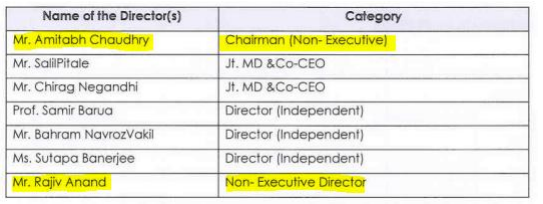

What is most surprising is that not only did Axis Capital sign off on the high-risk transaction, but it was also approved by Axis Bank, as both the Axis Bank CEO and the then Executive Director (present deputy CEO), Axis Bank, were and still remain on the board of directors of Axis Capital.

Axis Capital Board of Directors in FY2021

It remains to be seen how Axis Capital can prevent a default, and whether it can find an investor to purchase its minimum 26% stake in Lava International to cover the Rs 1.74 bn redemption amount. Failing which, Sojo Infotel will reflect on Axis Capital’s FY2024 balance sheet, and the merchant bank will have to realistically value the asset.

During the 4QFY2021 results call held on April 27, 2021, slightly more than one month after Sojo Infotel’s NCD issue was closed, Amitabh Chaudhry, CEO, Axis Bank was reassuring analysts on Axis Bank’s underwriting capabilities and how the different divisions in the bank and the group were working together to benefit corporate clients in capital market deals executed by Axis Capital.

Our risk management framework is more mature and broad-based today. And this is reflected, for example, in the strength of our credit underwriting processes…We have a unique opportunity to provide a complete range of solutions to corporates leveraging our corporate banking franchise and the strong capabilities of our subsidiaries. Different businesses of the Bank like Wholesale Banking products, Trustee services, Retail liabilities, Burgundy Private, Axis Securities and Axis Mutual Fund came together to offer One Axis solutions in 21 capital market deals executed by Axis Capital. These coordinated efforts are differentiating our value proposition and strengthening our relationships with the client.

That a single high-risk transaction could expose 50% of Axis Capital’s net worth, and yet was not considered a major risk by all the concerned parties, is an issue which the banking and capital market regulators and the Axis Bank stakeholders need to carefully examine.

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in Axis Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: