EXECUTIVE SUMMARY. Why is the capital market deliberately overlooking the serious concerns regarding corporate governance in the Kotak Mahindra group? Presumably because the bank has been rewarding shareholders over the years, as well as because of the stature of its founder-CEO, Uday Kotak. The latest issue emerging from the Kotak Mahindra stable is that of highly public promotions given to three senior officials from Kotak Mahindra Asset Management Company (KMAMC), all of whom were penalised for serious offences by the Securities and Exchange Board of India (SEBI) a few months ago.

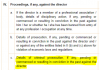

On June 30, 2022, after conducting a thorough investigation into malpractices by KMAMC, SEBI issued an order penalising, among others, Lakshmi Iyer (Chief Investment Officer-Debt and Head-Products), Deepak Agarwal (Vice-President and Fund Manager) and Abhishek Bisen (Fund Manager). The Kotak Mahindra group appealed the order to the Securities and Appellate Tribunal (SAT), which stayed the penalties by its order dated August 24, 2022, pending its final disposal scheduled on November 10, 2022. Pertinently, a SAT stay order on the penalties does not exonerate any of the senior executives found guilty by SEBI.

Extract from SEBI’s June 30, 2022 Order

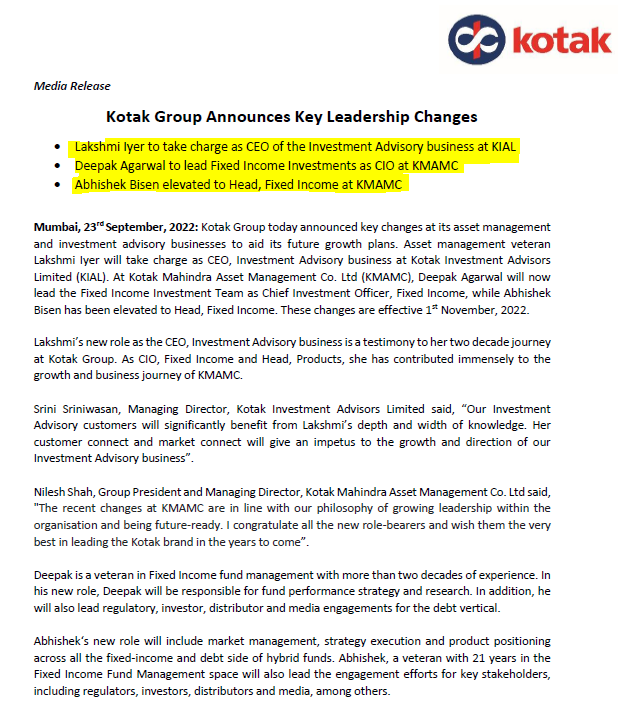

Yet, shockingly and brazenly, on September 23, 2022, the Kotak Mahindra group issued a media release informing the public of promotions given to all the 3 indicted officials. Lakshmi Iyer would take charge as CEO Investment Advisory business of Kotak Investment Advisors. At KMAMC, Deepak Agarwal would take charge as Chief Investment Officer (Debt Investments) while Abhishek Bisen will be elevated to Head Fixed Income. The changes will be effective from November 1, 2022. Despite the penalty, which has to date not been reversed by the higher authority, the senior executives of the group were not only not punished by the company, but were instead richly rewarded by the group, demonstrating its total disregard for the capital markets regulator.

Extract from Kotak Mahindra Media Release

KMAMC is an unlisted subsidiary of Kotak Mahindra Bank (KMB), and it has independent and non-executive directors on the board. The promotion of the senior executives in KMAMC would have required the approval of the Nominations and Remuneration Committee (NRC), which is chaired by Anjali Bansal, independent director, and has as its members, Sanjiv Malhotra, independent director and a veteran banker, and two former executives of the Kotak group, C. Jayaram and Gaurang Shah (who was himself penalised by SEBI).

That KMAMC’s NRC can publicly defy SEBI by giving promotions to key officials who have been penalised, without the higher authority overturning the capital market regulator’s penalties, defies explanation. It is indicative of the quality and calibre of KMAMC’s NRC, especially its chairperson and independent directors. Anjali Bansal is also on the board of directors of Nestle India, Voltas, Tata Power and Piramal Enterprises.

A professionally managed company having truly independent directors would have disciplined the concerned senior officials for the serious offences detected by the regulator, and demanded a complete overhaul of the policies and procedures at the company, since even the Managing Director (Nilesh Shah), Non-executive director (Gaurang Shah), Chief Investment Officer-Debt Investments (Lakshmi Iyer), Head-Compliance (Jolly Bhatt) and fund managers were found guilty. Not only was no such action apparently undertaken, but the board of directors, on the recommendation of the NRC, decided instead to reward the concerned indicted officials.

This analyst sent queries to the Kotak Mahindra group and to Anjali Bansal enquiring what disciplinary actions had been taken on the indicted officials, and how could the company have promoted them when SAT has not reversed the penalties. The queries were not responded to by the concerned parties. This incident is not an isolated event. The Kotak Mahindra group believes in preaching high standards of corporate governance to the public while implementing poor standards in its own companies.

When a prominent corporate group in the financial system believes it can treat regulators with contempt by rewarding penalised officials with promotions instead of punishing them, it signals to the capital market that the group is above the law. The media (with some exception) and analysts, instead of exposing such practices, are silent supporters, and the regulators don’t seem to mind that a powerful player in the system takes their actions so lightly.

As long as the entities are rewarding shareholders with superior performance, the capital market treats poor corporate governance and regulatory non-compliance as par for the course. Hence, in the case of the Kotak Mahindra group, nobody seems to be bothered. But shareholders need to consider what other activities such entities may be doing which have not been detected by the regulators. In the financial system such risks can multiply, with dangerous consequences.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in Kotak Mahindra Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.