The State Bank of India (SBI) is India’s largest bank by assets and the government’s most prestigious bank. Formerly the Imperial Bank of India under British rule, the SBI long remained something of an empire, its chairmen exalted figures ruling over an army of 235,858 employees. Unfortunately, the SBI has been in the news recently for a series of unsavoury episodes pertaining to the government’s scheme of electoral bonds. These episodes reflect unfavourably on Dinesh Khara, the current valet presiding as chairman.

Timeline of SBI’s Issues with EBS

| Date | Event |

| 2 January 2018 | Government notifies Electoral Bond Scheme (EBS) |

| 15 February 2024 | Supreme Court of India (SCI) Judgement says EBS is unconstitutional, instructs SBI to disclose details to ECI by 6.3.2024 & ECI will disclose to the public by 13.3.2024 |

| 4 March 2024 | SBI informs SCI it requires till 30.6.2024 to provide all the details |

| 11 March 2024 | SCI Order directs CMD, SBI to disclose EBS data by 12.3.2024 |

| 12 March 2024 | Dinesh Khara, CMD SBI files Affidavit with SCI attaching EBS details but omits alpha numeric nos of EBS |

| 18 March 2024 | SCI instructs CMD, SBI to disclose alpha numeric nos of EBS by 5 pm 21.3.2024 |

| 21 March 2024 | ECI uploads ECB data with alpha numeric codes |

| 30 March 2024 | SBI denies RTI request for providing SOP issued to its branches for sale & redemption of EBS |

| 10 April 2024 | SBI denies RTI request for disclosing legal fees paid to Harish Salve for SBI’s defence in SCI & request for data given to the ECI |

Source: Government of India, Supreme Court of India and X

The controversy erupted when, on February 15, 2024, the Supreme Court of India (SCI) declared the Electoral Bond Scheme, 2018 to be unconstitutional, and ordered the SBI to disclose all the details of the bonds to the Election Commission of India (ECI) by March 6, 2024. Unfortunately, on March 4, 2024, the SBI, through a junior officer submitted to the Court that it required till June 30, 2024 to provide all the details. On March 11, 2024, the Court dismissed SBI’s plea and ordered the chairman of the bank to submit the details by March 12, 2024. On March 12, the SBI chairman submitted the bond details, but deliberately omitted the important alpha numeric bond numbers. This resulted in a contempt petition being filed against the SBI. On March 18, 2024, the Court ordered SBI to disclose the alpha numeric numbers by March 21; this order was finally complied with by the bank. Subsequently, SBI continued with the obstruction of information to the public when, in response to Right of Information (RTI) requests, it declined to provide the standard operating procedure for the electoral bonds and to disclose how much it paid Harish Salve, the lawyer who appeared for SBI in the Supreme Court.

The largest stakeholder in any Indian commercial bank is the Indian public, and since the government of India owns 59.5% in SBI, its majority equity ownership is also in effect owned by the Indian public. Therefore, for the SBI to consistently decline to provide information sought by the highest court of the land, and thereafter fail to comply with RTI requests, is shameful.

The Supreme Court of India, in its order dated March 11, 2024, castigated India’s premier bank. When the bank stated it required 3 months to match the data between the donors and the parties, the court stated,

The SBI shall file an affidavit of its Chairman and Managing Director upon compliance with the directions which have been issued above. We are not inclined to exercise the contempt jurisdiction at this stage bearing in mind the application which was submitted for extension of time. However, we place SBI on notice that this Court will be inclined to proceed against it for wilful disobedience of the judgment if SBI does not comply with the directions of this Court as set out in its judgment dated 15 February 2024 by the timelines indicated in this order [bold ours].

While hearing the contempt petition against SBI on the bank not revealing the electoral bond alpha numeric numbers, D Y Chandrachud, the Chief Justice of the Supreme Court of India made the following observations,

Let SBI not be selective in its disclosure …We bank on the fact that State Bank of India will be candid and be fair to the court …Why has SBI not disclosed [bond numbers]…SBI’s attitude appears to be you tell us what is to be disclosed and we will disclose, that is not fair…It is State Bank of India which is coming to us, we expect there should be a degree of candour on the part of State Bank of India…We will say that SBI will not only disclose the bond numbers but it shall also file an affidavit before our court saying we will not suppress, not withhold, any details…you have to disclose all details because the burden should not lie on the court or the petitioners [bold ours]…”

The SCI’s strong comments on SBI’s abysmal conduct, bordering on finding it in contempt, should shame any institution, and in particular its chairman; but Dinesh Khara remained unfazed. That the highest court of the land was willing to proceed against the bank for “wilful disobedience of its judgment” and demanded “a degree of candour” from the bank should have shaken any banking institution.

It is apparent that Khara was following instructions from the political authorities, and lacked the moral integrity to decline to obey unlawful orders. Pertinently, while SBI informed the court it would require 3 months to tally the sale and the redemption of the bonds, independent media journalists were publishing articles within 5-6 hours of the disclosure by the ECI, highlighting the names of the companies and the amounts that they had given to the political parties.

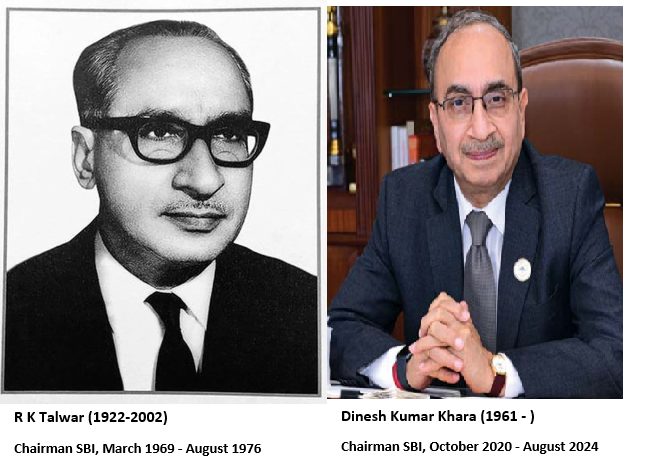

Khara’s lack of leadership is a far cry from the practice of his far more illustrious predecessor, R K Talwar, chairman of SBI from March 1969 to August 1976. Although Khara joined SBI as a probationary officer in 1984, nearly 8 years after the government sacked Talwar, he could have learnt from the latter how the SBI chairman’s primary role is to defend and develop the interests of a 218-year old institution which traces its origins to the Bank of Calcutta in 1806.

There are two incidents pertaining to Talwar’s leadership which Khara needs to be reminded of, and which are part of SBI folklore.

N. Vaghul, in a private publication on R.K. Talwar (R.K. Talwar: Tributes), recalls when a Minister of State called Talwar to his office and gave him instructions on how he should act in an industrial relations dispute. When Talwar declined to follow the Minister’s orders, the Minister said,

Are you refusing to carry out the orders of the Government?

Talwar replied,

Mr. Minister, you are not running SBI. I am. It is for me to decide what is in the best interest of the Bank. You have a right to decide whether I should continue to be the Chairman, but you have no right to tell me how to administer the Bank. If you want to issue a directive to me please do so in writing. The SBI Act provides for the issue of such a directive [Section 18, State Bank of India Act, 1955], but before issuing such a directive, you must first establish that it is in the public interests as provided for in the Act.

The Minister declined to take the issue forward.

In another incident, SBI declined to provide a loan to a cement company in Rajasthan, as it did not meet its loan criteria. The promoters of the company approached Sanjay Gandhi, the younger son of then prime minister, Indira Gandhi, who directed the Finance Minister to instruct the SBI chairman to approve the loan. Even after the Finance Minister contacted Talwar, the latter refused to budge. Ultimately the government had to modify the SBI Act, 1955 in order to sack Talwar for not carrying out its instructions.

In both instances, Talwar stood his ground and defended the interests of the bank. Doing so ultimately cost him his job, but he did not place personal attachment to the office of chairman above the interests of the bank. He did what was expected from him as a leader, and that is why his reputation lives on nearly half a century after he was sacked.

What Khara has failed to appreciate is that all bank employees are protected by the institution in their careers in the bank, as that is what is expected from the institution; in turn they are to protect the institution when they are in a position to do so. Indeed, SBI nurtured and groomed Khara’s career over the years: Chief General Manager – Bhopal Circle, a sought after Chicago posting, managed risk, information technology and compliance functions at different junctures. The bank no doubt found him competent to be exposed to these functions, which finally led to him being selected as managing director and thereafter as chairman. But when an individual reaches the pinnacle of the organisation his/her role changes, and it is now the individual’s responsibility to defend and protect the institution. As chairman, it is his/her job to withstand external pressures and prevent such interests from undermining the credibility of the organisation, even if such pressures originate from the government. Sadly, Khara was unwilling to withstand such pressures when it pertained to defending the government’s indefensible conduct in relation to the electoral bonds.

Khara’s reluctance to protect SBI’s credibility should be seen in the context of the fact that his 3-year term as chairman ended on October 6, 2023; the government gave him an extension in the post till August 2024. Hence, even before the Supreme Court gave its electoral bond verdict in February 2024, Khara had already completed his term, and he was on an extension provided by the government. Even if he had disobeyed the government’s instructions of asking for a 3 month extension from the SCI or not voluntarily giving the apha numeric numbers, the most damage the government could have done him was to make him resign, preventing him from completing his extension. However, even after enjoying a full term as chairman, he was unwilling to stand up for his organisation which had nurtured and groomed him.

As the electoral bond scheme has excited considerable public interest, especially after the Supreme Court’s verdict declaring the entire scheme unconstitutional, SBI should have voluntarily adopted a more transparent policy towards the Indian public, to reassure the nation of its own bonafides. But instead, it has denied RTI requests for disclosing the SOP of the sale and redemption of the bonds, on the spurious grounds that it is an internal guideline and comes under “commercial confidence”. The bank also refused to divulge the fees it paid Harish Salve, the lawyer it engaged in the Supreme Court.

Future SBI chairmen have a choice: should they imitate the conduct of the current valet-in-chief, bent on retaining his office as long as possible, or protect the credibility and the reputation of a more than 200-year old institution? That Khara’s conduct devalues the post of chairman, lowers public confidence and weakens the foundation of a crucial institution does not seem to bother even the present central board of directors.

When Khara’s term finally ends in August 2024, the private corporate sector may find his qualities of blind loyalty to political masters aptly suited to their requirements for independent directors, but proxy advisory firms and independent analysts must immediately sound the alarm. Any individual who is only concerned with his own narrowly defined self-interest, at the cost of the institution, is unfit to be on any board of directors as an independent director.

This article was also published in The Wire and can be read here

____________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in SBI. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: