Take two old private banks, of similar backgrounds. One embarks on an ambitious, disruptive strategy of nationwide expansion; the other remains stuck to its region of origin. In a little over three years the first bank more than doubles its total lending; the other grows too, but lags behind. Foreign investors buy large stakes in the first, and it has a larger number of high salary executives than that of the counterpart bank. The first bank is the one to bet on, right?

Maybe one should first take a look under the hood.

In southern India, two regional private sector banks, each over a century old, are forging divergent growth strategies under their respective Chief Executive Officers (CEOs). Karur Vysya Bank (KVB), founded in 1916 by the trading and entrepreneurial community of Chettiars, operates mainly in Tamil Nadu, and CSB Bank (formerly Catholic Syrian Bank), established in 1920 by Syrian Christians, has most of its branches in Kerala.

B. Ramesh Babu, a former State Bank of India career banker, took charge as CEO, KVB in end-July 2020, while Pralay Mondal, a private sector banker (HDFC Bank, Yes Bank, Axis Bank) took effective leadership of CSB Bank from April 1, 2022, though the Reserve Bank of India (RBI) approved him as CEO only in mid-September 2022.

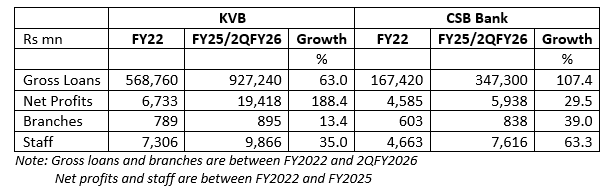

While the two CEOs took effective charge within two years of each other, their strategies for future growth, endorsed by their respective boards of directors, have been very different. CSB Bank has ventured into a more aggressive growth strategy in terms of loans, branches and staff, but its net profit growth has been subdued, not only as compared with its own loan growth, but also as compared with KVB.

CSB Bank has ambitious plans of rebranding itself from a local bank to a national tech-savvy bank focusing on metro centres. To achieve this radical transformation, the CEO, CSB Bank had stated when he took charge that the bank had to make major investments, that it would reach a take-off stage from FY2027 onwards and that it would be fully transformed by FY2030. Therefore he contends his performance can be judged only from FY2027 onwards.

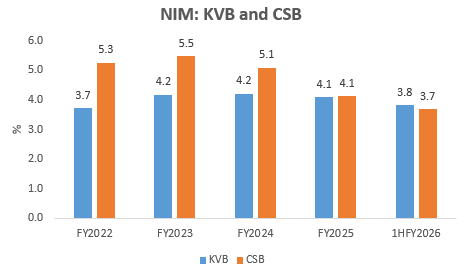

In contrast, the approach of the CEO of KVB has been to keep demonstrating improvement in critical parameters. The bank’s net interest margin (NIM) increased from 3.7% in FY2022 to 4.2% in FY2024, thereafter settling to 3.8% in 1HFY26. CSB Bank’s NIM, which, at 5.3% in FY2022, was considerably higher than that of KVB, has steadily declined to 3.7% in 1HFY26, which is even lower than that of KVB.

The cost-to-income of both banks shows completely divergent trends: while KVB’s ratio improved from 53.2% in FY2022 to 44.8% in 1HFY26, CSB Bank’s increased from 56.2% to 64.2% in the same period. It is very apparent that KVB has devoted considerable attention to keep operating costs under tight control even as it improves its income. Meanwhile CSB Bank has implemented a strategy of building up costs, which the bank believes is necessary for income to take-off from FY2027 onwards. However, in this period, with its NIM under severe pressure, and fee income unable to fully compensate for the decline in the NIM and the higher operating costs, the cost-to-income has already taken off.

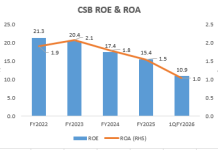

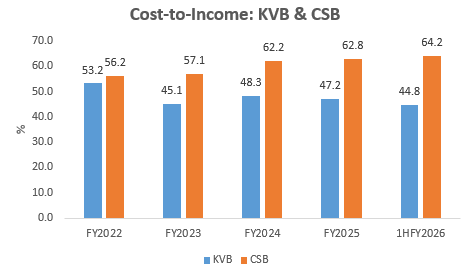

With the NIM and cost-to-income diverging for the two banks, it is no surprise that KVB’s profitability ratios have soared while CSB Bank’s have plummeted. The sharp decline in CSB Bank’s Return on Equity (ROE) from 21.3% in FY2022 to 12.7% by 1HFY26, and Return on Assets (ROA) from 1.9% to 1.2% in the same period, should have led to a major introspection by the board of directors, and a re-evaluation of its strategy. But it seems the board too holds the conviction that profitability will take off from FY2027. By contrast, KVB’s single-minded focus on its NIM and costs has resulted in a consistent improvement in the bank’s profitability.

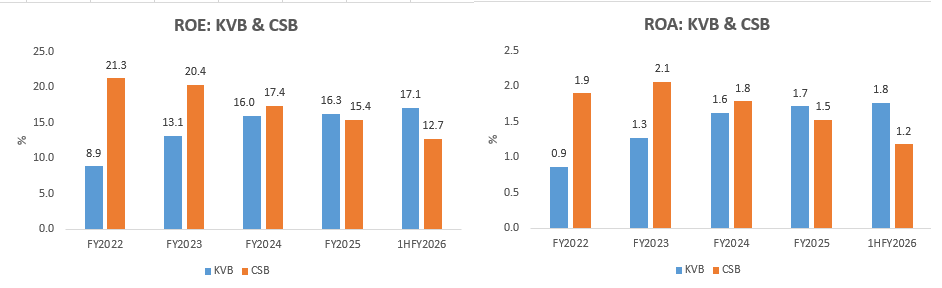

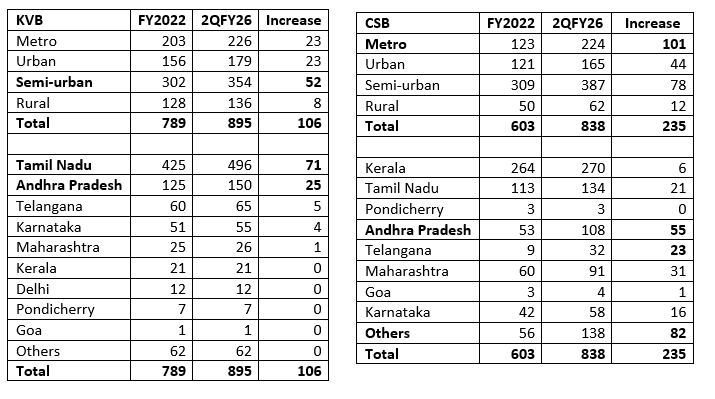

The branch expansion strategy of the two south India-based banks too is different. KVB, which originated as a community bank, and has its strongest presence in Tamil Nadu and semi-urban centres (population between 10,000 -100,000), has continued to focus on increasing its penetration in these areas. The maximum increase in its branches from FY2022 till the 2QFY2026 has been with the aim of deepening its penetration in semi-urban centres, and in Tamil Nadu and neighbouring Andhra Pradesh. The expansion strategy of KVB is highly focused; being a small regional bank, it is targeting continued concentration in areas where the customers are familiar with the bank, and where the competition from the large government banks and private sector banks is less.

Increase in Branches

CSB Bank’s branch expansion strategy is the opposite of KVB. Even though it is a small bank primarily in Kerala, and a reasonable presence in Tamil Nadu, Andhra Pradesh, Maharashtra and Karnataka, the major increase in branches has happened outside the southern states. The marginal growth in branches in Kerala is understandable, given the trade union activism in that state, but the increase in non-southern states is unusual, given the bank’s small size. Furthermore, the maximum increase in branches is taking place in metro centres, where the bank will be directly competing with the large well-entrenched government and private sector banks. By venturing boldly into its non-core strength areas, where the competition is intense, the bank may lose doubly: it may lose focus on its core areas of semi-urban centres in the southern states, even as it fails to make significant inroads in metro centres in the non-southern states. While CSB Bank’s ambition to become a national bank in a short span may be commendable, it entails higher costs, operating in unfamiliar terrain and difficulty in achieving profitable revenue growth.

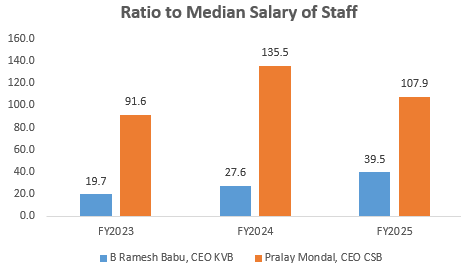

KVB is a much larger bank than CSB Bank: in 2QFY2026, the former’s assets, at Rs 1,300 bn, were 2.6x those of the latter. Nevertheless, the fixed component of the remuneration of the CSB CEO was higher than that of his KVB counterpart. In FY2025, Mondal’s fixed remuneration was Rs 25.4 mn, as compared with Babu’s Rs 21.7 mn. Strangely, Mondal’s salary when he was President-Retail, SME, Technology and Operations at CSB was even higher, and when he was appointed Deputy Managing Director, he had to take a 52% cut in his remuneration as per the Reserve Bank of India’s approval for the post. Even after the reduction in Mondal’s remuneration, the ratio of his salary as CEO to the median salary of staff was significantly higher than the corresponding ratio for KVB. Indeed, there is a wide divergence in the respective ratios of CEO remuneration to the median staff salary in these two banks.

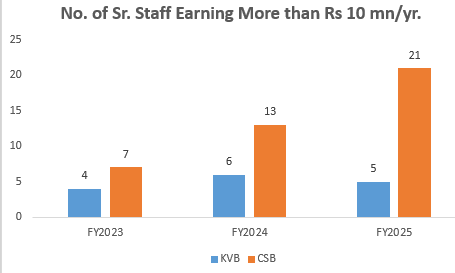

Despite CSB Bank being the smaller bank as compared with KVB Bank, the former has a significantly larger number of senior executives earning more than Rs 10 mn per year. Strangely, while the number for KVB has remained relatively constant in the last 3 years, for CSB Bank the number has increased from 7 executives in FY2023 to 21 executives in FY2025. This is highly unusual as CSB Bank’s banking activities are largely focused on gold jewellery loans (47% of total loans in 2QFY2026) while for KVB Bank gold jewellery loans is only 28% in 2QFY2026. As CSB Bank is focused on expansion in metropolitan centres, it is recruiting a large number of senior executives from metro-oriented banks like Yes Bank, Indusind Bank and Axis Bank. As a result, CSB Bank is paying a much higher remuneration for its senior executives as compared with KVB Bank but till date these senior executives have been unable to boost revenue for the bank, worse it appears that these executives are contributing to CSB Bank’s rising cost-to-income.

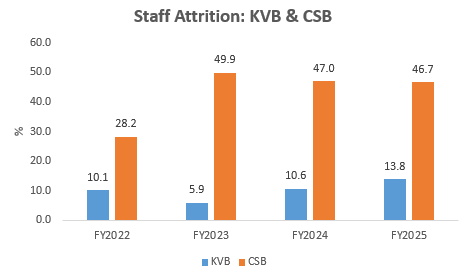

Staff play an important role in achieving business targets, client acquisition and customer service. A major difference in KVB and CSB Bank is the extent of staff attrition since FY2022. While for KVB staff attrition dipped to 5.9% in FY2023 and increased to 13.8% in FY2025, the attrition in CSB Bank is extremely alarming: in the last 3 years it has averaged a shocking 48%. There is no commentary by the board of directors or the management in the CSB Bank’s annual reports acknowledging the high attrition or the measures the bank is taking to rectify the issue. For a bank to lose nearly half its staff every year for the past 3 years would have caused a major disruption in operations, customer acquisition and customer service.

The attrition in CSB Bank demonstrates that the bank has a huge human resource problem, most likely at the lower levels of the sales function which needs to be immediately addressed. The bank CEO has repeatedly assured that the bank will achieve a take-off from FY2027, but either the staff lack confidence that the bank has a future, or the bank’s hiring process is so poor that it finds them incompetent and forcibly removes them. A high attrition rate increases hiring and training costs and disrupts operations, and would have compounded the problem of the bank’s declining profitability over the last 3 years.

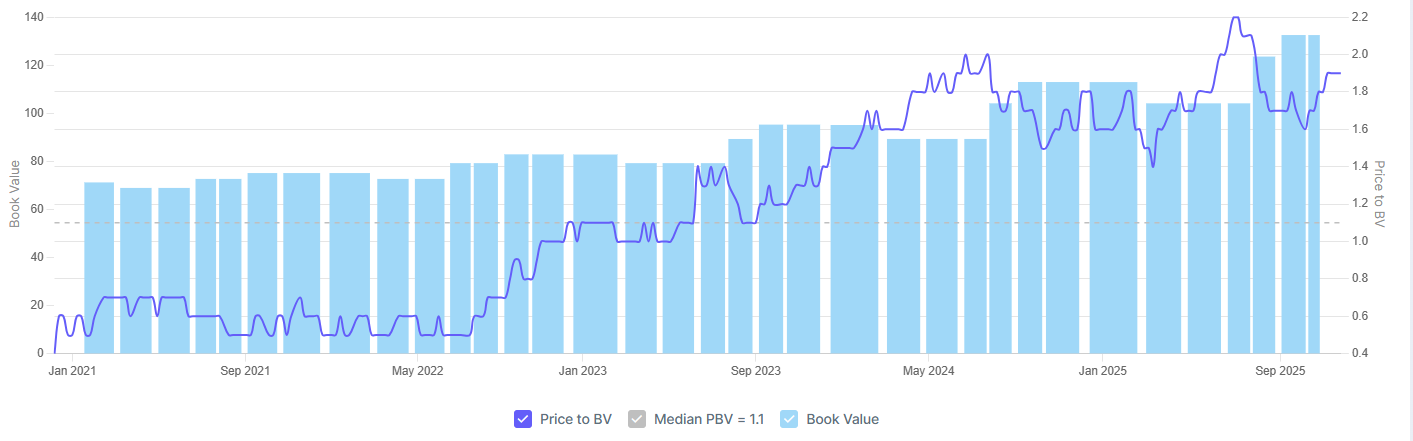

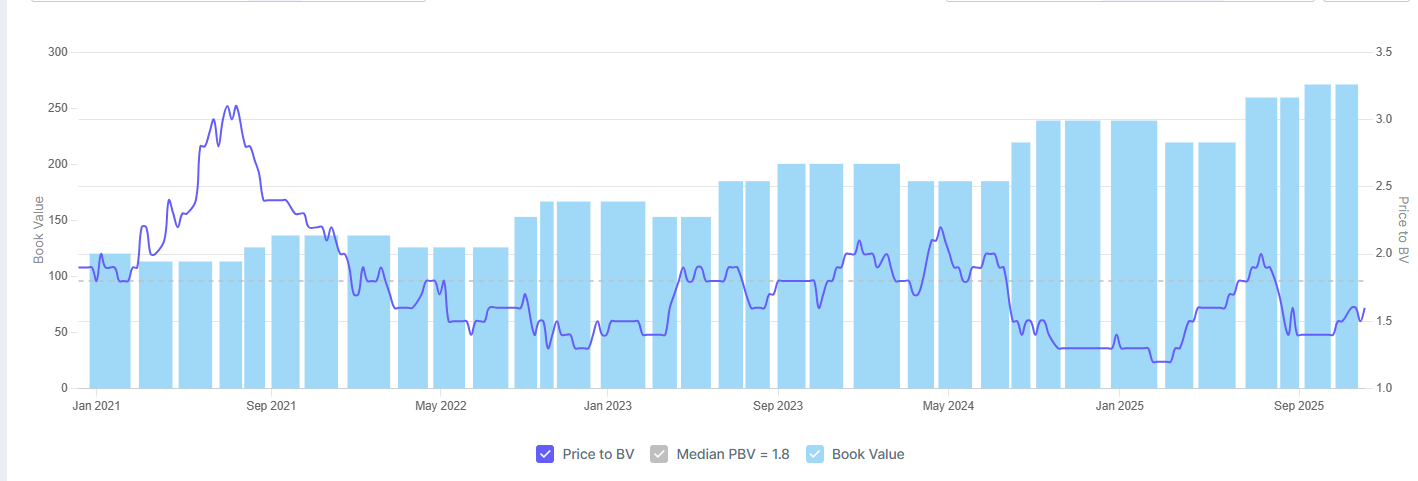

The stock market has taken its own call on the different strategies adopted by KVB and CSB Bank and is more impressed with the strategy of KVB. The price to book value of KVB which used to be 0.5x in March 2022, is presently 1.9x which shows the upward re-rating of the bank. Both the book value and the price to book value have increased rewarding the shareholders by a significant increase in the share price since the appointment of Babu as the CEO.

KVB Price to Book Value

In contrast to the re-rating of KVB, the price to book value of CSB has remained at 1.6x in the same period despite the increase in the bank’s book value. The market is probably waiting for an improvement in the profitability parameters which the bank’s management has committed will take place from FY2027.

CSB Bank Price to Book Value

The tale of these two banks since FY2022 reveals that KVB is following a prudent conventional strategy, concentrating on its core areas in non-metropolitan centres in southern India while maintaining a tight control over operating costs. This has resulted in a consistent increase in profitability. CSB Bank, by contrast, is implementing a radical disruptive strategy which is weakening its existing strengths in its core areas, while chasing unprofitable growth in its non-core areas of metropolitan centres in non-southern Indian states. The only stakeholder which is significantly benefitting in this period are senior executives at CSB Bank. The bank states that the deterioration in the key performance numbers is a necessary requirement for the bank to be reborn from FY2027, and fully bloom by FY2030.

Interestingly, CSB Bank’s single largest shareholder, the Canadian Fairfax group, endorses this strategy, and, as per media reports, plans to acquire larger Indian banks. If Fairfax does acquire a larger Indian bank, CSB Bank would get merged with it, thus burying all its issues within the folds of the larger bank. But if such questionable management strategies survive, they may spell trouble for the legatee bank, too.

________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in all the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.