Hemindra Hazari

Equity research analysts produce impressive reports, operate complex statistical models, and can talk confidently about the future on the business channels. But the...

Hemindra Hazari

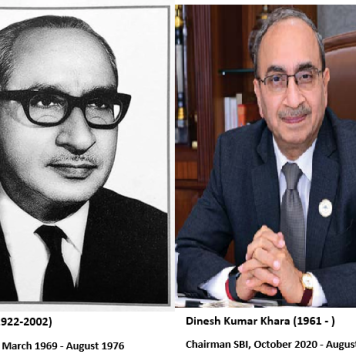

Everyone knows public sector banks are less profitable, more prone to political influence and have higher ratios of non-performing assets (NPAs) than their...

It is curious that the first step of a reform-minded Chicago-school scholar was to announce a subsidy. Of course, unlike the subsidies that Rajan criticised as chairman of the Committee on Financial Sector Reforms in September 2008, this subsidy would go not to low income sections of the population, but to the banks.

Academic studies have proved the commercial viability of research by taking it from the lofty towers of academia to the lowlands of the trading floor.

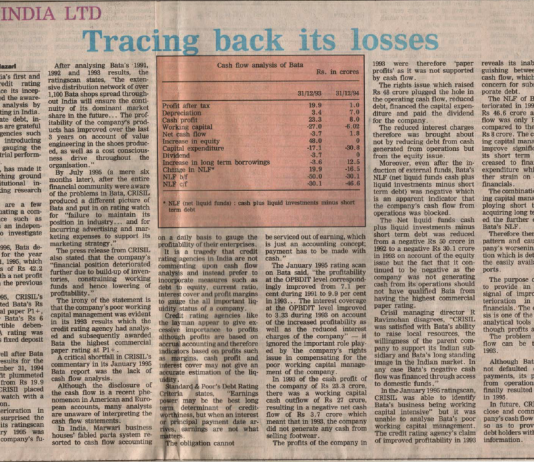

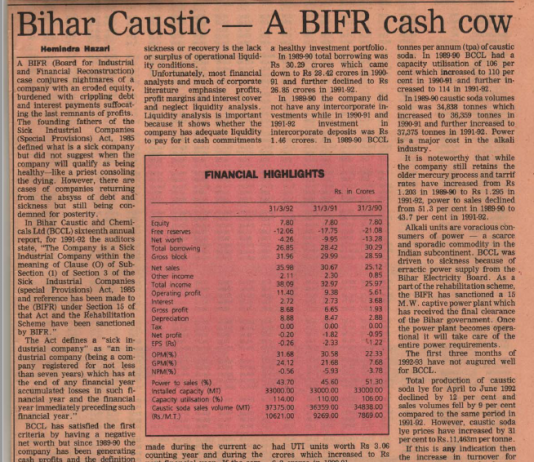

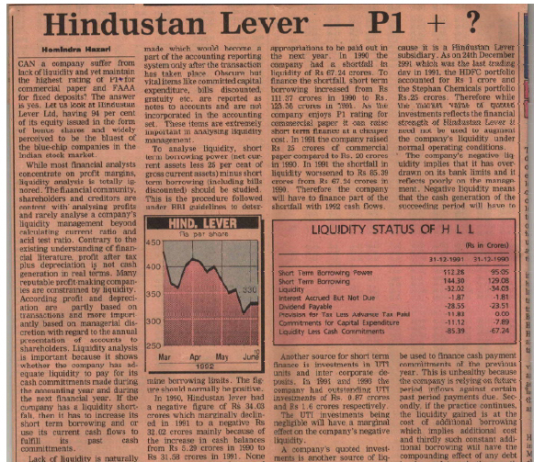

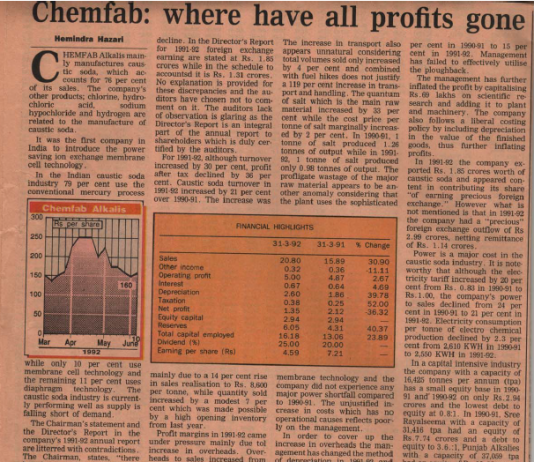

A liquidity crisis of such a magnitude is not an overnight phenomena yet the credit rating agency certified the compnay as investment grade thereby misinforming bond holders and bankers

Debate with CRISIL on providing the highest rating of P1+ to Hindustan Lever

HLL-3Download