Hemindra Hazari

9 July 2019

On 26 June 2019, confronted with a contempt petition filed in the Supreme Court of India by Right to Information Act, 2005 (RTI) activist, Girish Mittal, the Reserve Bank of India (RBI) finally disclosed the hitherto confidential annual inspection reports, called risk assessment reports (RARs),...

It is difficult to read the SEBI's scathing order and not wonder what on earth the NSE board was doing.

In Rudyard Kipling’s Jungle Book, Akela, the lone grey wolf leader, exhorts the pack to “look well” upon the cubs who are to be inducted into the pack as their own....

The central bank's decision to not spell out a rationale does little in terms of adding to the ownership debate.

Hemindra Hazari BANKING 12 HOURS AGO

It was surely one of the more odd episodes in the history of banking regulation. The Reserve Bank of India (RBI) recently concluded...

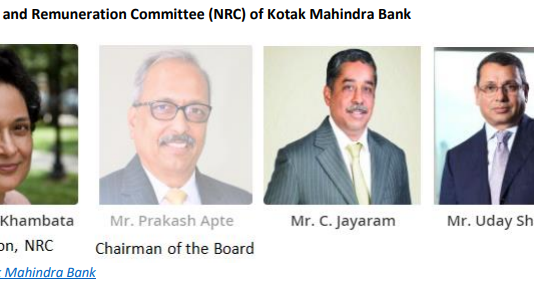

The legal battle concerns the RBI’s instructions to Kotak Mahindra Bank to reduce the promoter holding, and the bank's sharp practices while appearing to comply.

By Hemindra Hazari

MUMBAI, Maharashtra—A royal legal battle has been going on between Kotak Mahindra Bank (KMB) and the banking regulator, the Reserve Bank of India (RBI), in...

BANKING April 10, 2019

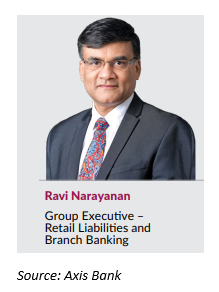

The sacked employees feel that they have been given a raw deal, which may have a demoralising impact on the bank's workforce.

By Hemindra Hazari

On April 1, 2019, the eve of Axis Bank’s 25th anniversary of commencing business, Amitabh Chaudhry, the newly anointed chief executive officer (CEO), announced one of his...

The RBI’s decision on April 26, 2021 to curtail tenures of bank chief executive officers and executive directors may finally lead to Kotak relinquishing his post at the end of 2023.

Had the Reserve Bank of India (RBI) descended, like Moses, from Mount Sinai, perhaps it would have carried two...

Jay Kotak’s appointment comes with questions for the private banking sector, which has mostly eschewed the dynastic tendencies of old-school India Inc companies.

Jay Kotak (standing) and Manish Agarwal of the Kotak Mahindra Bank's 811 initiative. Photo: YouTube screengrabSupport Us

Listen to this article:BANKING 36 MINUTES AGO

On May 26, 2022, a...

The bank’s official explanation of a technical glitch needs to be examined, by the RBI, which should commission a probe.

Hemindra Hazari

On November 5, 2021, the auspicious day of the Hindu New Year, the Economic Times burst a firecracker of a news story on IndusInd Bank. The story cited whistle blowers (a group...

In an unprecedented act, Kotak Mahindra Bank (KMB) on December 10, 2018 filed a writ petition in the Bombay high court against the Reserve Bank of India. The writ prayed for permission to include its preference capital (a debt instrument) issue in paid-up capital, thereby lowering the stake of the promoters...

By Hemindra Hazari

On January 11, 2019, the Reserve Bank of India (RBI) issued a press release informing the public that “by an order dated January 4, 2019 imposed a monetary penalty of Rs 30 million on Citibank N.A. India (the bank) for deficiencies in compliance with the RBI instructions on ‘Fit...