NAVDEEP YADAV DEC 16, 2020, 10:27 IST

In the past two years, more than eight robbery cases amounting up to ₹700 million in the top...

निधि रायबीबीसी संवाददाता, मुंबई से

6 दिसंबर 2020

बैंकिंग क्षेत्र के शीर्ष नियामक, भारतीय रिजर्व बैंक की इस बात के लिए आलोचना हो रही है कि...

These temporary restrictions will be lifted after the RBI is satisfied with necessary compliance on the part of the private sector lender.

The Wire Staff...

RBI measures won't affect existing customers. Similar measures could be taken for larger banks that faced recent outages

TopicsHDFC Bank | RBI | Digital banking

Subrata Panda & Anup Roy | Mumbai Last Updated...

Author Ranina SanglapTheme Banking

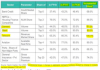

India's nonbanking financial companies will need to choose between cheaper money and less onerous regulation if the central bank accepts a...

G.R. Gopinath DECEMBER 02, 2020 00:15 IST UPDATED: DECEMBER 01, 2020 22:58 IST

They will not only enrich themselves but also crush competition

First, a confession is...

New suggestions says corporates may become promoters of banks. They could also make NBFCs more competitive, and generate more interest for banking licences

BY SALIL PANCHAL, Forbes...

Author Gaurav Raghuvanshi Rebecca Isjwara

DBS Group Holdings Ltd.'s ambitions to grow in India may get a leg up after the nation's central bank proposed...