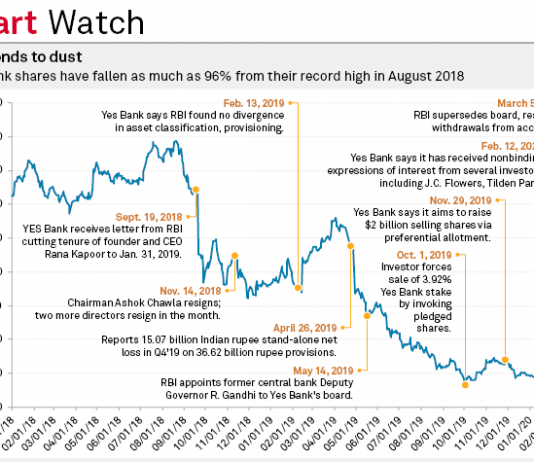

Grappling with bad loans, weak loan growth and leadership uncertainty, its valuation is under pressure

Prathamesh Mulye

Getty images

It’s now an accepted fact that Indian banks...

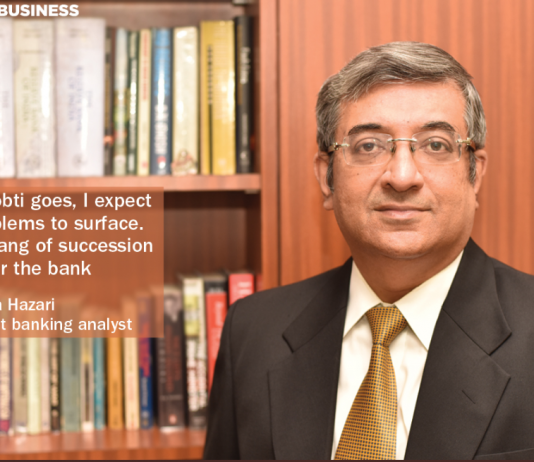

“When all group companies are constrained by liquidity problems, the strongest company will get impacted as a natural fallout,” said Hemindra Hazari

“Once a bank is put under a moratorium, its deposit franchise is irrevocably eroded, as banking is all about trust,” Hazari wrote.

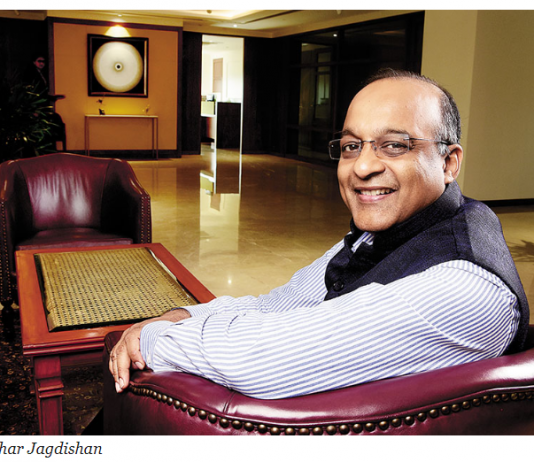

Sashidhar Jagdishan inherits a proven entity from predecessor Aditya Puri. However, the 'bank insider' will have to rebuild trust among business leaders and devise...

Independent banking expert Hemindra Hazari, who has studied the governance of banks in India extensively, says that he was “not surprised” that all these events have come to light in recent months, post Puri’s retirement. “Puri was so focussed on achieving targets and getting the ladoo in each business line that compliance took a backseat under his leadership,” Hazari says. Jagdishan is firmly trying to correct this while not compromising on growth. “Jagdishan is doing an honest job.’

The Yes Bank turmoil came with a one-off solution, but newer banks will not be spared from the infectious effect. And Covid-19 will only...

The RBI wants to see improved governance from private banks through proposed rules that limit the roles and tenures of CEOs. But will they...

Uday

Kotak is a cautious and savvy banker with deep and strong connections in the

business world. However, by no stretch, is he an activist. So,...

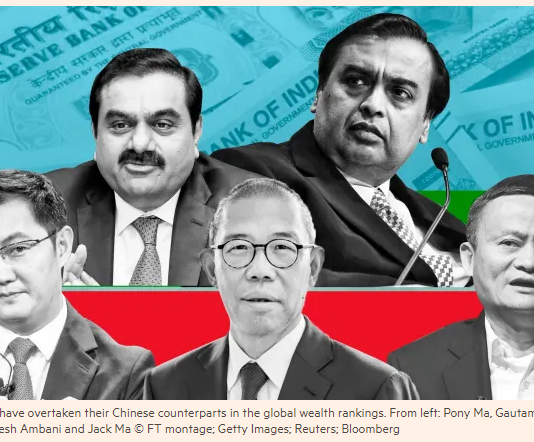

Hudson Lockett in Hong Kong, Benjamin Parkin and Stephanie Findlay in New Delhi

Fortunes of billionaires Mukesh Ambani and Gautam Adani soar past likes of Alibaba’s Jack Ma

India’s industrial moguls...

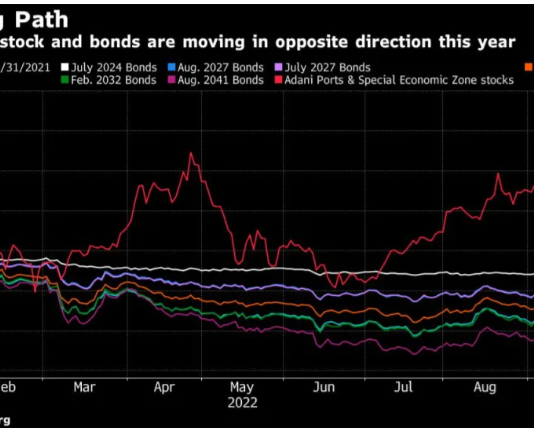

Divya Patil and Anto AntonyThu, September 22, 2022 at 4:30 AM·4 min read

World’s Second-Biggest Fortune Fails to Halt Rout in Adani Bonds

(Bloomberg) -- Surging...