9 min read. Updated: 22 Oct 2020, 08:48 PM IST Shayan Ghosh

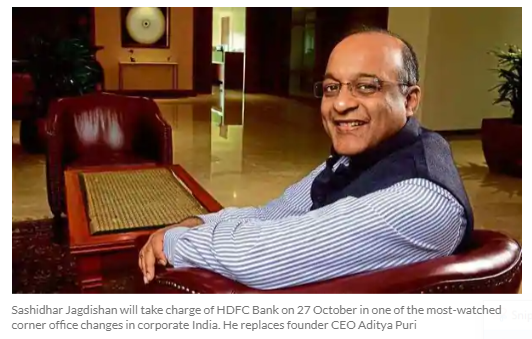

Incoming CEO Sashidhar Jagdishan inherits a bank in fine fettle. Where will he take it from here?

Over the upcoming Dussehra weekend, more than 100,000 employees at HDFC Bank will come together, virtually, to offer a befitting farewell to outgoing chief executive...

BHAKTI MAKWANA NOV 8, 2021, 12:46 IST

By Nupur Acharya and P R Sanjai June 15, 2021, 10:06 AM GMT+5:30 Updated on June 15, 2021, 5:00 PM GMT+5:30

Confusion over three Mauritius-based funds that whipsawed shares of companies controlled by Indian billionaire Gautam Adani this week has underscored a deeper risk for investors in such stocks owned by opaque entities.

Shares of Adani’s...

Last Updated : Apr 15, 2019 04:28 PM IST | Source: Moneycontrol.com

By proposing the use of perpetual non-cumulative preference shares to cut promoter holding, Kotak, the promoter, is guilty of not complying with the spirit of the law. So too, Kotak Mahindra Bank and its independent directors.

Ravi Krishnan@writesravi

As the battle...

AUNINDYO CHAKRAVARTY 20H 14M AGO OPINION5 min read 4.7k ENGAGEMENT

By the time Narenda Modi became Prime Minister of India, it was common knowledge that he was inheriting an economy riddled with bad-loans – loans that banks had given but were unlikely to be repaid. A wide range of numbers were...

“He’s not only on an acquisition spree and banks are willing to fund him,” but he has close ties to the current administration, Hazari said. “As long as this government lasts — and it is expected to last quite a long time — the music will continue.”

By Niha Masih

January 28, 2023 at 4:57 p.m. EST

Article can be read here